The Platform Transformation Wall Street Still Doesn't Understand

From Salesforce’s 2008 Crisis to Zscaler’s 2025 Validation: How AI Forces Infrastructure Decisions

TL;DR

History rhymes: Just as Salesforce redefined enterprise infrastructure during the 2008 financial crisis, Zscaler is proving that security is no longer “software” but foundational infrastructure.

The hidden moat: Inline inspection at massive scale, compounding data intelligence, and Z-Flex economics position Zscaler beyond Microsoft’s bundling threat.

The forcing function: Enterprise AI adoption is driving unprecedented demand for real-time security infrastructure—turning Zscaler into the control plane for the next era of computing.

In the spring of 2008, Marc Benioff faced his biggest credibility test. Salesforce had been growing rapidly, but the financial crisis was forcing enterprise customers to question everything—especially whether they should trust their mission-critical CRM systems to "some cloud company" instead of proven on-premise solutions.

I remember reading the analyst reports from that period. The common refrain was predictable: "Why would serious businesses replace their reliable, owned infrastructure with something they don't control?" The stock reflected this skepticism, trading at traditional software multiples despite Salesforce building something fundamentally different.

Here's what the market missed: Salesforce wasn't selling CRM software—they were selling business process infrastructure. The companies that made the leap during those uncertain months gained competitive advantages that compounded over years. Those that waited found themselves playing catch-up to competitors running on superior infrastructure.

I'm watching a remarkably similar dynamic play out today with Zscaler. Wall Street continues to value the company as premium security software facing Microsoft's bundling pressure, missing the foundational transformation happening beneath the surface. Zscaler's Q4 FY25 results, released last week, provide the clearest evidence yet that we're witnessing the emergence of security infrastructure as a distinct category—with all the competitive dynamics and investment implications that entails.

The Platform Becomes Visible

Unlike Salesforce's obvious SaaS transformation, Zscaler's infrastructure play is hidden in technical architecture that most investors don't fully grasp. This matters because the architectural differences create sustainable competitive advantages that traditional security approaches cannot replicate.

The numbers from Q4 tell a story that transcends typical quarterly results. Revenue of $719 million grew 21% YoY, beating consensus by 1.7% and guidance by 1.9%. Operating margins hit a quarterly record of 22.1%. Free cash flow beat estimates by 29%. These are solid results, but they're not the real story.

