Toast 3Q25 Earnings- The Restaurant Integration Layer

From point-of-sale to system-of-record — how Toast is becoming the Windows of food service.

TL;DR:

From terminals to tissue: Toast’s real moat isn’t better POS hardware — it’s owning the entire operational data flow of 156K restaurants, creating a unified integration layer much like Windows did for PCs.

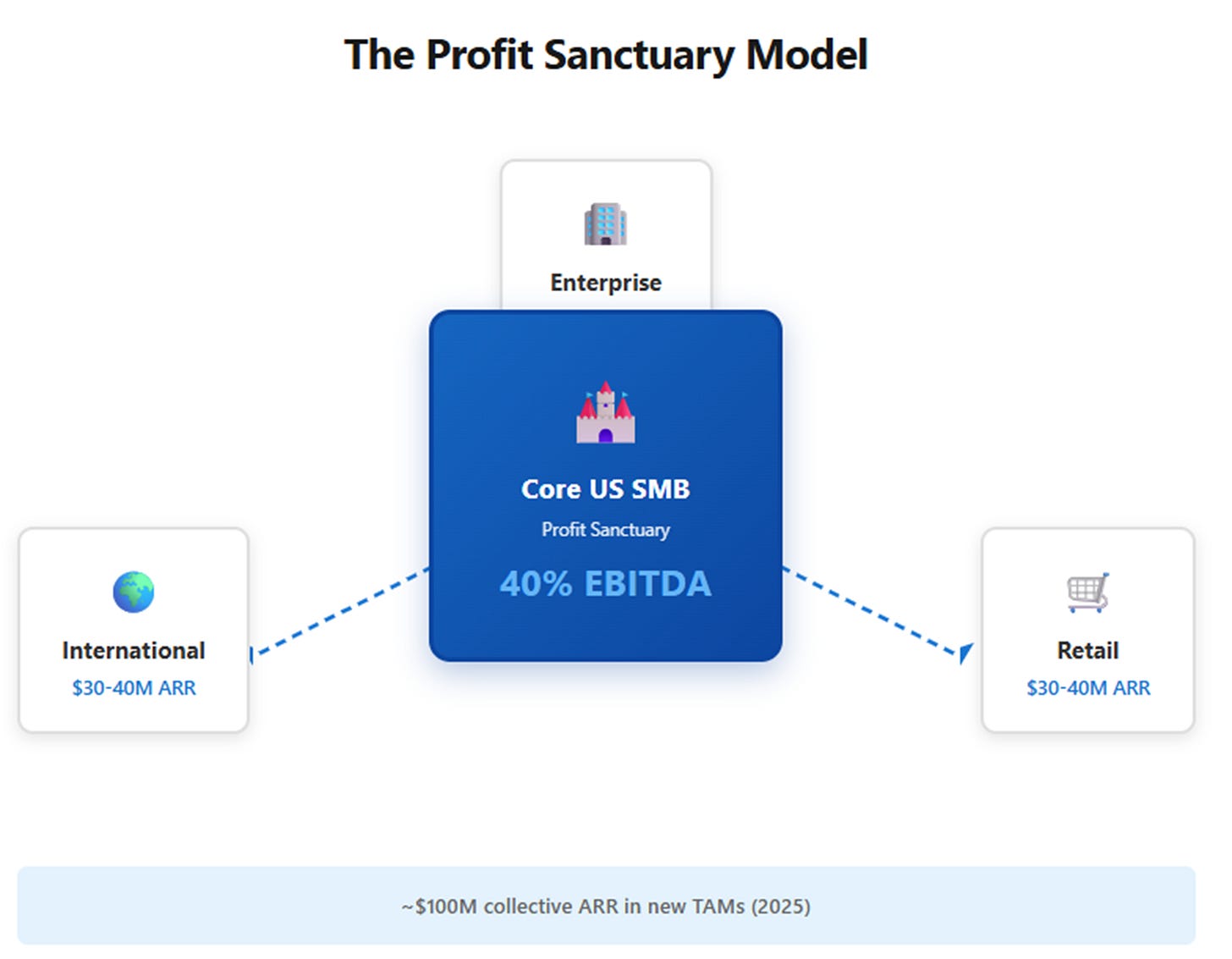

Profit sanctuary fuels expansion: A 40% margin core SMB business funds land grabs in enterprise, international, and retail verticals — extending the growth runway by a decade.

AI and demand control loop: With Toast IQ and its growing guest identity graph, the company is shifting from software vendor to demand aggregator — positioning itself as the central nervous system of the restaurant economy.

The Birth of the Standard

In 1985, buying a personal computer meant entering a world of bewildering fragmentation. A prospective buyer faced a cascade of incompatible choices: an IBM PC running MS-DOS, a Commodore 64 with its own proprietary system, an Apple II with yet another architecture, or any number of CP/M machines. Each system required software written specifically for it. A word processor built for one machine was useless on another. Developers faced an impossible choice: write their application multiple times for different platforms and reach a fraction of the market, or pick a single system and hope it won.

