The Sovereign Stack: Saab's Strategic Reinvention

How a Swedish defense contractor became Europe's nervous system

TLDR

From Survival Mode to Strategic Core: Saab transformed from a financially strained, niche European defense contractor into the backbone of Europe’s sovereign defense ecosystem. Triggered by the 2022 invasion of Ukraine, Saab leveraged its lean wartime operating model to rapidly scale operations, triple order backlogs, and evolve from a cyclical project executor to a multi-domain platform orchestrator with embedded strategic relevance.

The Power of the “Sovereign Stack”: Rather than competing on hardware alone, Saab redefined itself as a sovereign infrastructure builder—integrating air, land, and sea systems through AI-powered command-and-control platforms. Its “sovereign network effects” ensure that each new participant enhances system-wide interoperability, creating political, operational, and economic switching costs that entrench Saab in European defense strategy.

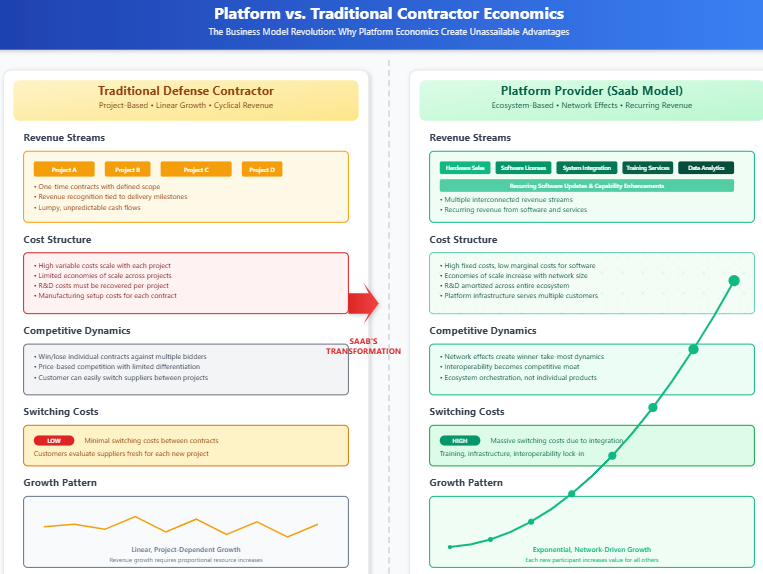

Platform Economics + Strategic Moats = Market Mispricing: Saab’s software-defined transformation—driven by partnerships like NVIDIA—unlocks scalable margins, recurring revenue streams, and rapid iteration cycles. While markets still value Saab like a traditional defense cyclical, the company’s platform-driven economics, geopolitical embedding, and flywheel of sovereign lock-in suggest it’s building the Microsoft of European defense, not just selling jets.

A Quiet Victory

In March 2020, Micael Johansson stood before a small gathering in Saab's Linköping headquarters to announce what he considered a career-defining achievement: the company's first substantial positive cash flow in years—SEK 2.8 billion. For a firm that had spent the better part of a decade proving it could merely survive in Europe's shrinking defense landscape, this represented vindication of years of disciplined cost-cutting and operational focus.

"One of the most important parameters to me has been to turn around the cash flow," Johansson said, his satisfaction evident but measured.

It was the quiet triumph of a CEO who had learned to celebrate small victories in an industry that offered few reasons for optimism.

What Johansson couldn't have known was that even as he savored this moment of financial stability, the assumptions underpinning Europe's entire security architecture were about to collapse. Within two years, his company would transform from a mid-sized defense contractor celebrating basic financial health into the architect of Europe's sovereign defense capabilities. The cash flow Johansson was so proud of would soon seem quaint compared to managing a SEK 189 billion order backlog.

The story of Saab's transformation is more than a corporate turnaround—it's a case study in how companies that position themselves at the inflection points of paradigm shifts can capture disproportionate value. More importantly, it reveals how the most profound strategic advantages often emerge from what initially appear to be constraints.