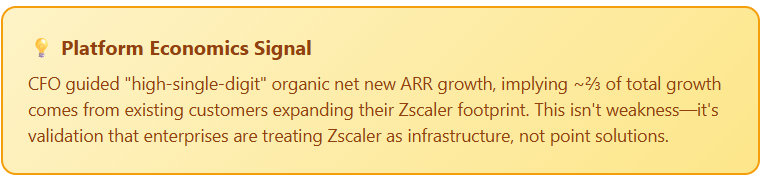

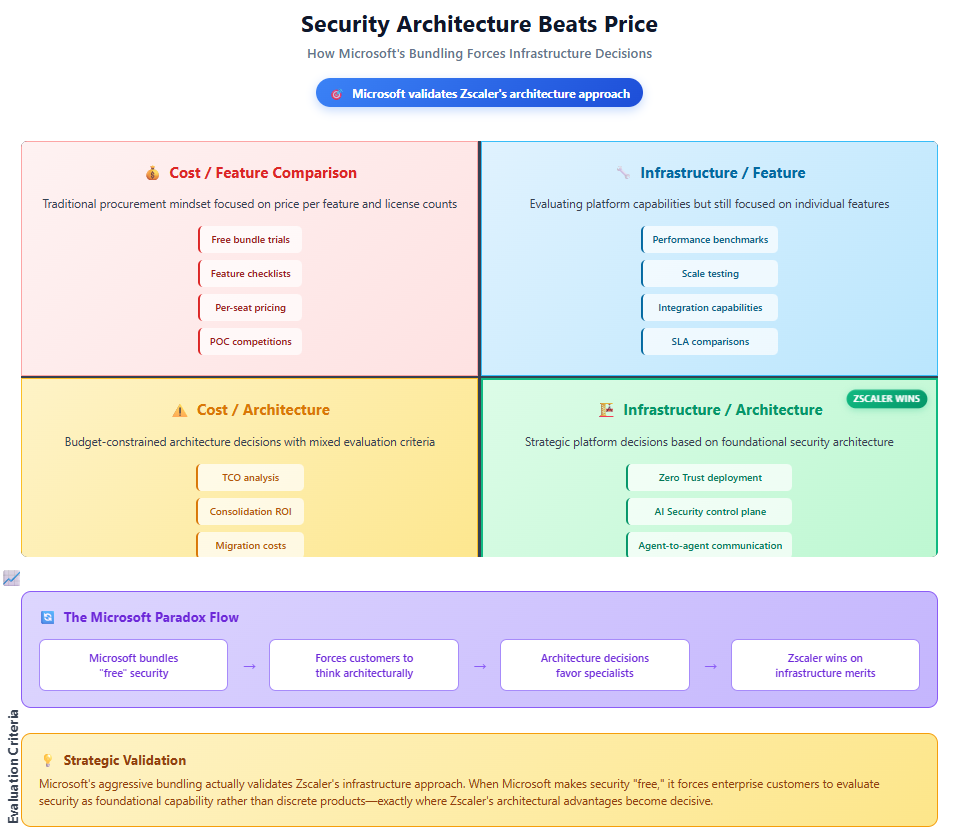

The real story is in CFO Kevin Rubin's guidance for "high single digit net new ARR growth in fiscal 2026 on an organic basis." Do the math: if total ARR is growing around 22-23%, and organic net new growth is in the high single digits, that means roughly two-thirds of Zscaler's growth is coming from existing customer expansion. This isn't weakness—it's validation of platform economics at work.

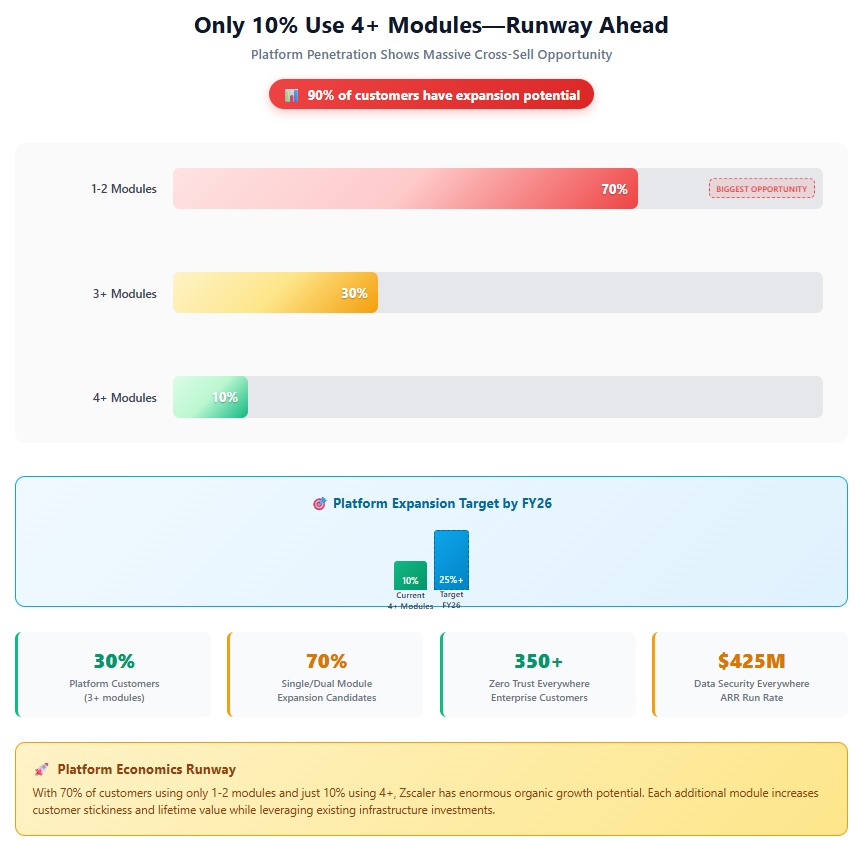

More telling still is the performance of three growth engines that have reached material scale. Zero Trust Everywhere now has over 350 enterprise customers, ahead of management's target of 390 by the end of FY26. Data Security Everywhere has reached $425 million in ARR, adding approximately $37.5 million in net new ARR each quarter—most of what SentinelOne generates for their entire business. Agentic Operations is targeting over $400 million in ARR for FY26.

Yet only 30% of Zscaler's customers use three or more modules, and just 10% use four or more. The cross-selling runway is enormous, and it's accelerating.