The true genius of Microsoft Windows—particularly Windows 3.1, which shipped in 1992—wasn’t the graphical interface, though that certainly helped. The breakthrough was that Windows created a standardized abstraction layer sitting between the hardware and the applications. A developer could write a word processor once and have it work on thousands of different machine configurations. Users could run multiple applications simultaneously, with data flowing between them. Windows didn’t succeed by being the best word processor or the best spreadsheet. It won by being the system where all word processors and spreadsheets would live. The value wasn’t in the components; it was in the integration layer that made the components work together.

This pattern—standardization winning by reducing system-wide friction rather than optimizing individual pieces—would repeat itself across the technology industry for the next three decades. And it’s playing out right now in an unlikely place: restaurant kitchens.

The Restaurant’s Fragmented Stack

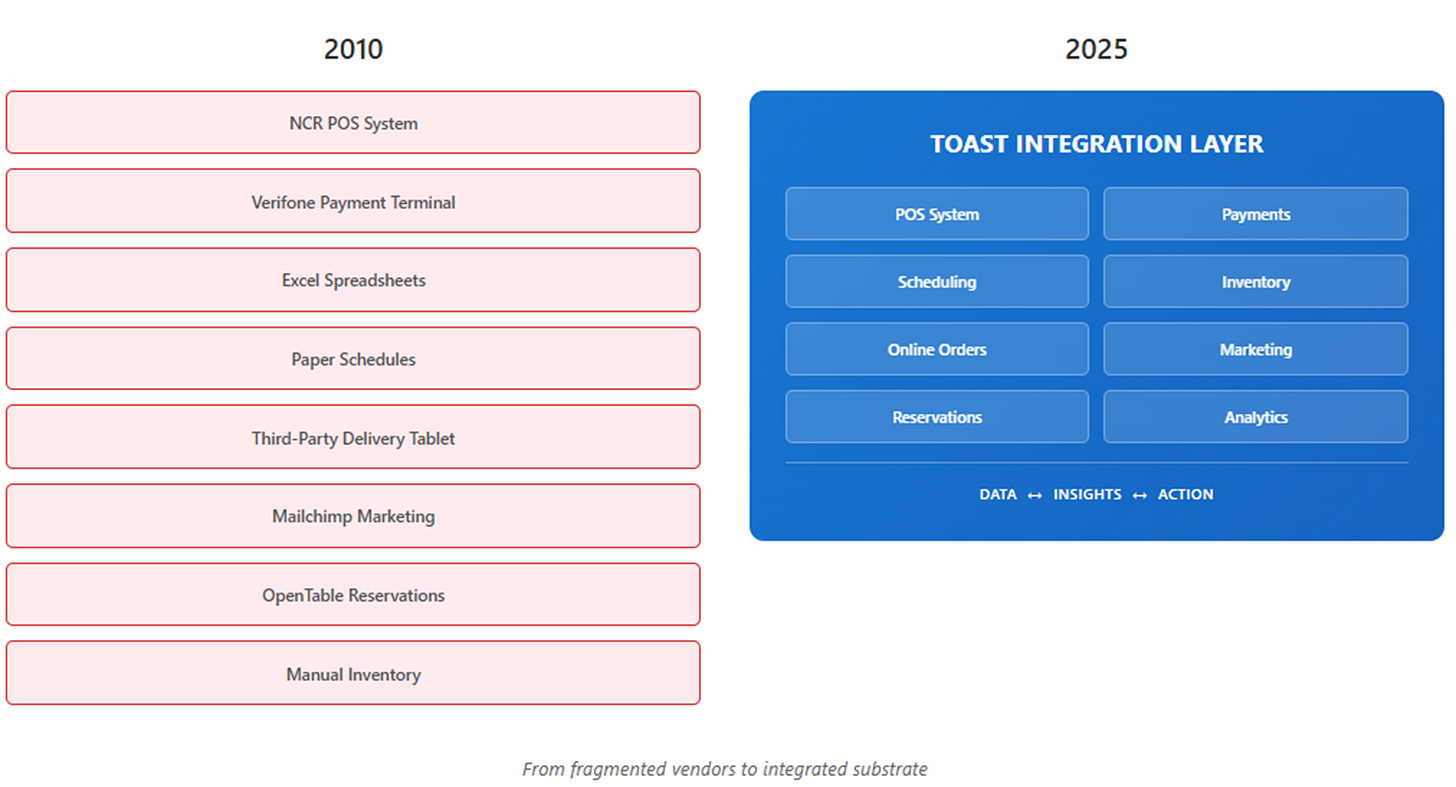

Walk into a typical restaurant in 2010 and you’d find an operational nightmare that would have been familiar to that frustrated 1985 PC buyer. The point-of-sale system was a legacy NCR or Micros terminal running software last updated during the Bush administration. Credit card payments ran through a separate Verifone terminal bolted to the counter. Employee schedules lived in a three-ring binder or, for the more sophisticated operators, an Excel spreadsheet. Inventory tracking happened on clipboards and order forms faxed to suppliers. Online orders arrived via a third-party tablet that had no connection to the main system. Marketing emails went through Mailchimp. Reservations ran through OpenTable. Each vendor optimized its own silo and extracted maximum rent. Integration was the operator’s problem.

