2026 is shaping up to be a very different market regime.

The macro picture entering 2026 is deceptively comfortable. Growth remains intact, earnings have held up better than expected, and the recession that once dominated forecasts never arrived. Manufacturing activity sits in expansion territory, consumer demand has cooled without breaking, and the long-anticipated slowdown has been postponed rather than realised. Yet market behaviour tells a more complex story. Volatility remains elevated, correlations fail precisely when diversification is expected to work, and policy easing delivers less support than historical precedent would suggest. This tension is not an anomaly. It reflects a regime shift.

The defining feature of 2026 is not uncertainty about growth, but instability around its path.

Markets have largely priced policy success, but not the friction of implementation. Trade agreements must still be executed. Inflation, though contained, remains sticky enough to constrain central bank flexibility. Fiscal expansion continues to support demand even as it reshapes the risk profile of duration. At the same time, capital is being deployed aggressively into AI and infrastructure, while the returns on that capital remain largely theoretical. In such an environment, being directionally correct is no longer enough. The structure of portfolios matters as much as the views embedded within them.

Much of today’s prevailing positioning still relies on relationships formed in a lower-volatility world. Duration is expected to hedge risk, even as term premia begin to reassert themselves. Credit spreads are relied upon for income, despite offering limited compensation after a long period of compression. Diversification is often achieved through exposure rather than genuine differentiation, leaving portfolios vulnerable when correlations rise. These assumptions become fragile when volatility is persistent rather than episodic. The result is portfolios that remain invested, but insufficiently prepared for drawdowns that arrive without recessionary justification.

This is the framework we refer to as the volatile expansion: a phase where growth persists, but calm does not; where participation remains essential, yet resilience becomes the primary source of compounding.

It is neither the optimism of a fresh bull market nor the pessimism of an impending downturn. It is something more demanding, a regime where good and bad developments occur simultaneously, and where the absence of crisis does not equate to stability.