The Inline Moat

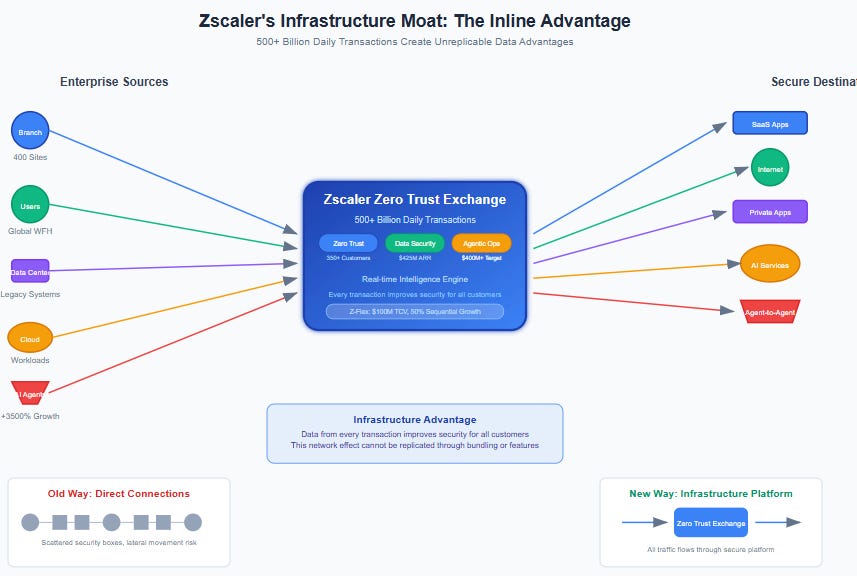

Here's the key insight that most investors miss: Zscaler processes over 500 billion transactions daily through inline inspection of every connection between users, applications, and increasingly, AI agents. This isn't just impressive scale—it represents a fundamentally different security model than anything that came before.

Traditional security operates on a detect-and-respond basis: threats are identified after they've entered the network, triggering alerts and remediation workflows. Zscaler's inline processing makes security decisions in real-time at the moment of connection. Every blocked threat, every policy enforcement, every anomaly detected feeds an intelligence engine that improves security for all customers simultaneously.

This data compounding effect is why I believe Zscaler has built something closer to infrastructure than software. The dataset they've accumulated through years of inline processing cannot be purchased, bundled, or rapidly engineered by competitors. Microsoft can offer "free" security, but they cannot offer the intelligence that comes from processing the volume and variety of transactions that flow through Zscaler's platform.

The numbers support this thesis. As Jay Chaudhry noted on the Q4 call: "AI/ML transactions on our cloud increased 3500% in the past year." That's not marketing hyperbole—it's infrastructure demand following enterprise AI adoption.

Z-Flex: Solving Infrastructure vs. Software Economics

The most strategically significant development in Q4 was Z-Flex generating $100 million in TCV bookings with 50% sequential growth. Most coverage treated this as customer-friendly flexible pricing, but I think it represents something far more sophisticated.

Z-Flex solves the fundamental tension between enterprise software economics (predictable revenue, fixed contracts) and infrastructure economics (consumption-based pricing, usage flexibility). Traditional consumption models create revenue volatility that public software companies struggle to manage. Pure enterprise licensing lacks the flexibility that infrastructure platforms require.

Z-Flex enables customers to commit to 3-5 year contract envelopes while consuming modules flexibly within those predetermined terms. Customers get infrastructure-style consumption with budget predictability; Zscaler gets revenue visibility while enabling platform expansion.

As Jay explained: "Our Z Flex program is becoming the preferred motion for strategic multiyear deals as it enables seamless adoption of new product modules by our customers." The rapid adoption suggests enterprises are demanding infrastructure economics, not traditional software licensing.

This model neutralizes Microsoft's primary competitive advantage—bundling economics. It's difficult to compete against flexible consumption within enterprise budgets, especially when the platform enables genuine consolidation of point products that customers are already purchasing separately.

