TLDR:

What CEG Really Sells & Why It Matters: Constellation isn’t in the loose-electron business as it sells assured, always-on “pressure”: >20 GW of nuclear capacity running at >92% capacity factors, delivering ~160 million MWh of carbon-free power annually. This reliability is critical for hyperscale data centres and electrified industries that can’t run on “when-the-sun-shines” bursts.

How the Economics Flow: Federal nuclear tax credits act as levees to protect the reservoir in low-price markets, while PJM capacity revenues function as tolls that reward readiness. Long-term 24/7 CFE contracts which are the pipes and valves are a route premium, verified clean flow directly to mission- critical buyers.

Where Growth Comes From: Constellation is raising the dam (nuclear uprates), reopening a dam (Crane restart), and adding pumping stations (Calpine integration) to expand both output and flexibility. Each new 24/7 CFE contract with priority AI and industrial customers increases stickiness, visibility, and the value of its dependable reservoir.

Executive Summary - Pressure beats rainfall

Most people picture electricity like weather: when wind or sun arrives, the grid fills up. But big customers like hospitals, fabs, data centres don’t buy weather. They buy pressure: reliable, carbon-free power at the tap, all day and all night.

That’s (CEG) Constellation’s edge. Across 2022 - 2025, its nuclear “reservoirs” held steady with capacity factors above 92%, delivering more than 20 GW of clean baseload. While wholesale markets swung with gas prices and weather, Constellation’s retail and C&I “pipes and valves” their long-term contracts and risk management kept revenue rising and adjusted EPS climbing from the low $1s in 2022 to $1.91 in Q2 2025.

Policy levees, like the nuclear production tax credit, kept water levels from falling too low, while market tolls and capacity revenues added hundreds of millions in annual earnings for simply being ready.

The result: in an era of volatile renewable output and surging AI-driven demand, Constellation stands as the market’s most dependable pressure pump for clean power.

Act I - The Reservoir vs. Rain

Rain, wind and solar are wonderful when they come. Rain is clean, cheap, and in 15 - minute trading intervals, it can flood wholesale markets with negative-priced power. But rain is irregular. It can’t guarantee the shower turns on at 6 a.m. for a surgical ward, or keep a data centre’s GPUs fed at 2 a.m. when the wind drops.

Reservoirs like nuclear plants do exactly that. Constellation’s 20+ gigawatts of nuclear capacity operate at capacity factors above 92% year after year, producing more than 160 million megawatt-hours of zero-carbon electricity annually. That steadiness shows up in the earnings reports: while gas-fired margins and renewable output whipsawed with weather, Constellation’s nuclear segment delivered consistent quarterly generation and stable revenue contributions through 2022 - 2025.

For daily investors: think about home water. Rain barrels are fine for the garden. But when you turn the tap, you expect pressure - instantly, every time. Constellation’s fleet is the grid’s tap pressure.

Just as a reservoir smooths out the bursts and droughts of the river feeding it, Constellation smooths the volatility of the grid by turning intermittent inflows into bankable, schedulable output. And in a world where AI workloads, electrified manufacturing, and critical infrastructure demand power every second of the day, that stability is worth more than ever.

Act II - Pipes and Valves (CEG’s Contracts)

A reservoir without pipes is just a lake. Constellation’s retail and C&I business is the network of pipes that carries carbon-free output straight to the customers who value it most. Each pipe is a multi-year agreement that is a fixed, predictable route for clean energy to flow, insulated from the stop-start rhythm of wholesale markets.

The valves are where the offer becomes truly differentiated. Constellation’s 24/7 Carbon-Free Energy products let buyers decide not just how much power they want, but when and how it’s delivered. A hyperscale cloud campus can match every server cycle to carbon-free generation in the same hour it’s consumed; a hospital can lock in overnight coverage without worrying about the wind forecast.

This is more than selling electricity. It’s selling reliability in a bottle which is the assurance that clean power will be there exactly when it’s needed. Every contract signed is a promise kept, and over time, those promises build

a moat. Where most generators sell megawatt-hours, Constellation sells service-level agreements: pressure, on schedule.

Act III - Levees and Tolls (Policy & Markets)

Even the best reservoirs need protection and upkeep. For Constellation, the levees are policy supports they are nuclear production tax credit (PTC) chief among them that keep the economics steady when wholesale prices drop. Think of it as flood control for cash flows: a structured floor that ensures output remains profitable even in seasons of low market prices.

The tolls come from capacity markets. Here, the grid pays not just for energy delivered, but for the assurance that it can be delivered at a moment’s notice. It’s like paying the dam to keep its gates staffed and ready, even if the surge hasn’t arrived yet. That readiness is its own product - a quiet but crucial source of earnings stability.

Together, levees and tolls make Constellation’s income less weather-dependent and more like a service contract. When rain is scarce and prices soften, the levees hold. When demand surges and peak capacity is scarce, the tolls pay. Either way, the reservoir keeps earning and investors get a steadier stream.