The friction tax was enormous, but most restaurant owners accepted it as the cost of doing business. Then Toast arrived with a deceptively simple wedge: a cloud-based point-of-sale system that actually worked. But the real strategy wasn’t selling better terminals. It was owning the transaction at the center of the restaurant’s operations, then methodically layering on additional capabilities—payments, then capital lending, then marketing automation, then AI-driven insights—each one deepening the integration and increasing the switching cost.

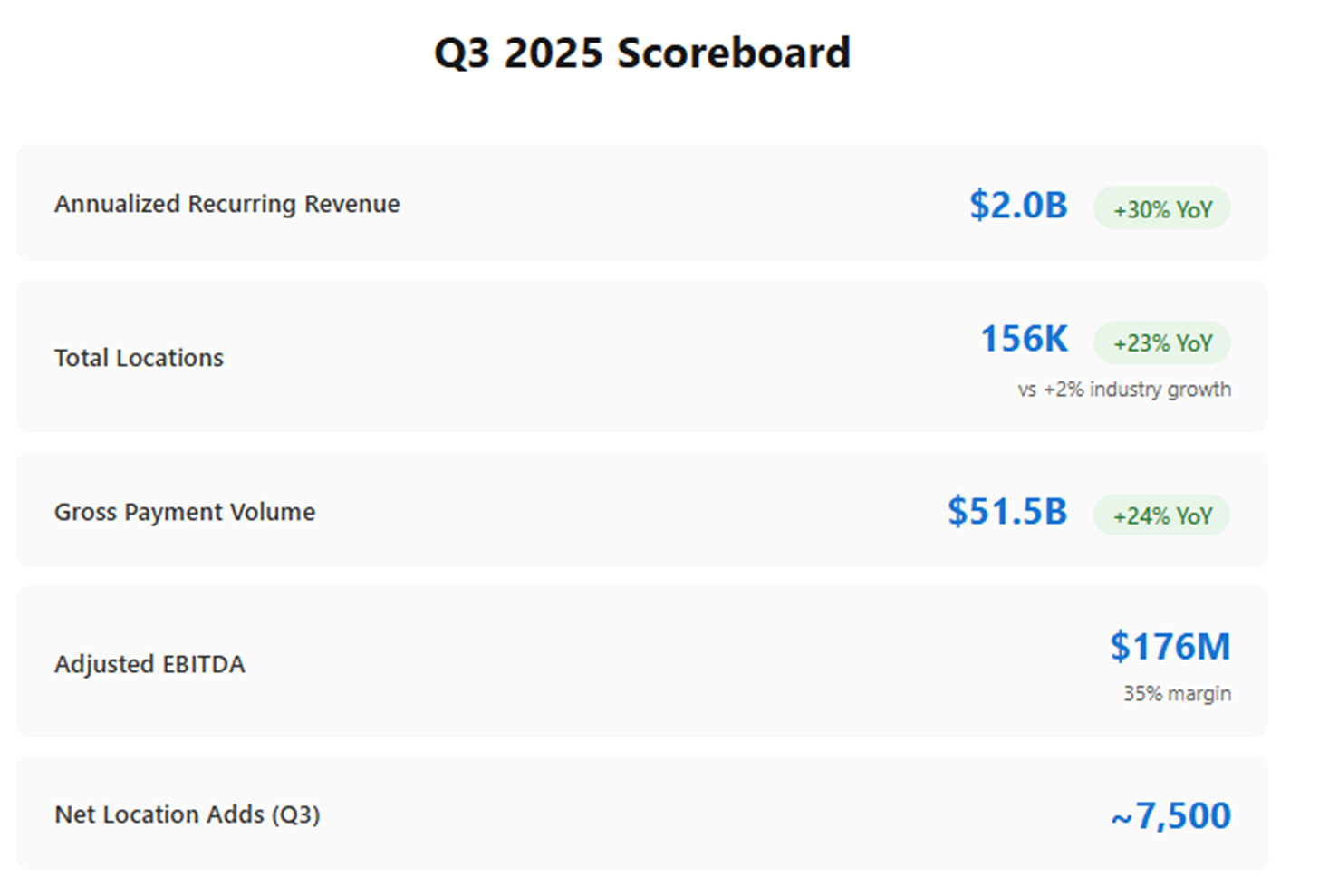

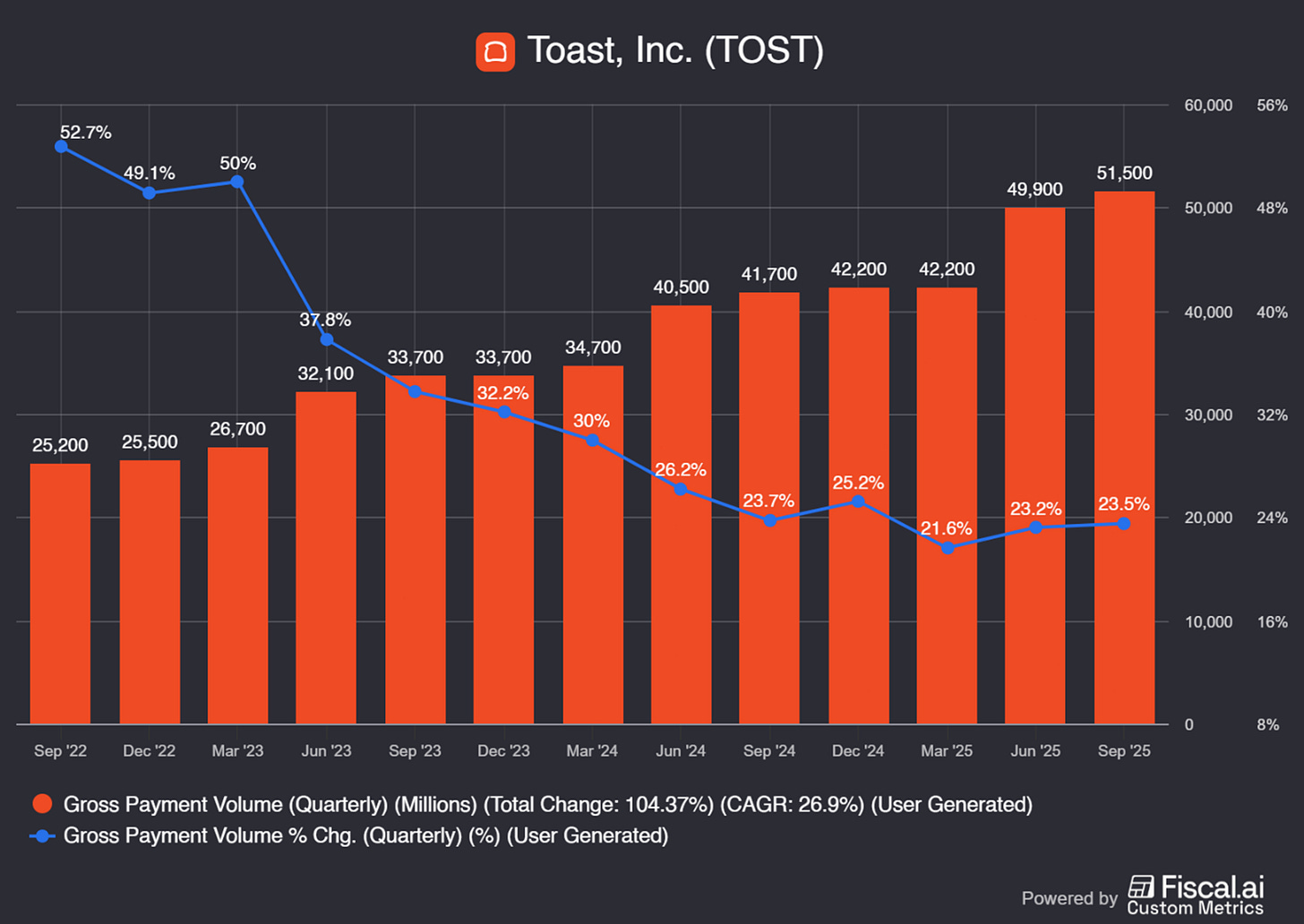

The third quarter of 2025 demonstrates how completely this strategy has succeeded. Toast now powers 156,000 locations, representing 23% YoY growth in an industry where total restaurant openings grew roughly 2%. The company added approximately 7,500 net new locations in the quarter alone. Gross payment volume reached $51.5 billion, up 24% YoY Annualized recurring revenue crossed $2 billion for the first time, growing 30% despite the company’s enormous scale.

More telling than the raw numbers are the types of customers now adopting Toast. Nordstrom recently committed to rolling out the Toast platform across nearly 200 dining locations spanning roughly 100 stores nationwide. TGI Fridays is moving its entire US footprint to Toast. These aren’t small cafes making an emotional decision about technology. These are sophisticated operators with complex requirements who concluded that Toast’s integrated system was superior to stitching together point solutions from multiple vendors.

Perhaps most revealing is the adoption of Toast IQ, the company’s AI-powered assistant that launched broadly in early October. Within four weeks, more than 25,000 restaurants used the tool over 235,000 times. Restaurant operators are asking Toast IQ to analyze sales patterns, optimize menu pricing, flag operational inefficiencies, and generate marketing campaigns. This isn’t a gimmick. It’s proof that the integration layer has reached sufficient depth that genuinely intelligent services can be built on top of it.

Toast isn’t building better restaurant software. It’s building the integration substrate for food service—the connective tissue where previously disconnected operational systems now communicate seamlessly.

The Variant Perception: Workflow Lock-in and Demand Control

Wall Street analyzes Toast as a “vertical SaaS plus payments” company. Analyst reports focus on metrics like net location additions, gross payment volume growth, and take rates. Competitive analysis consists of feature-by-feature comparisons with rivals like Shift4 and Clover: whose hardware is sleeker, whose processing rates are lower, whose software has more bells and whistles.