The Microsoft Paradox

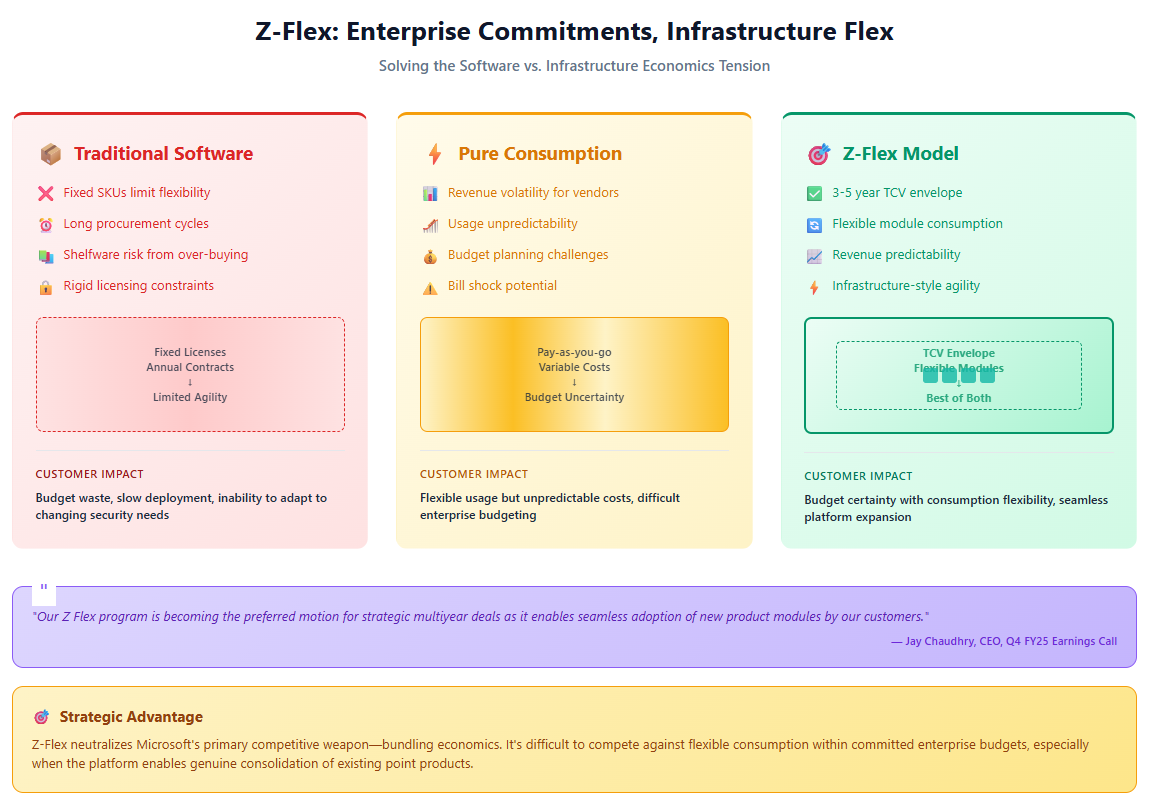

Most analysts view Microsoft's aggressive security bundling as an existential threat to Zscaler's premium positioning. I think they're missing the strategic implications entirely.

Microsoft's "free" security actually validates Zscaler's infrastructure approach. When Microsoft throws security into Office 365 bundles, it forces enterprise customers to think about security as foundational capability rather than discrete products. This creates helpful market education: customers start evaluating security architectures instead of comparing feature checklists.

The companies choosing Zscaler over free Microsoft security aren't making cost-benefit decisions—they're making infrastructure architecture decisions. They're betting that security infrastructure, like compute infrastructure before it, becomes more valuable when provided by specialists who can innovate without the constraints of broader platform considerations.

The evidence suggests this architectural differentiation is sustainable. Despite increased competitive pressure, Zscaler maintains pricing power with existing customers, demonstrated through Z-Flex success and expanding module adoption. As Jay noted: "The only two products Zscaler has seen that don't need any demand generation because there's so much demand out there—Zero Trust branch and AI security."

This mirrors the cloud transformation dynamic. Microsoft's Azure gained share by bundling with enterprise agreements, but AWS maintained leadership in infrastructure innovation and premium positioning. Zscaler appears to be following a similar path in security infrastructure.

AI as the Central Forcing Function

The 3,500% increase in AI/ML transactions processing through Zscaler's platform tells a story that most investors are missing entirely. This isn't just about securing AI applications—it's about Zscaler becoming essential infrastructure for enterprise AI deployment.

Their AI Security segment has meaningful momentum, but more importantly, they're positioning as the security control plane for agent-to-agent communication—the new "north-south" traffic pattern that emerges as AI agents become prevalent in enterprise environments.

As Jay explained: "We're developing Zero Trust solution to secure agent to agent and agent to application communication. As an increasing number of software vendors are introducing their own agents, enterprises are looking for a proven vendor agnostic platform like Zscaler to secure agentic communication."

This represents genuine strategic positioning rather than opportunistic AI rebranding. Processing AI workload communications creates security intelligence that compounds over time—data advantages that competitors cannot replicate through engineering effort or acquisition.

