The Physics Bottleneck: How ASML Turned Light Into the New Oil

A lesson that began with Carl Zeiss's microscopes in 1846 explains why a Dutch toolmaker controls the speed of AI—and why the market still mis-prices the cash it will mint.

TLDR

Physics as Moat: ASML’s mastery of EUV lithography has created a monopoly grounded in physics, not market competition—replicating its capabilities would take decades and billions in investment.

Recurring Revenue Flywheel: Its Installed-Base Management (IBM) business generates over €6B annually with high margins, forming a growing, high-stability cash engine that's underappreciated by markets.

Strategic Lock-In: AI-driven chip complexity, customer dependency (e.g., TSMC), and geopolitical alignment make ASML an irreplaceable infrastructure layer—positioned to dominate the semiconductor stack for years to come.

From Zeiss's Workshop to Philips's Crisis

In 1846, a young German mechanic named Carl Zeiss opened a workshop in Jena with a radical proposition: precision could be manufactured. While others crafted crude magnifying glasses, Zeiss obsessed over mathematical perfection in optical design. His microscopes didn't just enlarge—they revealed truths invisible to the human eye. Within decades, Zeiss's precision glass powered Germany's industrial revolution, from railroad construction to medical breakthroughs. The lesson was clear: control the precision, control the industry.

Fast-forward 138 years to a sterile laboratory in Eindhoven, Netherlands. Philips engineers huddled around semiconductor wafers, confronting an impossible wall. Their mercury-lamp steppers—the workhorses of chip manufacturing—could pattern features down to 1 micrometer. But the relentless march of computing demanded smaller, faster, more efficient circuits. The problem wasn't engineering talent or financial resources. It was physics itself.

Light, they realized, had wavelength limitations. Like trying to thread a needle with rope, you simply cannot use 400-nanometer light to create 100-nanometer patterns. The laws of nature had imposed a hard stop on Moore's Law, and with it, the entire digital revolution.

In that moment of crisis, an epiphany emerged: precision wasn't just power—it was the ultimate economic moat. The company that could bend light itself would own the future. From Philips's near-bankruptcy emerged ASML, inheritor of the precision trap that Zeiss had first discovered two centuries earlier.

The Physics of Irreplaceability

When Engineering Becomes Economics

The wavelength barrier that stymied Philips wasn't a temporary technical hurdle—it was a fundamental law of physics demanding a fundamental solution. Traditional deep-ultraviolet (DUV) lithography at 193 nanometers had reached its mathematical limits. Creating smaller chip features required shorter wavelengths, period.

Enter extreme ultraviolet (EUV) lithography at 13.5 nanometers—a wavelength so short it's closer to X-rays than visible light. The physics were theoretically sound, but the engineering was science fiction. EUV light is absorbed by everything, including air, requiring vacuum chambers. The light source needed to generate plasma hotter than the sun's surface, hitting droplets of molten tin 50,000 times per second with laser precision. The mirrors required atomic-level smoothness—if scaled to the size of Germany, the largest bump couldn't exceed 2 millimeters.

ASML embarked on a 20-year, €10 billion crusade to commercialize this impossibility. They assembled a global supply chain of specialists: Zeiss for mirrors, Cymer for lasers, TRUMPF for CO2 lasers, and dozens of others. No single company could master every component; no single country possessed all the expertise.

The result is what economists call an "impossibility theorem" in action. Recreating ASML's EUV stack would require:

€20+ billion in R&D investment

15-20 years of development time

Coordination across hundreds of suppliers

Physics expertise accumulated over decades

And even then, you'd be competing against ASML's continued innovation

The switching costs don't just approach infinity—they effectively are infinity. When the laws of physics become your competitive moat, you've transcended normal business competition entirely.

Hidden Flywheel: Services as Destiny

The Recurring-Revenue Revolution Nobody Talks About

While Wall Street obsesses over ASML's €400 million EUV system sales, they're missing the real goldmine: the installed base. Over 600 EUV and DUV systems scattered across global fabs generate €6+ billion annually in Installed-Base Management (IBM) revenue, growing at 15% CAGR with 60% incremental margins.