Europe's Fragile Peace Dividend

To understand Saab's remarkable journey, we must first understand the world that shaped it. Following the Cold War's end, Europe made a conscious choice: economics over security, butter over guns, American guarantees over indigenous capabilities. Defense spending across NATO's European members plummeted from 3-4% of GDP during the 1980s to barely 1-1.5% by the 2010s. The "peace dividend" seemed not just logical but inevitable.

This contraction had profound implications for Europe's defense industry. Major programs were canceled, companies consolidated or shuttered, and those that survived did so by becoming hyper-efficient specialists. The market rewarded frugality over innovation, project execution over strategic vision.

Saab epitomized this constrained reality. As Sweden's national defense champion, the company had built an impressive portfolio—the Gripen fighter, cutting-edge submarines, sophisticated radar systems—but it remained fundamentally a niche player. Its business model was project-based and cyclical: win a contract, execute flawlessly, hope for the next opportunity. Margins were thin, visibility was low, and growth came in lumps separated by valleys of uncertainty.

This was the context in which Johansson's 2020 cash flow announcement made sense. In a shrinking market where survival was success, turning cash flow positive represented genuine achievement. Saab had proved it could endure Europe's defense winter. What it hadn't yet proved was whether it could thrive in any other season.

February 24, 2022: The Paradigm Shatters

At 4:00 AM Moscow time, Russian forces crossed into Ukraine from multiple directions. Within hours, the assumptions that had governed European security for three decades lay in ruins. The invasion wasn't just an attack on Ukraine—it was an assault on the entire edifice of European strategic thinking.

The response was swift and stark. Germany, which had spent decades building economic ties with Russia while neglecting its military, announced a €100 billion defense spending package. NATO members who had spent years dodging the 2% GDP spending target suddenly embraced it as a floor, not a ceiling. The European Union, long allergic to military matters, began discussing "strategic autonomy" and defense industrial policy.

For Saab, the change was immediate and overwhelming. Order inquiries that had previously trickled in now arrived as a flood. Countries that had deferred equipment purchases for years suddenly needed everything immediately. The company that had spent the previous decade optimizing for efficiency now faced the entirely different challenge of scaling for explosive growth.

The numbers tell the story: Saab's order intake surged 45% in 2022 to SEK 63.1 billion. But numbers alone don't capture the psychological transformation. Overnight, Saab's management shifted from defending every kronor of spending to figuring out how to hire thousands of people and build production facilities across multiple continents.

Three Phases of Transformation

Saab's evolution since February 2022 can be understood as three distinct but overlapping phases, each representing a fundamental shift in how the company understood its role and opportunity.

Phase 1: Crisis Response (2022)

The initial response was reactive and urgent. With order intake exploding, Saab's immediate challenge was capacity—how to deliver on contracts that exceeded the company's historical annual revenue. This meant emergency hiring, supply chain acceleration, and facility expansion. The mindset was simple: execute on the unprecedented demand as quickly and efficiently as possible.

The results were impressive but also revealing. Despite the massive scaling effort, Saab maintained its operational discipline. Margins held steady, quality remained high, and delivery schedules were met. This wasn't lucky—it was evidence of organizational capabilities that had been forged during the lean years.

Phase 2: Rapid Scaling (2023)

As it became clear that the demand surge wasn't temporary, Saab shifted into strategic scaling mode. The company achieved 23% organic growth while actually expanding margins from 7.8% to 8.3%—a combination that's extraordinarily rare and suggests genuine operational leverage.

More importantly, Saab began thinking beyond simply fulfilling existing demand. The company embarked on an ambitious expansion program, building new facilities not just in Sweden but in the United States, India, and the United Kingdom. It hired over 3,000 new employees, invested heavily in R&D, and began forming strategic partnerships with technology companies like NVIDIA.

The narrative evolved from "urgent execution" to "strategic positioning." Saab was no longer just responding to the crisis—it was positioning to shape the market that would emerge from it.

Phase 3: Platform and Protocol Shift (2024–Present)

The third phase represents the most profound transformation: Saab's evolution from a traditional defense contractor to something entirely different—a platform provider for European sovereign defense capabilities.

