The Narrative-Price Pendulum: How Adobe's Story Swings Between Disruption and Infrastructure

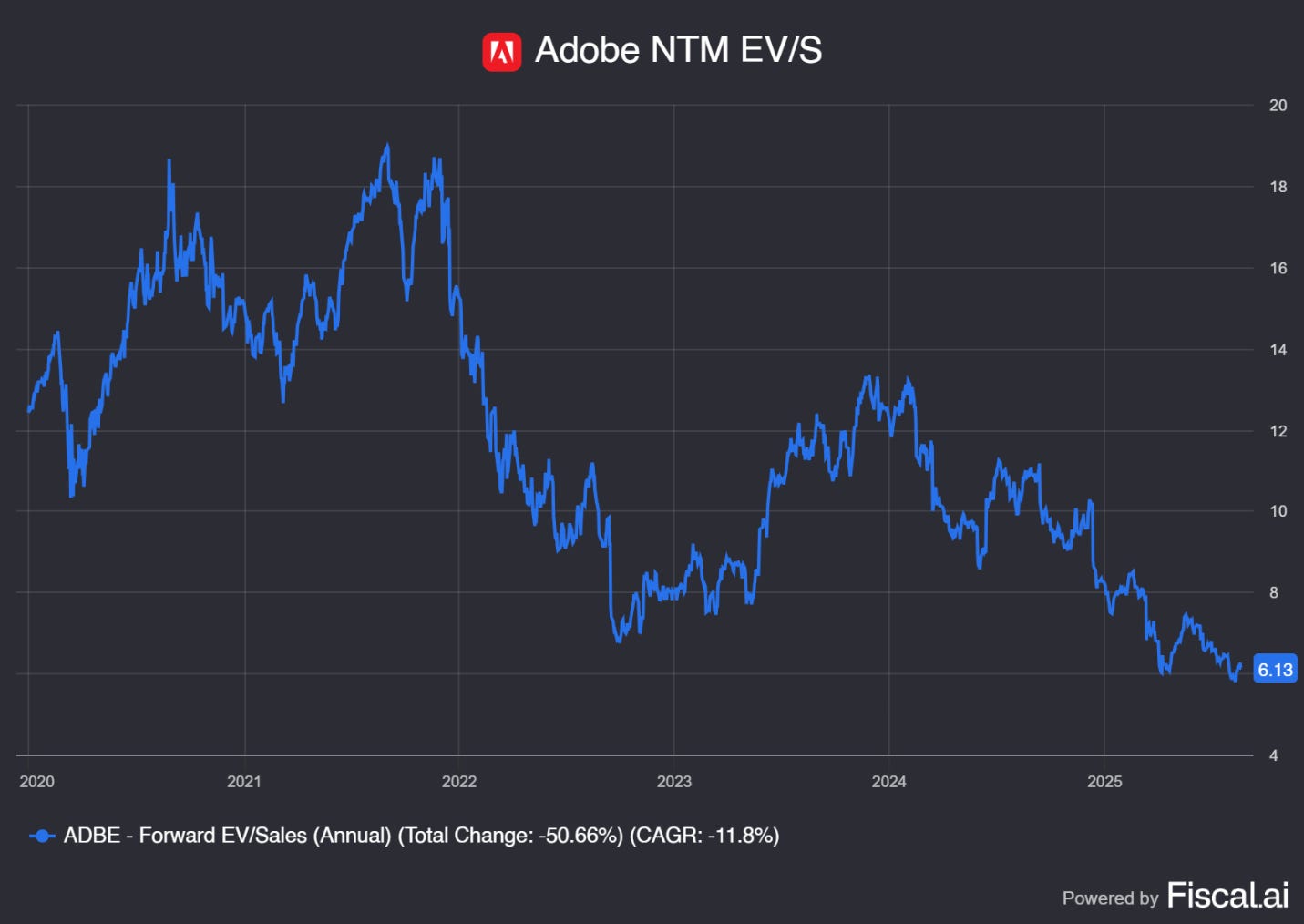

Why ADBE trades at “maximum uncertainty” (≈6.7× EV/Sales) and what must change for the multiple to reset.

TL;DR

Story leads price: From pandemic resilience to AI monetization pioneer, Adobe’s multiple has tracked narrative swings 6–12 months ahead of fundamentals—peaking near 15× sales in 2021 and settling around 6–7× today.

