TSMC 4Q25 Earnings: The Constraint Is the Product

Q4 2025 earnings reveal why manufacturing, not design, is now the binding limit of the AI economy.

TL;DR

Margins at all-time highs (62.3%) with shipments down proves this isn’t mix or efficiency—it’s pure pricing power.

AI demand has turned TSMC into base-load infrastructure, erasing semiconductor seasonality and reframing cyclicality.

Arizona isn’t margin dilution—it’s customer lock-in, converting sovereignty spend into a structural moat.

TSMC spent two years warning about margin compression. Arizona fabs cost 4, 5x more than Taiwan. Overseas expansion would dilute profitability by 2, 3% annually. The 2nm ramp would pressure margins through 2026.

Then they reported Q4 2025: gross margin of 62.3% , the highest in company history , beating guidance by 130 basis points. And they guided Q1 higher still, to 63, 65%.

In my Q2 2025 analysis, I upgraded the bull case probability from 20% to 60% after TSMC demonstrated margin resilience despite supposed headwinds. This quarter suggests even that was conservative.

The question worth asking isn’t whether TSMC beat expectations. They always beat expectations. The question is what this particular beat reveals about the structural position TSMC actually occupies , and whether the market’s framework for valuing this company is fundamentally wrong.

The Data Behind the Beat

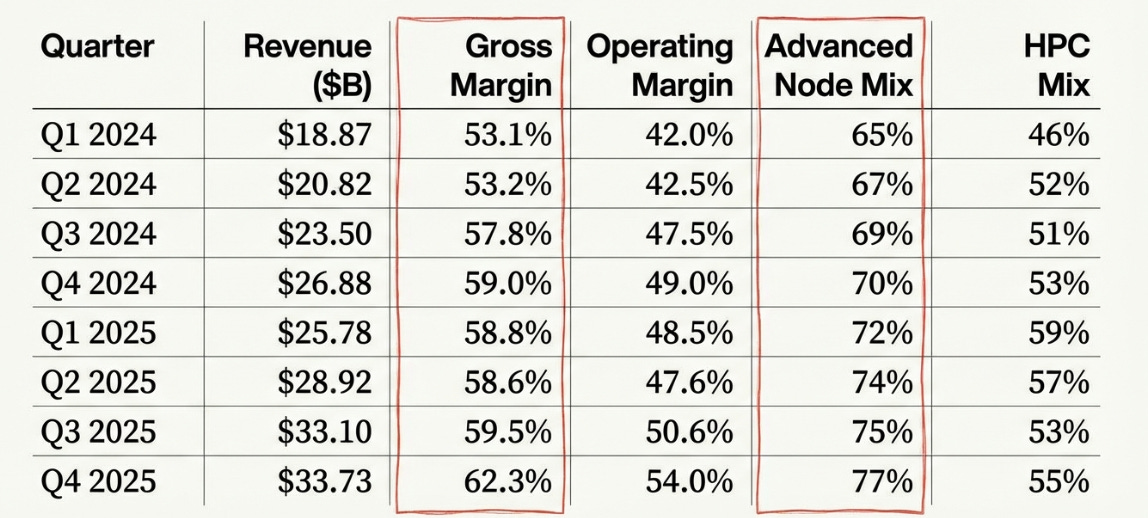

Here’s the margin trajectory over eight quarters:

The pattern isn’t just “beating expectations.” It’s acceleration. Gross margin expanded 920 basis points in two years , from 53.1% to 62.3%. Advanced node concentration rose from 65% to 77%. HPC went from minority contributor to dominant platform.