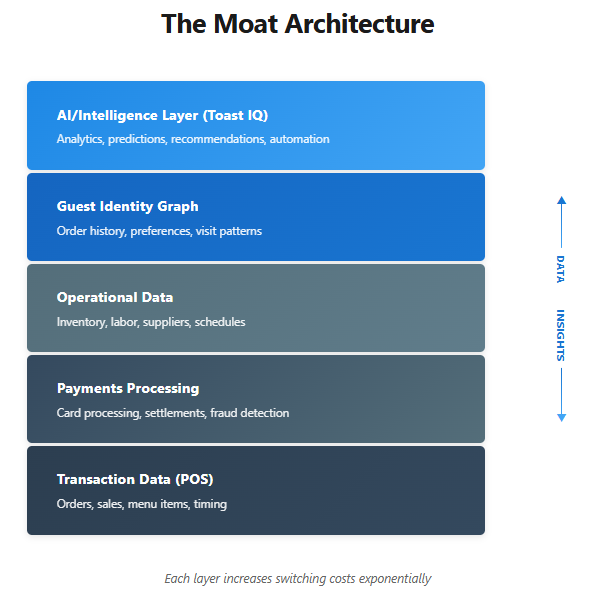

This framing misses the entire strategic picture. Toast’s actual moat has nothing to do with having the best terminal design or the lowest processing fees. The defensibility comes from owning the restaurant’s complete data and workflow layer. When a guest places an order through Toast, that transaction doesn’t just ring up a sale. It automatically depletes inventory quantities, triggers reorder suggestions, updates real-time labor productivity metrics, feeds into personalized marketing campaigns, and now powers AI-driven operational recommendations through Toast IQ. The value isn’t in any single piece of this chain. It’s in the seamless data flow connecting all the pieces.

Consider what Toast IQ actually represents. It’s an AI assistant that can answer complex questions like “Which menu items have the highest profit margin during lunch?” or “How should I adjust staffing for next Tuesday given the weather forecast and historical patterns?” These queries are only possible because Toast controls the entire integrated stack—the sales data, the inventory costs, the labor schedules, the weather context, and the historical performance across thousands of similar restaurants. A competitor selling point solutions—even if they have better individual components—cannot replicate this capability because they don’t have access to the complete workflow.

The switching cost isn’t the hardware sitting on the counter. It’s the operational muscle memory built up over months and years of using a system where everything connects. It’s the marketing automations that run themselves based on sales patterns. It’s the labor schedules that auto-generate based on forecasted demand. It’s the supplier relationships flowing through integrated procurement. Moving to a competitor means not just replacing a terminal but rebuilding an entire operational nervous system.

But the deeper strategic implication extends beyond workflow efficiency. Toast sits between 156,000 restaurants and their millions of guests. As the guest identity graph strengthens—order histories, preferences, visit patterns across the ecosystem—Toast accumulates leverage not just over the transaction but over the relationship itself. This isn’t merely an advertising opportunity. It’s demand aggregation.

Imagine Toast recommending which restaurants a guest should visit based on their historical preferences. Imagine dynamic pricing suggestions flowing to operators based on real-time demand signals across the network. Imagine loyalty programs that work across venues, with Toast as the clearing house. The integration layer doesn’t just reduce friction for operators; it positions Toast as the intermediary controlling guest attention and restaurant discovery. This is fundamentally different from being a software vendor. It’s closer to the role that OpenTable plays for reservations or that DoorDash plays for delivery—except Toast owns the underlying transaction infrastructure, making the relationship far stickier.

The Windows metaphor breaks down here because restaurants remain fiercely differentiated by location, cuisine, and brand. Toast isn’t commoditizing restaurants the way Windows commoditized PC hardware. But the guest relationship layer is centralizing, and Toast’s position at that nexus creates optionality that pure software vendors don’t possess.

Third-quarter results demonstrate that this moat is both real and widening. The company’s total take rate—the percentage of gross payment volume it captures as revenue—reached 98 basis points, up 7 basis points YoY. Critically, this expansion came primarily from product mix and cost optimization rather than price increases. Non-payments fintech services, including Toast Capital lending and early advertising products, contributed $58 million in gross profit and approximately 11 basis points to the overall take rate. Management noted that win rates improved YoY against every major competitor in both quick-service and full-service segments.

The Profit Sanctuary Strategy

The most revealing insight in Toast’s third-quarter earnings call came from CFO Elena Gomez’s discussion of margins. She noted that the core US small and medium-sized restaurant business—the original wedge that now represents roughly 95% of revenue—operates at approximately 40% adjusted EBITDA margin. This is a stunningly profitable business at scale. Yet the company is guiding investors to expect full-year 2026 margins that are “flat to slightly up” despite revenue growth expected to exceed 20%.

Wall Street treated this guidance cautiously, with the stock trading roughly flat despite the company beating expectations and raising its full-year outlook. The interpretation: margin pressure suggests the business is maturing or facing competitive headwinds.

The actual explanation is far more interesting. Toast has built what might be called a “profit sanctuary”—a core business throwing off cash at rates that would make most software companies envious. Rather than harvest those profits to maximize near-term earnings, management is making a deliberate strategic choice: deploy that cash to fund an aggressive land grab in three adjacent markets that have enormous long-term potential but require upfront investment.

The 40% margin figure demands scrutiny, however. Those economics—Oracle-level profitability on Visa-scale transaction volume—suggest either a structurally superior business model or temporary underinvestment in competitive defenses. The durability of this sanctuary determines whether Toast can fund expansion indefinitely or whether competition eventually forces reinvestment back into the core. The encouraging signal is that management reports win rates improving against all major competitors, suggesting the moat is widening rather than eroding. But sustained vigilance is required: if core margins compress even modestly, the entire expansion strategy loses its funding source.