Act IV - Raising the Wall and Reopening an Old Dam (Growth)

Some growth comes from new rivers. But Constellation’s near-term growth is about getting more from the reservoirs it already controls. Uprates are incremental improvements to existing nuclear units and are like raising the wall of a dam: same footprint, more headroom, more pressure from the same flow. Small engineering changes add up to extra megawatts, each one carbon-free and immediately monetizable through long-term contracts.

Then there’s the reopening of a dam long closed. The planned restart of the Three Mile Island Unit 1 at Crane will return a major reservoir to service just as the AI era’s power demands are spiking. This isn’t nostalgia but it’s timing. Bringing a large block of steady, carbon-free capacity back online as hyperscale data centres and electrified manufacturing scale up is like filling a fresh reservoir right before a long dry season.

And Constellation isn’t only about steady flow. The integration of Calpine adds flexible gas generation and a commercial platform that can route supply to where it’s most valuable. Think of these as new pumping stations the assets that can shift, blend, and optimize the flow between markets and customers.

Together, uprates, restarts, and new flexibility give Constellation more volume to sell into a market that’s paying premiums for certainty.

Act V - The Business Model in One Picture

A nuclear plant is like a reservoir: costly to build, but once it’s there, the flow lasts for decades. The capital comes up front; what follows is years of steady, service-like delivery.

That long life pairs with stickiness. Once a customer’s “pipes” are laid and a contract signed, operational systems aligned then switching isn’t just inconvenient; it’s costly and risky. For a hospital or a hyperscale campus, a disruption isn’t an option.

Policy levees like the nuclear PTC set a floor under earnings, while capacity market tolls add a second layer of protection. Multi-year retail and C&I contracts give line-of-sight to margins that’s rare in a commodity market.

For investors, it’s a blend that looks more like infrastructure or subscription software than like a merchant power plant: high predictability, long duration, high switching costs, and strong visibility. It’s the kind of profile Wall Street likes to hold.