What $353 implies: The market bakes in 8–10% growth, modest AI impact, and a defensible but pressured core—not a platform re-rating to enterprise content infrastructure, nor a full disruption spiral.

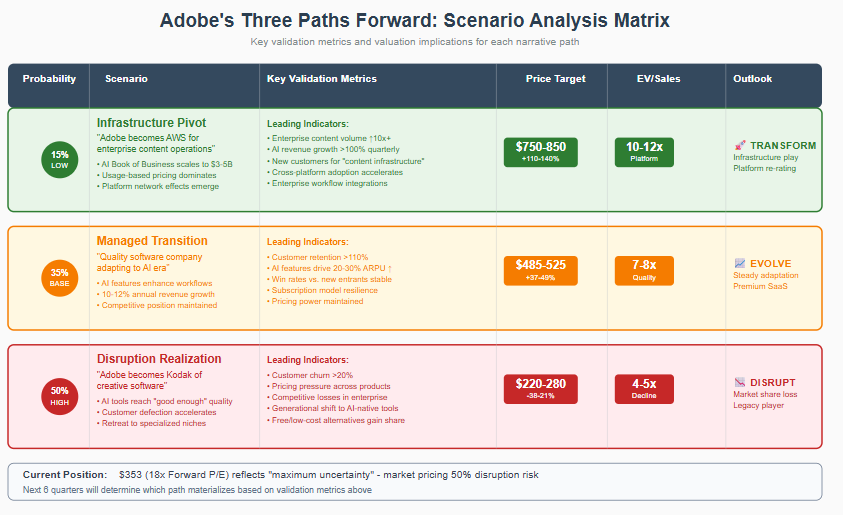

Next swing = three paths: Infrastructure Pivot ($750–850), Managed Transition ($485–525), or Disruption Realized ($220–280). Watch AI Book of Business growth, enterprise content volume, NRR/ARPU uplift, and competitive win rates to see which story wins.

In 1995, Oracle Corporation was trading at what seemed like an impossible valuation. The database company, founded by Larry Ellison with characteristic Silicon Valley audacity, was commanding a premium that made seasoned investors shake their heads. IBM's database offerings were technically superior in many ways, and yet Oracle's stock price suggested the market believed something fundamental was changing in enterprise computing.

The skeptics had a point: Oracle's technology wasn't obviously better, their customer support was notoriously inconsistent, and IBM had decades of enterprise relationships that seemed unassailable. What the skeptics missed, however, was that Oracle wasn't really competing on technical merit alone—they were riding a narrative about the future of computing that would prove far more powerful than any feature comparison.

Oracle's story was simple: enterprises would move from proprietary mainframe systems to open, networked architectures. IBM represented the old world of expensive, locked-in systems; Oracle represented the new world of portable, scalable solutions. For nearly five years, Oracle's stock price swung wildly as this narrative battled with quarterly results, competitive pressures, and market sentiment. The company's valuation became a proxy for investor belief in the fundamental transformation of enterprise computing.

By 2000, it was clear the narrative had won. Oracle had become the dominant enterprise database platform not because their technology was inherently superior, but because they had correctly identified—and positioned themselves for—an irreversible shift in how enterprises approached data management.

Today, Adobe finds itself in a remarkably similar position, caught between competing narratives about the future of content creation. Like Oracle in 1995, Adobe's stock price has become a pendulum swinging between stories of transformation and decline, with each quarterly result either validating or challenging the market's shifting beliefs about what Adobe represents in the age of artificial intelligence.

The Five Acts of Adobe's Narrative Evolution

Adobe's journey from 2020 to 2025 reads like a five-act drama, with each act driving distinct market reactions and valuation frameworks that reveal how deeply intertwined narrative and price have become in technology investing.

Act I: Pandemic Resilience (Q1-Q4 2020) When COVID-19 struck, Adobe's initial narrative was refreshingly simple: subscription stability in uncertain times. The company's recurring revenue model and remote-work enablement positioned it as a defensive quality play. Revenue grew a steady 14-19% year-over-year, Document Cloud exploded as PDF usage surged, and management's calm messaging emphasized continuity over opportunity.

The market responded accordingly. Adobe's stock appreciated steadily to the $500 range, with investors treating it as a "flight to safety" technology play. The multiple expansion was modest but consistent, reflecting relief that creative professionals weren't abandoning subscriptions despite economic uncertainty.