The first expansion target is Enterprise. Large restaurant chains and hospitality brands have historically been hesitant to adopt cloud-based systems, preferring the control and customization of legacy on-premise solutions. Toast is systematically dismantling that resistance with a combination of proven reliability and enterprise-grade management capabilities. The Nordstrom and TGI Fridays wins aren’t one-offs. Management described the enterprise pipeline as stronger than ever and noted closing the two largest deals in company history during 2025.

The enterprise reality is more complex than the headline wins suggest, however. For a small restaurant, Toast replaces clipboards and fragmented point solutions. For a large chain, Toast is replacing SAP-level enterprise resource planning systems—an entirely different risk calculus. Installation cycles extend from weeks to 12-18 months. Customization requirements multiply. The switching cost works both ways: enterprise customers are harder to win but also harder to lose once deployed. The question is whether Toast’s sales organization can consistently navigate these complex deployments or whether early wins represent cherry-picked opportunities that won’t scale systematically.

The second target is International. Toast operates in several markets outside the United States, and management reports that international SaaS average revenue per unit grew 20% YoY. The total addressable market internationally is roughly three times the size of the US market. The product requires localization and regional payment integrations, but the core system architecture is identical. This is classic leverage: slight modifications to an existing platform open massive new revenue pools.

The third target is Food & Beverage Retail. Grocery stores, convenience stores, specialty food retailers, and similar establishments have many of the same operational needs as restaurants—inventory management, checkout, labor scheduling, customer loyalty. Toast’s platform can be adapted to these use cases with relatively modest investment. Recent go-lives include DeLallo Italian Market in Pennsylvania and Nature’s Best in Illinois.

Collectively, these three new markets reached approximately $100 million in annualized recurring revenue during 2025, up from essentially zero two years ago. Management’s conviction that each could eventually reach $1 billion in ARR isn’t promotional hyperbole—it’s based on demonstrated product-market fit and total addressable market math.

The Amazon parallel is direct. In 2012, Amazon Web Services was already profitable and could have contributed meaningfully to Amazon’s bottom line. Instead, Jeff Bezos plowed those profits into Prime, devices, and logistics infrastructure. Wall Street punished the stock for years. Today, AWS is one of the most valuable businesses on earth, and the early investment in the consumer flywheel built an insurmountable moat. Toast is executing the exact same playbook: establish a profit sanctuary in the core business, then use that cash to fund the construction of additional compounding loops before competitors can react.

Three Futures: The 2028 Outlook

Starting from price of roughly $37 per share and an enterprise value near $20 billion, three distinct scenarios capture Toast’s plausible range of outcomes over the next three years.

The bear case, which might be titled “Complexity Wins,” assumes the company’s multi-front expansion proves more difficult than anticipated. Enterprise sales cycles extend indefinitely, with large brands unwilling to cede control of their restaurant technology stack. International markets resist the Toast model due to entrenched local competitors or structural differences in restaurant economics. Food and beverage retail turns out to be a false adjacency requiring substantially more product development than expected. Meanwhile, a consumer recession drives restaurant closures and elevates credit losses in Toast Capital.

The credit risk deserves particular emphasis. Toast Capital currently contributes 11 basis points to overall take rate and represents one of the fastest-growing components of non-payments fintech gross profit. But it’s also an existential vulnerability. The business model is merchant cash advances—lending to restaurants based on projected future sales. In a 2020-style operational shutdown, those projections evaporate overnight. The piece currently mentions an 8% loss rate threshold, but that assumes normal recessionary conditions, not structural disruption to the restaurant industry. Toast Capital is 5% of current take rate but potentially 100% of bankruptcy risk in a severe downturn.

In this bear scenario, revenue grows at a compound annual rate of roughly 15% through 2028, reaching $7 billion, while margins compress to 30% as investments fail to pay off and credit losses spike. At 14 times forward EBITDA—a multiple appropriate for a decelerating business with elevated risk—the stock trades to approximately $30 to $35 per share, representing a 16% decline from current levels.

The base case, “The Dominant Niche,” assumes Toast successfully solidifies its leading position in the US restaurant market, capturing 25% to 30% share over time, but the newer market expansions proceed more slowly than the most optimistic projections. Enterprise and international contribute meaningfully but don’t transform the growth profile. AI tools and advertising serve primarily as retention mechanisms rather than major profit centers. Revenue compounds at 22% annually to reach $9.1 billion by 2028, with margins expanding modestly to 36% as the core business scales and new markets begin approaching profitability. At 18 times forward EBITDA, the stock reaches $55 to $65 per share, a 54% return.

The bull case, “The Standard Emerges,” assumes Toast successfully replicates its small business playbook in the enterprise, international, and retail verticals while the AI and advertising layers develop into high-margin revenue streams. The company becomes the default integration substrate for food service establishments of all types, benefiting from network effects as the guest identity graph strengthens and demand aggregation dynamics take hold. Revenue grows at 28% annually to $10.5 billion, with margins expanding to 40% as the new markets mature and achieve economics similar to the core. Toast Capital and advertising contribute meaningfully to non-payments take rate, which expands from 98 basis points today toward 110 basis points. At 22 times forward EBITDA—a premium multiple justified by durable growth and expanding margins—the stock reaches $85 to $95 per share, representing a 139% return.