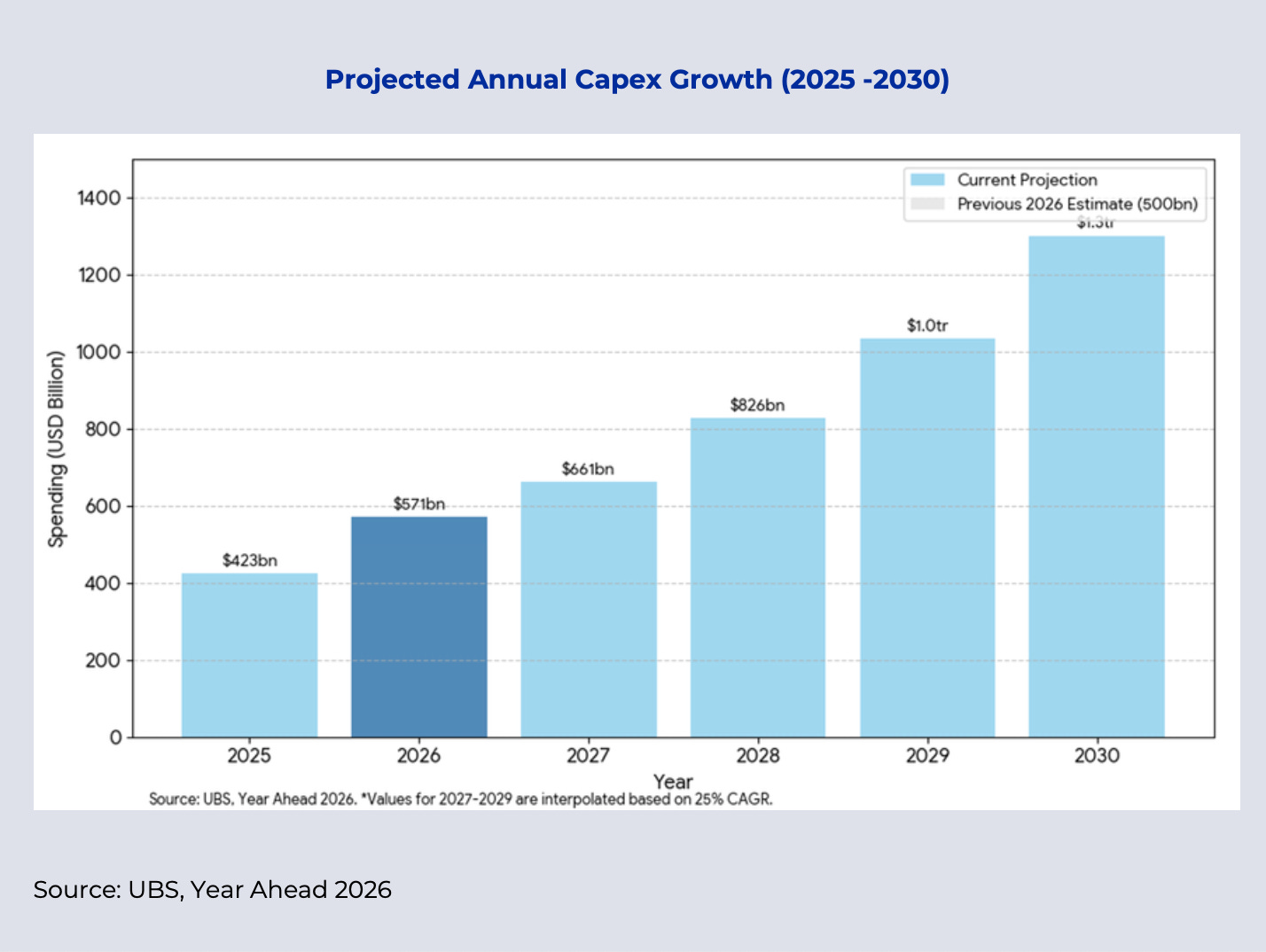

Capital deployment continues to accelerate into 2026, even as visibility on the returns from that capital remains limited.

Chart: AI capital expenditure continues to rise sharply into 2026

Source: Kristal Investment Committee Outlook 2026

One possible response to this environment is a greater focus on portfolio architecture rather than tactical trading. Portfolios must be designed to function across scenarios rather than optimised for a single outcome. Equity conviction remains intact, but its expression has evolved toward broader exposure across genuinely differentiated regions, recognising that the US, Europe, Japan, China, and India each represent distinct return drivers rather than a single global beta.

Income is increasingly sourced through structure rather than spread, where seniority, floating rates, and covenants matter more than headline yield. Hedging must work even when equities rise, reflecting a world where correlations are less reliable. Duration must be used deliberately, with liquidity preserved and long-end exposure treated with caution as fiscal realities intrude.

Over recent weeks, our Investment Committee has examined how these shifts translate into real-world portfolio positioning for 2026. The conclusion is not a retreat from risk, but a reorientation within it. The objective is not to predict every bend in the river, but to build systems that endure as conditions change.

We will be discussing this framework in detail in an “upcoming live session,”

focusing on how the volatile expansion reshapes portfolio construction in the year ahead, from the market regime itself, to global opportunity sets that truly diversify, to the evolving roles of income, hedging, and duration in a structurally noisier world.

2026 Investment Outlook | The Volatile Expansion: How to Position Portfolios for 2026

Date: 5 February 2026

Time: 4:30 pm SGT | 2:00 pm IST | 12:30 pm GST

The session will be led by Asheesh Chanda, Founder and Global Chief Investment Officer at Kristal.AI, and moderated by Rakesh Khajuria, Head of Trading and HNW Business, Kristal.AI.

If 2026 unfolds smoothly, this approach should continue to participate. If it does not, it is designed to endure. That distinction, between direction and durability, is likely to define investment outcomes in the years ahead.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.