Act II: Digital Transformation Leader (2021) By 2021, the narrative had evolved dramatically. Adobe wasn't just surviving the pandemic—it was becoming essential infrastructure for a permanently digital world. The "genie isn't going back in the bottle" messaging resonated powerfully with investors convinced that remote work and digital-first business models were irreversible trends.

The numbers supported the story: Q1 2021 delivered 26% year-over-year growth, net new Annual Recurring Revenue hit $518 million in Q2, and Experience Cloud subscription growth consistently exceeded 20%. Adobe looked like the quintessential "picks and shovels" play for digital transformation.

The market's response was euphoric. Adobe's stock peaked near $700, trading at 15x+ sales as investors priced in Adobe as essential digital infrastructure. The company wasn't just adapting to change—it was enabling it.

Act III: Platform Integration Play (2022) The $20 billion Figma acquisition announcement in Q3 2022 represented Adobe's boldest narrative bet: evolving from individual creative tools to an integrated creative-to-commerce platform. Management painted a vision of seamless workflows spanning design, content creation, marketing, and customer experience.

The market's reaction was tellingly mixed. Some investors saw strategic vision; others saw valuation desperation. The stock price became volatile around the deal announcement, reflecting uncertainty about whether Adobe was making a transformative platform play or overpaying for a competitive threat.

In retrospect, the Figma bid revealed something crucial: Adobe's management saw existential competitive pressure that wasn't yet reflected in their financial metrics.

Act IV: AI Disruption Victim (2023) The ChatGPT launch in November 2022 and subsequent explosion of AI creative tools fundamentally changed Adobe's narrative. Suddenly, the company that had built moats around creative expertise found those moats under assault from AI tools that could generate professional-quality content with simple text prompts.

DALL-E, Midjourney, and later ChatGPT's image generation capabilities suggested that Adobe's core value proposition—providing tools for creative professionals—might become obsolete. The narrative shifted from "essential digital infrastructure" to "disrupted incumbent fighting for relevance."

Adobe's stock compressed to a 6x sales multiple as investors priced in competitive threats and market share erosion. The company that had been seen as a digital transformation winner was suddenly viewed as an AI transformation victim.

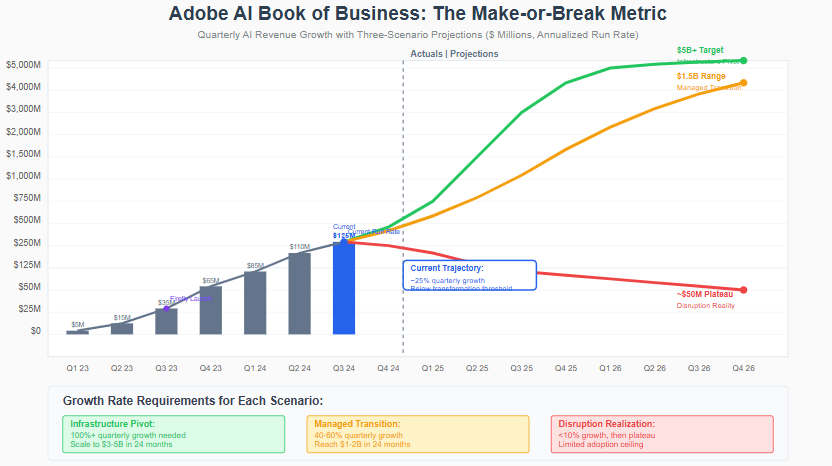

Act V: AI Monetization Pioneer (2024-2025) Adobe's response to AI disruption has driven the current narrative: the company isn't being disrupted by AI, but rather pioneering its monetization. Firefly's launch in March 2023, followed by rapid adoption (24+ billion image generations by Q2 2025) and explicit revenue tracking (>$125 million AI Book of Business), positioned Adobe as the first major software company to successfully monetize generative AI.

The current market reaction reflects cautious optimism mixed with uncertainty. Trading in the $320-400 range, Adobe's valuation suggests investors are taking a "show me" approach to the transformation story. The 6.7x sales multiple reflects neither the premium of a successful AI platform nor the discount of a disrupted incumbent—it's the valuation of maximum uncertainty.