The mathematics are startling. A single upgrade can boost system throughput by 30% without requiring a new €400 million purchase. These aren't discretionary enhancements—they're essential improvements that keep fabs competitive as chip architectures evolve. Miss an upgrade cycle, and your production line becomes obsolete.

Here's what competitors can't replicate: this flywheel requires first replicating ASML's 30-year installed base—an impossibility that grows stronger with time. Every new system ASML ships expands their recurring revenue footprint. Every upgrade deepens customer integration. Every service call strengthens the switching-cost moat.

IBM alone can offset a €2 billion dip in system sales. Yet the market continues pricing ASML as a cyclical equipment manufacturer rather than a recurring-revenue platform. This buffer means ASML can maintain profitability and cash generation even during the worst semiconductor downturns—a fact completely ignored in current valuations.

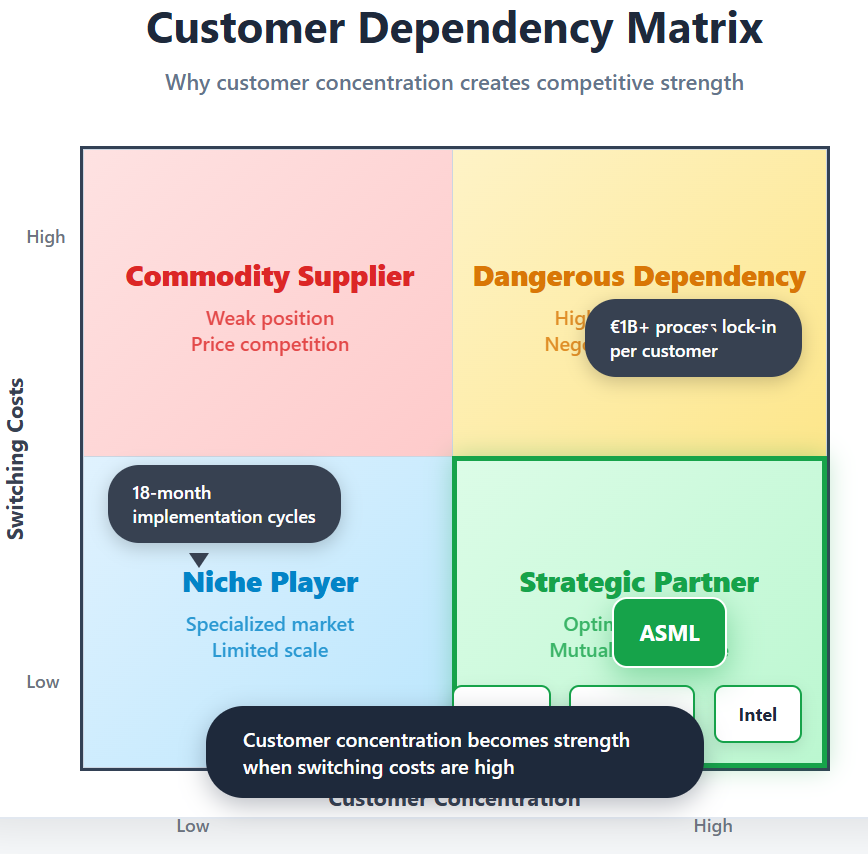

The Customer Paradox: Dependency as Strategy

Taiwan Semiconductor Manufacturing Company (TSMC) is ASML's largest customer, representing roughly 30% of orders. Conventional wisdom suggests this concentration creates dangerous dependency for ASML. The reality is precisely the opposite.

TSMC's success actually deepens their reliance on ASML. Each new fab represents €1+ billion in process lock-in investments—specific recipes, yield optimization data, and manufacturing know-how coded exclusively to ASML specifications. Switching suppliers would require rebuilding this intellectual property from scratch, causing 18-24 month delays and billions in lost revenue.

The hardware equivalent of network effects compounds this dependency. Every mask shop worldwide designs patterns for ASML steppers. Every process development kit (PDK) assumes ASML specifications. Every yield database reflects ASML tool characteristics. The entire semiconductor ecosystem has evolved around ASML as the central standard.