For the bull case math to work, Toast needs to add roughly 100,000 locations annually by 2028. That requires all three expansion engines firing: core adding 50,000 (maintaining current pace), international adding 30,000 (tripling current contribution), and retail adding 20,000 (new vertical scaling successfully). This isn’t impossible, but it demands flawless execution across multiple fronts simultaneously.

Assigning probabilities is inherently subjective, but the evidence suggests roughly 60% weight to the base case, 25% to the bull, and 15% to the bear. The execution track record—eight consecutive quarters of beating expectations and raising guidance—argues against high bear-case probability. The complexity of managing multiple expansion vectors simultaneously argues against assigning too much weight to the bull. The base case of steady, profitable market share gains in the core while thoughtfully building adjacent businesses seems most consistent with both management’s demonstrated capabilities and the fundamental economics of the opportunity.

Tracking the Thesis

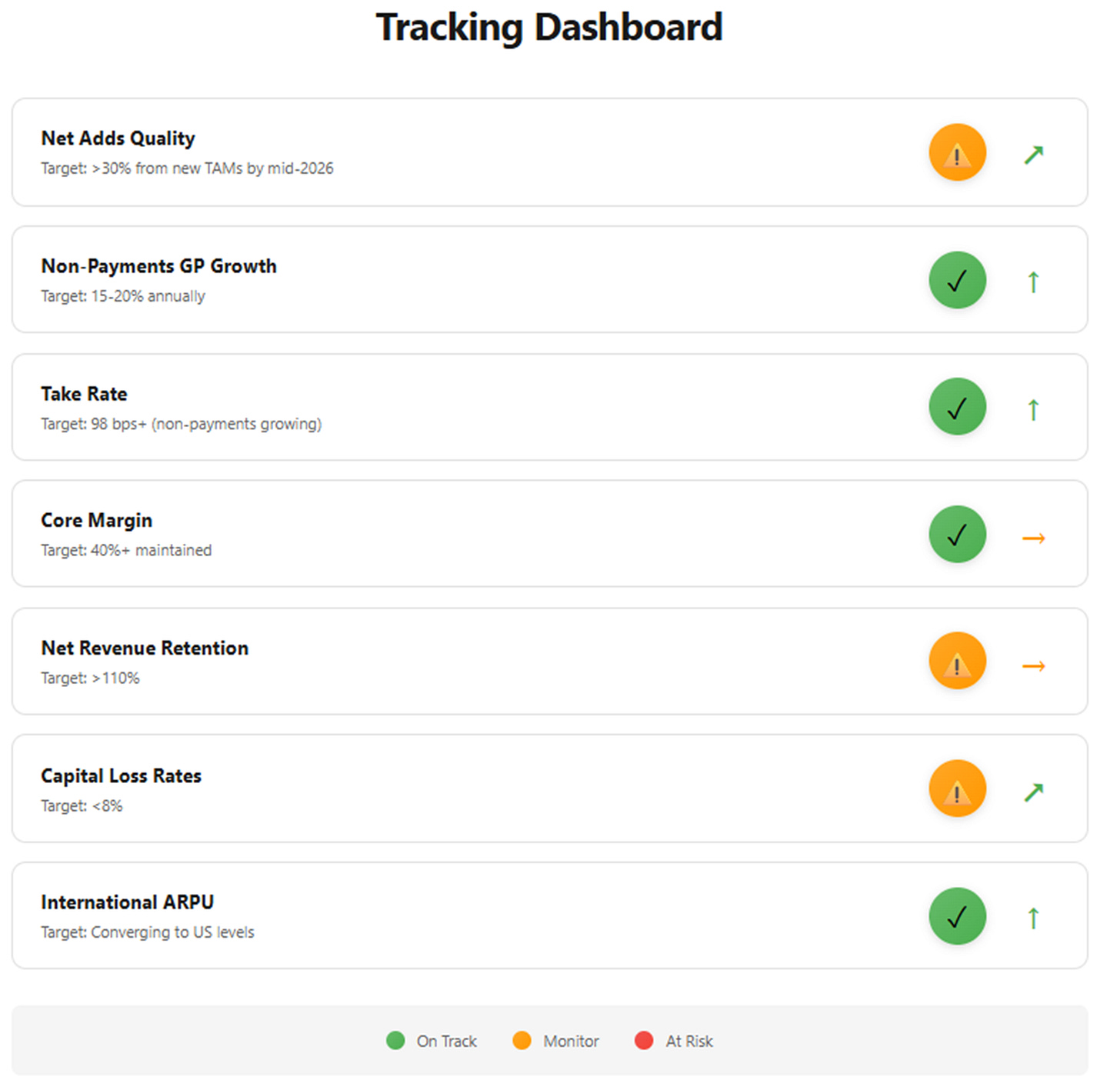

Seven metrics matter more than the rest for determining which scenario ultimately plays out.