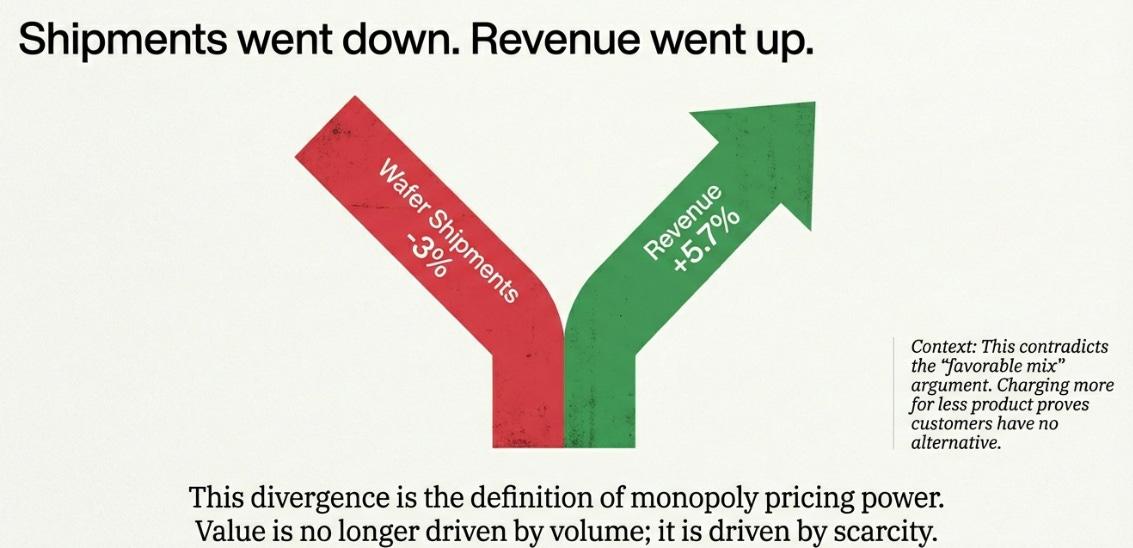

But one detail buried in Q4 tells the real story: wafer shipments declined 3% sequentially while revenue increased 5.7%.

Shipments down. Revenue up.

That’s not cost improvement or favorable mix. That’s pricing power , the kind you only have when customers have no alternative.

The Constraint Is the Product

In any economic system, value accrues to the constraint. For two decades, the constraint in semiconductors was design. The companies that could architect the best chips , Qualcomm, Nvidia, Apple , captured the value. The foundry was a cost center, a necessary but commoditized step.

That relationship has inverted.

The constraint is now manufacturing. Specifically, TSMC’s manufacturing.

Consider the landscape: Samsung’s advanced node yields remain challenged. Intel 18A is perpetually “next year.” Every company designing leading, edge silicon , Apple’s iPhone chips, Nvidia’s AI accelerators, AMD’s processors , flows through TSMC. There is no alternative at scale.

The monopoly isn’t a thesis to be debated. It’s visible in the financials.