The Narrative-Price Correlation

What makes Adobe's story particularly compelling is how precisely its stock price has tracked narrative shifts rather than fundamental performance. Each major reframing of Adobe's competitive position preceded corresponding changes in financial metrics by 6-12 months.

The 2021 peak at $700 reflected belief in Adobe as permanent digital infrastructure before that positioning was tested by economic cycles or competitive pressure. The 2023 trough reflected fear of AI disruption before any evidence of customer defection or revenue impact materialized. Today's range-bound trading reflects narrative equilibrium—competing stories about transformation and decline roughly balancing each other.

This pattern reveals something important about technology investing: narrative often leads fundamentals, particularly during periods of technological transition. Investors aren't just buying Adobe's current business performance; they're buying their belief about what Adobe represents in the future landscape of content creation.

What the Current Price Discounts

At $353 per share, Adobe's valuation embeds specific assumptions about the company's trajectory that reveal the market's collective uncertainty about competing narratives.

The current 6.7x EV/Sales multiple suggests the market expects:

Revenue growth of 8-10% annually with modest AI contribution

Gradual competitive pressure but defensible market position for 3-5 years

Partial AI transformation success—incremental revenue, not business model revolution

Continued subscription model stability with modest pricing power

What the current price notably does NOT discount:

Adobe becoming enterprise content infrastructure platform (would justify 10-12x sales)

Explosive growth in enterprise content volume requiring workflow management

Platform network effects from customer data improving AI capabilities

Strategic acquisition premium from Microsoft, Google, or Amazon

The market is essentially pricing Adobe as a mature SaaS company with execution uncertainty, rather than either a successful platform transformation or a disrupted incumbent.

Three Scenarios for the Next Narrative Arc

The next 18-24 months will likely resolve the current narrative uncertainty in one of three directions, each carrying distinct implications for Adobe's valuation and competitive position.

Scenario 1: The Infrastructure Pivot (15% probability)

New Narrative: "Adobe becomes AWS for enterprise content operations"

In this scenario, AI democratization creates exponential demand for content workflow management rather than reducing demand for Adobe's tools. Enterprises generating 10x or 100x more content with AI assistance discover they need sophisticated infrastructure for brand compliance, approval workflows, and distribution management.

Adobe's integrated Creative-Document-Experience platform uniquely positions it to capture this opportunity. The AI Book of Business scales to $3-5 billion annually, driven by usage-based pricing on content processing rather than per-seat subscriptions.

Key validation metrics: Enterprise customers reporting 10x+ content volume increases, AI revenue growing >100% quarterly, new customer acquisition explicitly for "content infrastructure" rather than creative tools.

Valuation framework: 10-12x sales on infrastructure platform positioning, driving stock price to $750-850 range.

Scenario 2: The Managed Transition (35% probability)

New Narrative: "Quality software company adapting to AI era"

Adobe successfully integrates AI capabilities into existing workflows without fundamental business model disruption. Creative professionals embrace AI as productivity enhancement rather than replacement, and enterprise customers continue valuing integrated platform benefits.

Revenue growth continues at 10-12% annually, driven by AI feature upsell and steady subscription expansion. Competitive pressure remains manageable through product differentiation and switching cost advantages.

Key validation metrics: Customer retention >110%, AI features driving 20-30% ARPU increases, competitive win rates maintained against new entrants.

Valuation framework: 7-8x sales on mature SaaS with AI enhancement, driving stock price to $485-525 range.

Scenario 3: The Disruption Realization (50% probability)

New Narrative: "Adobe becomes Kodak of creative software"

AI tools reach "good enough" quality for most enterprise content needs while remaining significantly cheaper than Adobe subscriptions. Customer defection accelerates as economic pressure forces evaluation of software spending, and younger creative professionals prefer AI-native alternatives.

Adobe's platform integration advantages prove insufficient against free or low-cost alternatives that meet 80% of customer needs. The company retreats to specialized enterprise niches while overall market position erodes.

Key validation metrics: Customer churn >20%, pricing pressure evident across product lines, new competitive wins in enterprise accounts, generational preference data favoring alternatives.

Valuation framework: 4-5x sales on declining software business, driving stock price to $220-280 range.