With a record backlog of SEK 189 billion providing multi-year revenue visibility, Saab gained the strategic flexibility to invest in the future rather than just deliver on the present. The company launched what it calls an "AI Factory" in partnership with NVIDIA, began developing software-defined weapons systems, and started positioning its products not as standalone platforms but as components of an integrated defense ecosystem.

This phase is defined not by what Saab builds but by what it enables: a connected, interoperable, and sovereign European defense capability.

Sovereign Network Effects: The Strategic Breakthrough

To understand why Saab's transformation represents something genuinely new, consider a scenario that's increasingly common on European battlefields: A German Leopard tank identifies a threat but lacks the sensors to engage it effectively. Swedish Gripen fighters overhead detect the target using advanced radar and AI-powered threat recognition. Polish ground-based air defense systems track incoming missiles. All three platforms share information instantaneously through Saab's command and control systems, enabling coordinated response in real-time.

This isn't just military cooperation—it's the sovereign stack in action.

Saab's breakthrough insight was recognizing that in an interconnected world, defense isn't about building the best individual platforms; it's about creating the infrastructure that enables all platforms to work together effectively. The company doesn't just sell products—it builds sovereign capability infrastructure.

This creates what I call "sovereign network effects"—a phenomenon where each new country or platform that joins the network makes the entire system more valuable to all participants. Unlike traditional network effects driven by user adoption, sovereign network effects are reinforced by political and economic considerations that make switching costs extraordinarily high.

Consider what happens when a country adopts Saab's systems. First, it integrates them into its national defense architecture—a process that involves training thousands of personnel, building maintenance infrastructure, and adapting command structures. Then it begins participating in NATO exercises and joint operations where interoperability becomes essential. Finally, domestic production creates local jobs and political constituencies with strong incentives to maintain the relationship.

The result is a form of strategic embedding that goes far beyond traditional customer relationships. Countries don't just buy Saab's products; they become part of Saab's ecosystem. And once embedded, the costs of switching—economic, political, and operational—become prohibitive.

The Digital Inflection Point: From Hardware to Software

Ukraine's battlefields have provided a brutal education in modern warfare's realities. The conflict has demonstrated conclusively that victory belongs not to whoever fields the most tanks or planes, but to whoever can integrate information, automate decision-making, and adapt faster than the enemy.

This insight drives Saab's most significant strategic bet: the transformation from a hardware-centric company to a software-defined platform provider.

The partnership with NVIDIA exemplifies this shift. Together, they're developing capabilities that would have been science fiction just a few years ago:

Real-time sensor fusion that combines data from air, land, and sea platforms across 30+ allied nations into a single battlefield picture

AI-powered threat recognition trained on actual combat data from Ukraine, capable of identifying and classifying targets faster than human operators

Predictive maintenance algorithms that optimize NATO fleet readiness by anticipating equipment failures before they occur

Autonomous swarm coordination enabling dozens of drones to operate as a coordinated unit with minimal human oversight

The Gripen E fighter illustrates this transformation perfectly. While it looks like a traditional aircraft, it represents a fundamental shift toward software-defined capabilities. More importantly, its capabilities can be continuously upgraded through code deployments—transforming it from a fixed asset to an evolving platform.

This software-centric approach gives Saab a crucial advantage: speed. While traditional defense contractors measure development cycles in years or decades, Saab can now iterate at software pace, deploying new capabilities in weeks or months. In an industry where technological superiority often determines outcomes, this speed advantage is decisive.

Why Incumbents Can't Replicate This

Saab's transformation might seem replicable, but several structural factors make it extremely difficult for larger competitors to follow suit.

Lockheed Martin, despite its scale and technological capabilities, faces fundamental constraints. As an American company, it's subject to export controls that limit its ability to share advanced technologies with European allies. More importantly, its size and prominence make it a poor fit for the kind of local embedding that creates sovereign network effects. When Germany wants sovereign defense capabilities, buying from America's largest defense contractor doesn't solve the sovereignty problem.