Three-Year Investment Framework

Based on my analysis of platform transformation progress and competitive dynamics, I see three primary scenarios for Zscaler over the next three years:

Bull Case (25% probability): $425 target Revenue CAGR of 24-25% driven by accelerated AI Security adoption and Z-Flex success, operating margins reaching 32% as platform scale advantages become evident, and market valuation expanding to 12-15x revenue reflecting infrastructure platform premium.

The catalyst would be Z-Flex becoming the dominant commercial model (60%+ of enterprise customers), AI Security exceeding $600 million ARR by FY28, and clear evidence of sustainable competitive advantages through data network effects.

Base Case (60% probability): $335 target Revenue CAGR of 20-21% with steady platform execution, operating margins expanding to 28-30% as platform economics mature, and market valuation settling at 10-12x revenue (premium SaaS recognition).

This scenario assumes sustained demonstration of platform economics—Z-Flex adoption reaching 40-50% of enterprise customers, average contract terms extending toward 4+ years, and customer expansion rates remaining consistently above 30%.

Bear Case (15% probability): $275 target Revenue CAGR of 17-18% as new customer acquisition struggles persist, operating margins constrained to 25% due to competitive pricing pressure, and market valuation remaining at 8-10x revenue (traditional security software multiple).

The risk factors would be organic net new ARR growth falling below 5%, Z-Flex adoption plateauing below 30% customer penetration, and sustained gross margin compression indicating pricing power deterioration.

The Execution Stack

While I'm constructive on Zscaler's platform transformation, several execution risks deserve honest assessment.

The most significant is measurement opacity. Zscaler's shift from emphasizing billings to focusing on ARR metrics comes without comprehensive disclosure of the underlying platform adoption metrics that would justify premium valuations. Without clear visibility into Z-Flex penetration rates, customer expansion patterns, and competitive win/loss trends, the market may not recognize platform transformation progress.

Integration complexity represents another concern. Scaling three distinct growth vectors (AI Security, Zero Trust Everywhere, Data Security Everywhere) while integrating Red Canary's MDR business creates operational challenges that could impact execution quality. Kevin Rubin's conservative approach to Red Canary ARR guidance, citing "higher churn rates" typical of MDR businesses, suggests management recognizes these risks.

The growth model dependency on existing customer expansion creates vulnerability if platform adoption plateaus. With 65-70% of growth coming from existing customers, any slowdown in module adoption or contract expansion could significantly impact overall growth trajectory.

What to Track

Monitoring Zscaler's platform transformation requires focusing on leading indicators rather than lagging financial metrics. Here's what I'll be watching:

Z-Flex penetration rates are critical—I'm looking for 50%+ of enterprise customers by Q4 FY26. Average contract duration trends matter too; progression from the current 3.2 years toward 4+ years would validate infrastructure-level commitments.

Customer expansion rate consistency above 30% quarterly, along with module adoption progression—specifically the percentage with 4+ modules—will indicate platform saturation progress.

On the competitive front, organic net new ARR growth trends are the warning flag; sub-5% organic growth would suggest Microsoft's bundling pressure is working. Gross margin trends under competitive pressure and customer concentration metrics will assess platform defensibility.

Completing the Salesforce Arc

Returning to that uncertain spring of 2008: Salesforce customers who trusted their business processes to cloud infrastructure during the financial crisis gained competitive advantages that compounded over subsequent years. Those early adopters could adapt faster, scale more efficiently, and innovate more rapidly than competitors locked into on-premise constraints.

Today, enterprises choosing Zscaler's security infrastructure over Microsoft's bundled approach are making a similar foundational bet. They're wagering that security infrastructure, like business process infrastructure before it, becomes more valuable when provided by specialists who can innovate without broader platform constraints.

The investment parallel is equally compelling. Like Salesforce in 2009-2012, Zscaler has proven their infrastructure model works at enterprise scale, but market recognition lags the actual business transformation. The companies that gain full infrastructure platform recognition during this transition period often deliver the most compelling long-term returns.

As Jay Chaudhry concluded on the earnings call: "We're still in the early innings of disrupting a large $100 billion security market." Based on the Q4 results and platform adoption metrics, I believe we're watching the early innings of that disruption play out in real-time.

The question for investors today is the same as it was for Salesforce in 2008: Are you buying a software vendor, or are you buying the foundational infrastructure for the next era of computing? Sometimes the best infrastructure investments require thinking in years while others obsess over quarters. Zscaler's Q4 results suggest the platform transformation is real—the question is whether investors will recognize it before or after it becomes obvious to everyone else.

ZS 0.00%↑ PANW 0.00%↑ MSFT 0.00%↑ CRWD 0.00%↑ FTNT 0.00%↑

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.