First is the quality, not just quantity, of net location additions. Toast added approximately 7,500 net new locations in the third quarter, maintaining the same range as a year ago despite being twice as large. But the critical question is composition: what percentage of those additions came from enterprise, international, or retail versus the core SMB restaurant market? As the new markets mature, they should represent an increasing share of total additions. By mid-2026, these segments should account for at least 30% of net adds if the expansion thesis is on track.

Second is non-payments recurring gross profit growth. This metric isolates the high-value software, lending, and future AI-adjacent products from the commodity payment processing stream. In the third quarter, non-payments fintech contributed $58 million in gross profit, driven primarily by Toast Capital. As AI monetization and advertising scale, this line should grow 15% to 20% per year independent of gross payment volume trends. It’s the purest measure of whether Toast is successfully building additional compounding loops on top of the payment rails.

Third is take rate composition. The total take rate of 98 basis points needs to be decomposed into its constituent parts: payment processing (49 basis points), driven by cost optimization and scale, versus non-payments products (11 basis points), driven by attach rate and new product adoption. Take rate expansion driven primarily by pricing increases would be fragile and subject to competitive pressure. Take rate expansion driven by customers voluntarily adopting more products is durable and signals genuine value creation. The quarterly question is whether the non-payments component is growing faster than the payments component.

Fourth is the health of the profit sanctuary itself. Management’s commentary around the core US business operating at 40% EBITDA margins is the foundation of the entire investment thesis. If competitive dynamics force margin compression in the core, the company loses the strategic flexibility to invest in new markets. Conversely, if the core margin expands beyond 40% as scale continues, it provides even greater capacity to fund growth initiatives.

Fifth is net revenue retention in the core SMB cohort. While Toast doesn’t disclose this metric explicitly, it can be approximated from same-store gross payment volume growth and product attach rate trends. A healthy SaaS business maintains net revenue retention above 110%—meaning existing customers are growing their spending faster than inflation and churn combined. If this metric dips materially below that threshold, it suggests the profit sanctuary is eroding from within, either through competitive pressure on pricing or customers hitting natural spend ceilings.

Sixth is Toast Capital credit quality by vintage. Aggregate loss rates need to remain below 8% of originations for the unit economics to remain attractive, but the more important question is how specific cohorts perform through economic cycles. The 2023 and 2024 vintages need to demonstrate stable performance as they season. The third quarter saw the contingent liability for expected credit losses increase from $29 million to $40 million, and credit loss expense of $66 million for the nine months year-to-date suggests the portfolio is expanding quickly. A spike in losses above 10%, particularly in recent vintages, would signal underwriting deterioration or broader consumer stress and force the company to pull back on originations.

Seventh is international average revenue per unit trajectory. The 20% YoY growth in international SaaS ARPU is encouraging, but the critical question is whether international markets are converging toward US-level economics or plateauing at structurally lower margins due to competitive dynamics, willingness to pay, or regulatory constraints. If international ARPU stalls at 70% to 80% of US levels, the total addressable market calculation becomes less compelling and the margin expansion path elongates.

The Uncommon Bet

The conventional wisdom treats Toast as a mature vertical SaaS and payments company, fairly valued at roughly 10 times annualized recurring revenue. The growth rate is solid, the margins are acceptable, and the competitive position is secure. It’s a fine business. Nothing more.

The variant perspective recognizes that Toast is building something considerably more ambitious: the integration substrate for food service, with emerging control over the demand aggregation layer that sits between restaurants and their guests. The profit sanctuary throwing off 40% margins in the core business isn’t a ceiling—it’s the engine funding a multi-year land grab into enterprise, international, and retail verticals where the exact same integrated system can be deployed with marginal additional investment. The AI capabilities emerging through Toast IQ and the consumer identity graph forming across 156,000 locations represent entirely new compounding loops that don’t exist in the current valuation.

When a management team says “we’ve never been more confident” while delivering their eighth consecutive quarter of beating expectations and raising guidance, growing locations 23% in an industry expanding at 2%, and posting win rates that improved against every major competitor, the appropriate response is to believe the execution track record, not the conservatively sandbagged guidance.

The 2026 margin “sacrifice”—flat margins despite 20%-plus growth—isn’t a sign of business deterioration. It’s the cost of building infrastructure that extends the growth runway by a decade. Microsoft’s margins looked uninspiring while it invested to make Windows ubiquitous. Amazon’s margins looked terrible while it was building AWS and Prime. Toast’s margins will look flat while it constructs the integration layer that every food service establishment will eventually run on.

The risk is real and shouldn’t be minimized. The 40% core margin needs to prove durable. The Toast Capital portfolio needs to survive a recession. The enterprise sales motion needs to become repeatable rather than opportunistic. International markets need to converge toward US economics. Any of these could fail, justifying the bear case.

But at $37 per share, even the conservative base case offers 54% upside over three years. The bull case delivers more than double. The risk-reward calculates favorably if the profit sanctuary remains intact and the new market expansions execute even moderately well. This isn’t about perfect execution or betting on miracles. It’s about recognizing that the market is pricing a mature business when the company is actually in the middle of a calculated, well-funded expansion that extends the growth runway by a decade.

The integration layer is being built. The only question is whether investors recognize it before the evidence becomes obvious.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.