BAE Systems might seem like a natural competitor, but Brexit has fundamentally altered its position in Europe. The company's UK focus limits its appeal to continental European customers increasingly focused on EU strategic autonomy. Moreover, BAE lacks the software and AI capabilities that Saab has developed through its NVIDIA partnership.

Rheinmetall represents perhaps the closest analog—a European company with strong technological capabilities and growing ambitions. However, its focus on land systems means it lacks the air and naval expertise necessary for true multi-domain integration. More fundamentally, its German-centric approach contrasts with Saab's deliberate multi-domestic embedding strategy.

The deeper issue is that replicating Saab's approach isn't just about technology or business model—it requires a fundamental reimagining of what a defense company does. Traditional contractors sell products to customers. Saab creates sovereign capabilities with partners. This distinction might seem semantic, but it drives entirely different strategic choices about everything from R&D investments to facility locations to partnership strategies.

Platform Economics Hidden in Defense Accounting

The most remarkable aspect of Saab's transformation is how it's achieving something that's supposed to be impossible: expanding margins during explosive growth. Traditional economics suggests that rapid scaling should pressure profitability as companies stretch their operational capabilities and compete more intensively for scarce resources.

Saab's financial performance tells a different story. The company has expanded its EBIT margin from 7.4% in 2020 to 9.2% in early 2025, even while growing revenues by more than 50%. This margin expansion during a period of massive hiring, facility construction, and R&D investment suggests something profound is happening beneath the surface.

The explanation lies in platform economics that are largely hidden within traditional defense contractor accounting. Unlike hardware sales, software scales without proportional cost increases. Integration services command premium pricing because they're mission-critical and have few alternatives. Most importantly, each new platform sale increases the value of Saab's entire installed base by expanding the network of interoperable systems.

Consider the economics of a software update that enhances threat recognition capabilities across Saab's fighter fleet. The development cost is fixed regardless of whether the update goes to 10 aircraft or 1,000. But the value created scales with the size of the network—not just because more platforms benefit, but because the network becomes more effective as more participants share enhanced capabilities.

This dynamic is creating a new category of revenue that doesn't exist in traditional defense accounting: recurring platform revenue. Countries aren't just buying aircraft or submarines; they're subscribing to continuously evolving capabilities. Training programs, software updates, capability enhancements, and system integrations create ongoing revenue streams that are more predictable and higher-margin than episodic hardware sales.

The cash flow profile reflects this transformation. While Saab's free cash flow conversion has declined from 57% to 17% as the company invests heavily in infrastructure and capabilities, this represents strategic positioning rather than operational deterioration. The company is trading current cash flow for future platform control—a bargain that will pay dividends for decades.

Durable Competitive Moats

Saab's strategic positioning creates multiple overlapping competitive advantages that are extraordinarily difficult to replicate or dislodge.

The regulatory moat stems from security clearances and "trusted supplier" status across more than 70 countries. Defense contracts aren't just commercial relationships—they involve national secrets, strategic capabilities, and sovereign interests. The vetting process for new suppliers is measured in years, not months, and the standards for maintaining access are continuously rising.

The integration moat reflects the sunk costs of embedding Saab's systems into NATO command structures, government operations, and training programs. Consider the complexity of integrating a new fighter aircraft into a nation's air force: pilot training programs that take 5+ years to complete, maintenance infrastructure representing billions of dollars in investment, and command systems that must interface seamlessly with existing operations. The switching costs aren't just financial—they're operational and strategic.

The political moat emerges from Saab's multi-domestic production strategy. When the company builds facilities in key electoral districts across multiple countries, it creates constituencies with strong incentives to maintain the relationship. Politicians face career-ending explanations if they cancel contracts that eliminate thousands of high-paying manufacturing jobs.

Most importantly, the network moat grows stronger with each new participant. As more countries adopt Saab's systems and integrate them into NATO operations, the cost of choosing alternative suppliers increases exponentially. A country considering non-Saab systems must weigh not just the direct costs but the operational penalties of reduced interoperability with allies.