Customer concentration in this context becomes strength, not weakness. TSMC, Samsung, and Intel aren't just customers—they're partners locked into ASML's technology roadmap. Their success requires ASML's continued innovation, creating aligned incentives that transcend normal supplier relationships.

When your biggest customers literally cannot succeed without you, concentration becomes the ultimate competitive advantage.

Geopolitical Amplifier: Trade Wars That Fortify Moats

Export controls and trade tensions have created an unexpected consequence: they've strengthened ASML's competitive position rather than weakened it.

Consider the logic. Export restrictions primarily harm competitors trying to build alternative supply chains. Chinese semiconductor companies, already 10+ years behind ASML technologically, now face additional barriers accessing Western subsystems and expertise. Meanwhile, ASML's Western customers find themselves forced into deeper integration as geopolitical alignment becomes business necessity.

The dependency acceleration is remarkable. Western fabs that might have considered diversification for strategic reasons now view ASML partnership as both technological requirement and political insurance. Technology sovereignty, it turns out, requires technological dependence—just dependence on the "right" suppliers.

China faces an impossible trilemma: build alternatives (10+ year timeline), steal technology (increasingly difficult with export controls), or accept dependence (politically unpalatable). None of these options closes the gap before 2030, giving ASML nearly a decade to extend their lead further.

Western alignment has become an additional switching cost. In an era where technology choices carry geopolitical implications, partnering with ASML isn't just technically optimal—it's strategically mandatory.

AI Hunger and the Next TAM Expansion

Beyond Traditional Lithography

Artificial intelligence is reshaping semiconductor architecture in ways that multiply lithography demand rather than reduce it. The shift isn't just about making existing chips faster—it's about fundamentally new approaches that require more lithography steps, not fewer.

High-bandwidth memory (HBM) stacks dozens of memory layers vertically, each requiring precise alignment. Chiplet architectures disaggregate monolithic processors into specialized components, demanding advanced packaging technologies. Backside power delivery routes electricity through the chip's rear, adding entirely new lithography-intensive process steps.

The result is advanced packaging lithography—a market barely reflected in current models that could add 10%+ wafer-start uplift by 2030. These aren't traditional semiconductor processes; they're precision assembly techniques requiring ASML's expertise in sub-micron alignment and multi-layer registration.

High-NA EUV amplifies this opportunity. At €400+ million per system with superior margins once at scale, High-NA represents both technological evolution and economic expansion. Early customers aren't buying these systems for incremental improvements—they're essential for next-generation AI architectures that simply cannot be manufactured any other way.

AI isn't creating cyclical demand for existing tools. It's creating structural demand for entirely new capabilities that only ASML can provide.

The Market's Misreading

What €656 Per Share Gets Wrong

At €656 per share, ASML trades at 30x next-twelve-month earnings—a multiple that reflects deep skepticism about future growth. This pricing embeds several fundamental misunderstandings about ASML's business model.

The Cyclical Fallacy: Wall Street models ASML as an equipment manufacturer, focusing on quarterly shipment volumes. They see tool sales and miss infrastructure tolls. The reality is ASML operates more like a utility, collecting recurring fees from an irreplaceable installed base while occasionally adding new "power plants" to the grid.

The China-Cliff Myth: Consensus expects Chinese revenue to collapse from 25% to sub-15% levels, implying permanent demand destruction. But front-loading isn't the same as demand destruction. Chinese fabs are accelerating purchases before potential restrictions tighten, shifting timing rather than eliminating orders entirely.

IBM Buffer Math: Services represent over 40% of gross profit, yet most models treat this as a rounding error. IBM's growth trajectory alone could offset significant system sales volatility, providing earnings stability that justifies premium valuations.

High-NA Timing Fixation: The market obsesses over High-NA adoption timelines while missing the forest for the trees. Whether these systems ramp in 2025 or 2027 is irrelevant to the 10-year value creation story, yet quarterly guidance on pilot programs drives massive price swings.

The mispricing stems from applying cyclical equipment frameworks to what is fundamentally an infrastructure monopoly with recurring revenue characteristics.