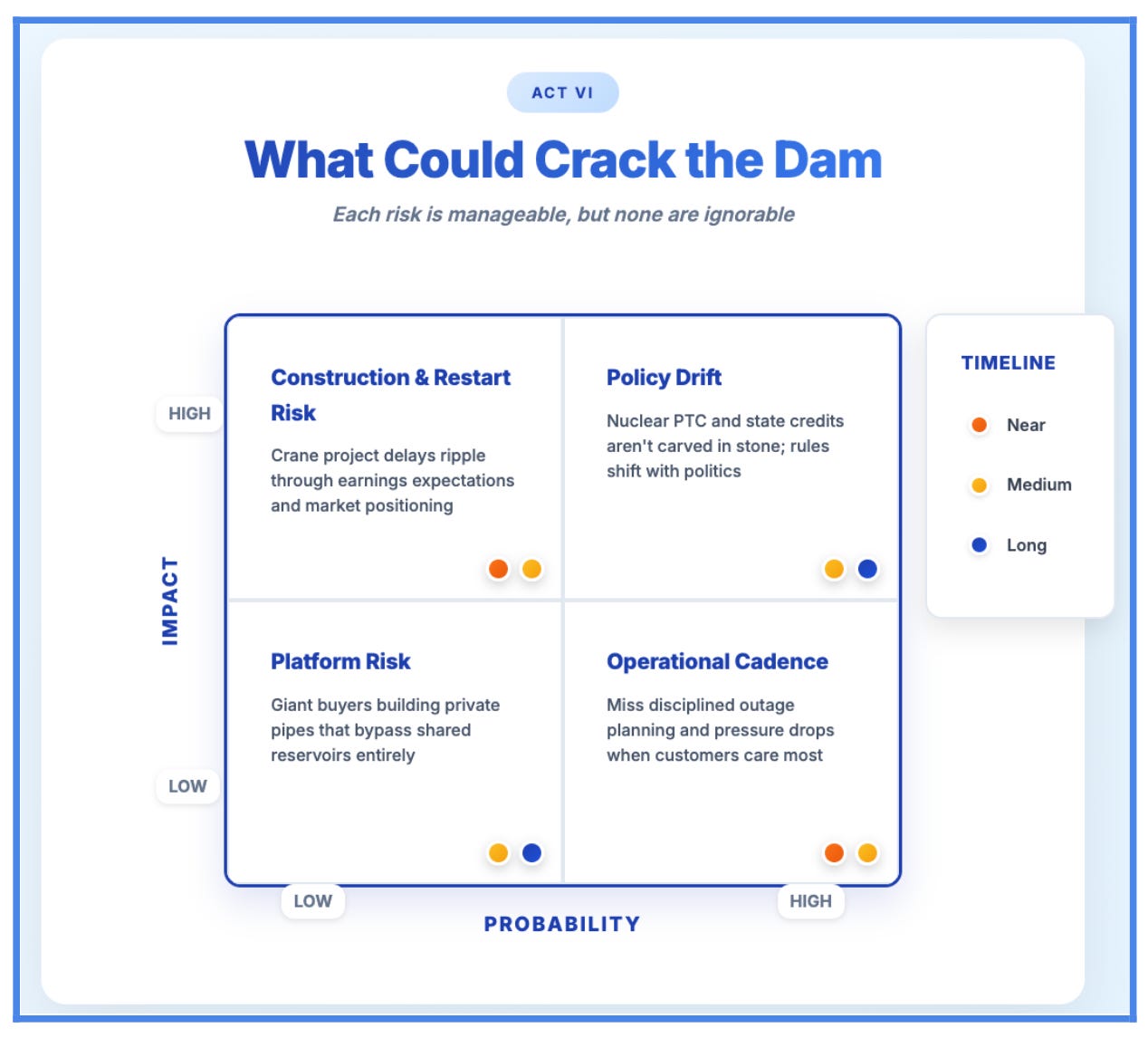

Act VI - What Could Crack the Dam (Risks)

Even the strongest reservoir faces stress. For Constellation, one pressure point is construction and restart risk: delivering the Crane project on time and within budget. Nuclear work is complex; delays can ripple through both earnings expectations and market positioning.

Policy drift is another. The levees that protect earnings which are the nuclear PTC, state-level credits, and other incentives aren’t carved in stone. Rules can shift with politics, and Constellation has to stay aligned with the changing current.

Operational cadence matters too. Nuclear reliability depends on disciplined outage planning and maintenance. Miss the cadence, and pressure drops especially sometimes at the moments the customers care most.

Finally, platform risk: giant buyers, from hyperscale tech to industrial conglomerates, are increasingly exploring their own “private pipes” that are dedicated generation or behind-the-meter solutions that bypass shared reservoirs entirely.

Each of these risks is manageable, but none are ignorable. A strong dam is built not just for today’s river, but for tomorrow’s storms

.

Act VII - The AI Customer in Plain English

AI facilities don’t just need electricity but they also need pressure that never drops. In model training, if the “shower” sputters even for a moment, the job stops, the GPUs idle, and hours of work can be lost.

They also need that pressure to be clean. Meeting climate targets with a patchwork of offsets and certificates is messy; buyers are looking for direct, hour-by-hour proof that the power they’re using is carbon-free.

Constellation’s pitch to them is straightforward: one partner, one pipe, guaranteed flow that is verified in real time. The reservoir delivers the uptime; the valves and pipes shape it to the site; the policy levees and tolls keep the economics steady. For AI customers, it’s not just about energy, it’s about certainty.

Act VIII - Scorecard & What to Watch (Next 12 Months)

For Constellation, the next year is about proving the reservoir’s pressure is as dependable as its promise. On the operations side, that means keeping the nuclear fleet’s reliability high and outage cadence disciplined with no unexpected drops in flow.

On the policy front, levees and tolls deserve attention. Federal credits and state incentives must hold their shape, and the upcoming PJM capacity auctions will be an early reading on the value the market places on Constellation’s readiness.

New volume is coming into view: hitting milestones on the Crane restart and folding Calpine’s assets into the routing network will expand both capacity and flexibility.

And then there’s the customer front by adding more 24/7 CFE contracts with priority buyers, from hyperscale data centres to mission-critical campuses. Each new pipe laid increases stickiness and visibility.

Closing Loop - Own the Reservoir, Not the Weather

Chasing short-term power price “rain” is speculation. It’s thrilling when it pours and wholesale prices spike, traders capture a windfall but it’s unpredictable, and it disappears just as fast. You can’t plan a hospital’s surgery schedule, keep a semiconductor fab online, or run a year-long AI training job around a passing shower.

Owning the reservoir that sets pressure is different. It’s not about chasing bursts; it’s about shaping the flow which is steady, schedulable, carbon-free and by also delivering it exactly when and where it’s promised. That’s Constellation’s Lane. Its nuclear fleet is the reservoir, its contracts the pipes, its 24/7 CFE products the valves. Levees in the form of policy supports keep water levels from dropping too low; tolls from capacity markets pay for readiness even before the surge arrives.

This model rewards patience and discipline. Expanding the walls through uprates and restarts adds more headroom for growth. Integrating flexible assets like Calpine’s fleet adds routing power, making the system more resilient to shifts in demand. Every new 24/7 CFE deal with a priority buyer lays another pipe, increasing stickiness and visibility.

In a grid becoming more complex by the day especially where intermittent rain from renewables is both abundant and volatile - Constellation is in the business of guaranteeing pressure. And in a world that’s increasingly intolerant of downtime, that’s a promise the modern economy can’t run without.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.