These moats reinforce each other in ways that make Saab's position increasingly unassailable. Regulatory approval enables integration, which creates political constituencies, which strengthen the network, which makes regulatory approval more likely for future contracts. It's a virtuous cycle that becomes more powerful over time.

Market Misunderstanding (and Variant Perception)

Despite Saab's remarkable transformation, financial markets continue to analyze the company through the lens of traditional defense contractor metrics. This represents a significant analytical gap that creates opportunity for investors who understand what's actually happening.

The market sees a Swedish defense company benefiting from a cyclical upturn in European spending. Analysts apply traditional frameworks: project-based revenues, cyclical margins, and government customer concentration risk. The current valuation of roughly 44 times next-twelve-months earnings seems expensive for a defense contractor, leading many to view the stock as overvalued.

This analysis misses the fundamental transformation occurring beneath the surface. Saab isn't just growing faster—it's becoming a different type of company entirely. The margin expansion during explosive growth reveals platform economics. The multi-year backlog demonstrates recurring revenue characteristics. The geographic embedding creates switching costs that traditional contractors never achieve.

Most importantly, the market underestimates the structural nature of the demand shift. This isn't a temporary increase in defense spending driven by Ukraine-related fears. It's a permanent realignment of European strategic thinking that recognizes indigenous defense capabilities as essential for sovereignty. The 2% GDP spending targets aren't ceilings to be reached temporarily—they're floors for a new era of sustained investment.

Real-world validation continues to strengthen Saab's position. Ukrainian forces are using Saab systems in actual combat, proving that the company's technology thesis works under the most demanding conditions possible. Each successful engagement provides marketing value that no amount of peacetime testing could match.

The investment implication is significant. Markets are pricing Saab as a traditional defense contractor having a good run. The reality is a platform company in the early stages of capturing network effects in a structurally transformed market. The valuation gap reflects this misunderstanding.

Risks and Strategic Tensions

No transformation of this magnitude comes without substantial risks, and Saab's evolution faces several challenges that could derail the platform strategy.

The most immediate risk is execution. Saab is simultaneously managing over 40 construction projects while integrating more than 6,000 new employees—a scaling challenge that would strain any organization. The company's historical strength has been operational discipline, but there's no guarantee that capabilities developed during the lean years will translate to managing explosive growth.

Geopolitical risks represent another category of concern. While the current security environment strongly favors increased defense spending, political winds can shift. A successful resolution to the Ukraine conflict, broader US-China détente, or fiscal pressures in European capitals could reduce the urgency driving current procurement decisions.

Technology risks shouldn't be underestimated either. Large technology companies like Google and Microsoft have vast resources and sophisticated AI capabilities. If they decide to enter defense markets directly, they could potentially leapfrog Saab's technological advantages. The company's partnership with NVIDIA provides some protection, but it's not insurmountable.

Perhaps most fundamentally, there's the question of whether Saab has truly crossed the chasm from cyclical contractor to structural platform provider. The evidence is compelling but not conclusive. Platform effects take time to fully manifest, and network effects can be more fragile than they appear.

The central tension in evaluating Saab is balancing the compelling strategic logic against the substantial execution risks. The opportunity is real and significant, but realizing it requires near-flawless performance across multiple dimensions simultaneously.

Universal Strategic Lessons

Saab's transformation offers insights that extend far beyond defense contracting. The company's experience illustrates several principles that apply across industries and strategic contexts.

First, network effects in sovereignty create uniquely powerful competitive positions. When products or services become essential to national interests, the switching costs transcend normal commercial considerations. Companies that can embed themselves in sovereign capabilities gain access to switching costs that purely commercial businesses can never achieve.

Second, constraints often breed advantages in disguise. Sweden's historical neutrality, which initially seemed like a limitation in defense markets, became a crucial asset in an era when European countries seek alternatives to American dependency. Similarly, Saab's smaller size, which prevented it from competing head-to-head with industry giants, enabled the agility necessary for platform transformation.