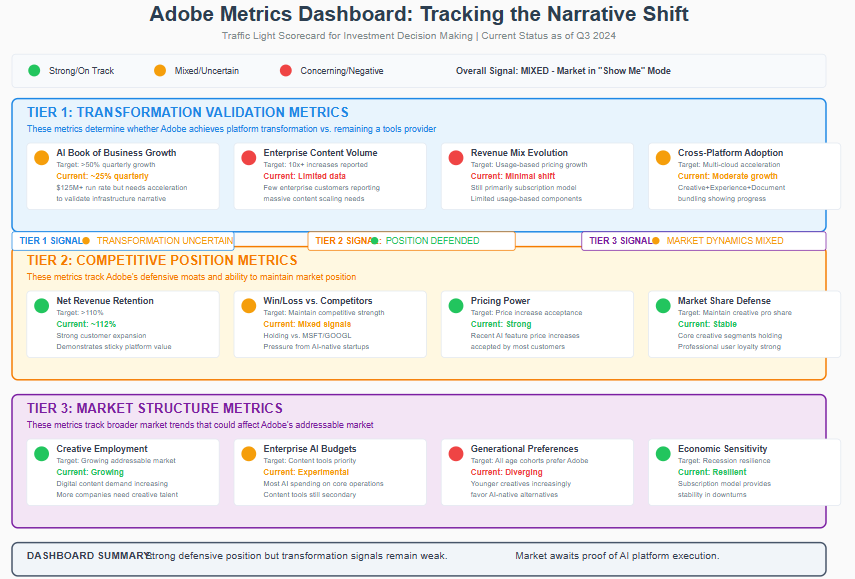

The Metrics That Matter

Given the narrative-driven nature of Adobe's valuation, investors should focus on leading indicators that signal which story is emerging as dominant.

Tier 1: Transformation Validation Metrics

AI Book of Business quarterly growth >50% (infrastructure narrative validation)

Enterprise content volume reports showing 10x+ increases (demand expansion proof)

Revenue mix evolution from subscription to usage-based pricing (business model transformation)

Cross-platform adoption rates among multi-cloud customers (ecosystem value demonstration)

Tier 2: Competitive Position Metrics

Net Revenue Retention >110% (customer value expansion)

Win/loss rates against Microsoft, Google, and AI-native startups (competitive strength)

Subscription price increase acceptance rates (pricing power maintenance)

Market share trends in core creative professional segments (defensive position)

Tier 3: Market Structure Metrics

Professional creative employment trends (addressable market size)

Enterprise AI budget allocation to content tools (category investment)

Creative professional tool preferences by age cohort (generational adoption)

Economic sensitivity of creative spending (cyclical resilience)

The current performance shows mixed signals across these metrics. AI monetization ($125+ million) is progressing but too small to validate the infrastructure narrative. Revenue growth (11% year-over-year) suggests steady execution but lacks the acceleration needed for transformation premium. Customer retention (>95%) demonstrates defensive strength but not expansion dynamics.

The Pendulum's Next Swing

Adobe's narrative-price pendulum has swung from pandemic resilience to digital infrastructure to platform integration to AI disruption to monetization pioneer. Each swing has driven dramatic valuation changes that preceded fundamental performance by quarters or years.

The current equilibrium at 6.7x sales reflects maximum uncertainty about which narrative will prove correct. This uncertainty creates both opportunity and risk: if Adobe successfully demonstrates infrastructure transformation, the stock could double; if competitive disruption accelerates, it could fall 40%.

What makes this moment particularly compelling is that Adobe faces the same challenge Oracle navigated in the 1990s: positioning for an irreversible technological shift while maintaining current business performance. Oracle succeeded by correctly identifying that enterprise computing would move from proprietary to open systems, then building the platform to capture that transition.

Adobe's challenge is arguably harder: they must transform from selling tools to creative professionals into providing infrastructure for AI-democratized content creation. This requires not just technological evolution but fundamental business model change during a period of intense competitive pressure.

The metrics over the next six quarters will determine whether Adobe writes Oracle's transformation success story or becomes another cautionary tale about incumbent vulnerability to platform shifts. For investors, Adobe's stock price will continue serving as a real-time referendum on one of technology's most important questions: whether established software companies can successfully navigate the AI transition or will be swept aside by it.

The narrative-price pendulum is still swinging, and its final resting place will reveal whether Adobe represents the infrastructure of the AI content era or the last chapter of the desktop software age.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.