Numbers Behind the Narrative

What €275 Billion Market Cap Actually Buys You

ASML's current valuation implies modest expectations for a business with monopoly characteristics. Consider the quality metrics: gross margins consistently above 50%, return on invested capital exceeding 25%, and a fortress balance sheet with €9 billion net cash.

Probability-weighted scenario analysis reveals the embedded conservatism:

The bull case assumes High-NA success, AI-driven demand sustainability, and margin expansion from operational leverage. The base case models modest growth with margin stability. Even the bear case—assuming China loss and High-NA disappointment—only justifies 30% downside from current levels.

Entry sweet-spot analysis suggests €600 or below (27x NTM P/E) provides asymmetric risk/reward. At those levels, you're paying reasonable multiples for a monopoly business with recurring revenue characteristics and long-term growth optionality.

For patient capital willing to navigate 12-24 months of geopolitical uncertainty, current pricing offers compelling risk-adjusted returns across multiple scenarios.

Real Risks and Scorecard

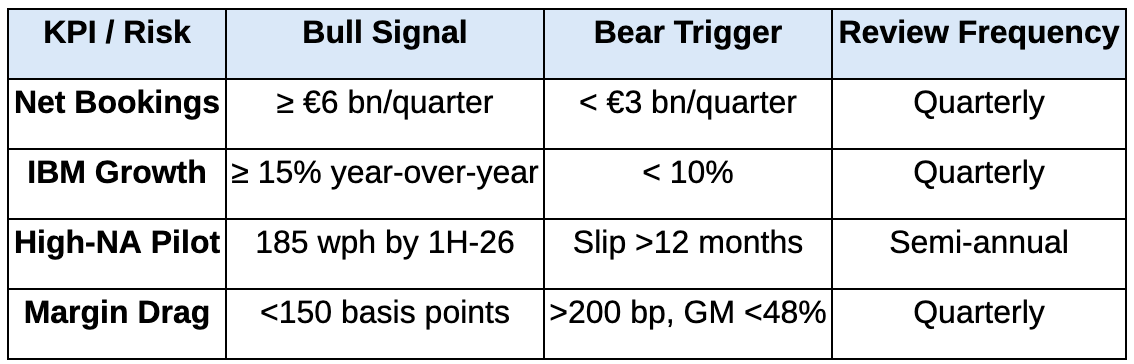

Understanding ASML requires monitoring leading indicators rather than reacting to quarterly noise. The key metrics that matter:

The framework is simple: exit if two bear triggers appear simultaneously; double-down if price drops below €560 but KPIs remain intact.

Real risks center on execution rather than competition. High-NA throughput misses could delay revenue recognition. Tariff escalation might compress margins beyond sustainable levels. Customer concentration means TSMC's capex pulse affects quarterly results even if long-term trends remain intact.

What's notably absent from high-probability risks: competitive threats. The physics moat continues deepening rather than eroding, with each technological generation requiring greater precision and system integration that favor incumbents over new entrants.

From Zeiss's Glass to ASML's Light

The arc from 1846 precision glass to 2025 precision light reveals a timeless truth: physics bottlenecks define economic eras. Zeiss's workshop powered Germany's industrial emergence. ASML's clean rooms power the digital revolution's next phase.

Control of the chokepoint equals control of value creation, and ASML sits squarely atop AI's production chain. The precision trap that Zeiss discovered has been perfected into an economic moat that transcends normal competitive dynamics.

What started as Carl Zeiss's competitive advantage in mechanical precision has evolved into ASML's economic monopoly in quantum-level engineering. The tools change, but the fundamental principle endures: whoever masters the precision controls the industry.

For investors, the implication is clear: ignore quarterly air-pockets and focus on long-term cash compounding. In an era where artificial intelligence demands ever-greater semiconductor precision, owning the precision trap means owning the future.

The market will eventually recognize what physics already dictates: some monopolies become more valuable over time, not less. At €656 per share, ASML offers patient capital the opportunity to compound alongside the precision revolution that powers our digital age.

The light that ASML turns into new oil illuminates more than just semiconductor wafers—it reveals the path to generational wealth creation through technological irreplaceability.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.