Third, early positioning at paradigm shifts enables disproportionate value capture. Companies that recognize and position for structural changes while others are still operating under old assumptions can gain advantages that persist for decades. Saab's investment in software-defined systems and AI capabilities while competitors focused on traditional hardware has created a technological moat that strengthens over time.

Finally, platform beats scale in networked markets. Saab will never be larger than Lockheed Martin or Boeing, but it doesn't need to be. In a multipolar world where interoperability and sovereignty matter more than raw scale, being the universal connector can be more valuable than being the biggest provider.

These lessons apply beyond defense. In any industry where network effects, switching costs, and ecosystem integration create competitive advantages, the principles of platform strategy can enable smaller companies to compete effectively against larger incumbents.

Returning to Linköping

Today, if you were to visit Micael Johansson in that same Linköping office where he celebrated SEK 2.8 billion in cash flow just five years ago, you would find a leader managing fundamentally different challenges. The company he now runs bears little resemblance to the efficiency-focused contractor that struggled to maintain profitability in a shrinking market.

Saab's current backlog of SEK 189 billion—representing nearly three years of revenue at current levels—provides the kind of visibility that defense contractors typically only dream about. Production facilities spanning multiple continents replace the single-country operation that defined the company for decades. Most significantly, software and AI capabilities that didn't exist in 2020 now represent core competitive advantages in an industry transformed by Ukraine's lessons.

"Our cash flow once defined survival," Johansson might say today, "now it defines our strategic flexibility to build Europe's sovereign capabilities."

The transformation is both complete and just beginning. Saab has successfully positioned itself as the architect of Europe's defense nervous system, creating network effects and switching costs that traditional contractors never achieve. But the platform strategy's full potential remains unrealized. Software-defined capabilities are still emerging. AI applications are in early stages. The network of interoperable systems continues expanding.

What's certain is that Saab has fundamentally altered its strategic position. The company that once competed project-by-project for survival now shapes the ecosystem within which competition occurs. It has moved from participating in the market to defining the market's architecture.

The Broader Implication: Defense's Platform Moment

Saab's transformation represents more than one company's strategic evolution—it signals a broader shift in how defense capabilities are developed, delivered, and maintained. The traditional model of discrete platforms competing for individual contracts is giving way to integrated ecosystems where interoperability and continuous capability development matter more than standalone performance.

This shift reflects deeper changes in how warfare itself is conducted. Modern conflicts are won not by whoever fields the most advanced individual systems, but by whoever can integrate information, coordinate responses, and adapt faster than adversaries. Success requires networks, not just nodes.

Saab's template—embedding in sovereign infrastructure, creating interoperability standards, and enabling continuous capability evolution—points toward the future of defense industrial strategy. Companies that can master these dynamics will capture disproportionate value. Those that cling to traditional project-based models risk obsolescence.

The implications extend beyond defense. As governments increasingly recognize certain technologies and capabilities as strategic assets, the principles of sovereign network effects become relevant across industries. From semiconductors to renewable energy to telecommunications infrastructure, the intersection of technology and sovereignty creates opportunities for companies that understand how to build platforms rather than just products.

Saab's journey from a struggling Swedish contractor to Europe's defense nervous system demonstrates that in an era of platform competition, strategic positioning often matters more than scale. Sometimes the most profound advantages come disguised as constraints, and sometimes the companies that seem smallest can build the biggest competitive moats.

The lesson for business strategy is clear: in a world where networks and platforms increasingly define competitive advantage, the winners won't necessarily be the biggest or strongest. They'll be the companies that best understand how to create and capture network effects, especially when those networks intersect with sovereign interests.

Saab may have started as a Swedish defense contractor, but it has become something much more significant: a case study in how platform thinking can transform industries and create enduring competitive advantage. The sovereign stack it has built will shape European defense capabilities for decades to come—and provide lessons for strategic transformation across industries far beyond defense.

The Sovereign Stack: Saab's Strategic Reinvention reveals how companies can leverage platform thinking and network effects to capture disproportionate value during paradigm shifts. The transformation from constraint to advantage, from products to platforms, offers universal lessons for strategic positioning in an increasingly networked world.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.