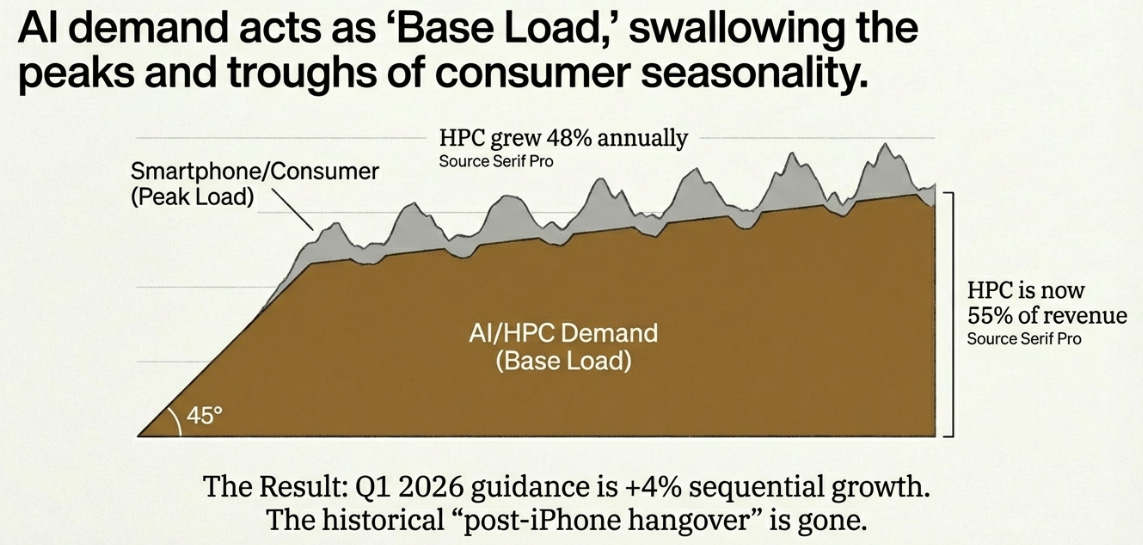

This explains something else that should have gotten more attention: TSMC guided Q1 2026 revenue up 4% sequentially. Q1 is historically TSMC’s weakest quarter , the post, iPhone hangover. Sequential declines of 5, 10% were the norm for twenty years.

Not anymore.

Think about it in utility terms. Smartphone demand is “peak load” , variable, seasonal, tied to consumer cycles. AI datacenter demand is “base load” , constant, infrastructure, driven, contracted years in advance.

When HPC represents 58% of revenue and grows 48% annually, the base load swallows the peaks and troughs. Consumer seasonality becomes noise. TSMC isn’t a cyclical semiconductor company anymore , not because semiconductors changed, but because TSMC’s customer mix shifted to customers whose demand isn’t cyclical.

The Verification

Here’s what makes the current moment different from previous semiconductor cycles.

CEO C.C. Wei spent three to four months personally verifying AI demand with hyperscalers before committing to $52, 56 billion in 2026 capital expenditure. He didn’t delegate this. He called the cloud service providers himself, checked their financial statements, asked for evidence that AI was generating actual returns.

His explanation on the earnings call was unusually candid:

“I’m also very nervous about it. You bet. Because we have to invest about 52 to 56 billion US dollars for the CapEx. If we didn’t do it carefully, that would be a big disaster to TSMC.”

What he found: the hyperscalers are profitable from AI, their balance sheets are strong (”They are very rich”), and every infrastructure constraint , power, cooling, networking , has been solved or planned for years in advance.

Every constraint except one.

“Their message to me is silicon from TSMC is the bottleneck and asked me not to pay attention to all others because they have to solve the silicon bottleneck first.”

TSMC is the binding limit on how fast the AI buildout can proceed. The hyperscalers told Wei directly: stop worrying about anything else. We’ll buy everything you can make.

This isn’t forecasting demand. It’s responding to verified, committed infrastructure spending from the richest companies on Earth , companies whose financials Wei personally audited.

Arizona: Moat, Not Drag

The bear thesis on TSMC has centered on overseas expansion. Arizona costs 4, 5x more to build. Startup inefficiencies would pressure yields. Margins would structurally compress.

Q4 tested this thesis directly. The results:

Arizona yields are now “almost equal to Taiwan” , faster convergence than anyone modeled. And gross margins hit all, time highs despite supposedly absorbing dilution.

One detail mentioned almost in passing: TSMC just purchased a second parcel of land in Arizona.

TSMC doesn’t buy land speculatively. They have multi, year demand visibility that justifies expansion well beyond the current four, fab plan. The “giga cluster” isn’t the end state , it’s phase one.

The reframe I’d offer: Arizona isn’t a tax on TSMC’s profitability. It’s customer lock, in infrastructure.

When Apple and Nvidia co, invest in $165 billion of American semiconductor capacity, switching costs become structural. You can’t unwind shared infrastructure because a competitor offers better pricing. The sovereignty spend becomes the moat.

The bear case assumed TSMC was a commodity supplier absorbing geographic costs. The margin structure proves they’re a monopoly supplier passing those costs through , with additional margin on top.

What Would Break This

Three things could derail the thesis.

AI demand collapse. A major hyperscaler fails or cuts CapEx dramatically. Enterprise AI adoption stalls. Wei’s verification tour suggests this is low probability , he checked the books, confirmed the business models , but it’s not zero.

Competition materializes. Intel 18A achieves yield parity and wins meaningful volume. Samsung closes the gap. The time constants work against this: 2, 3 years to qualify a process, 1, 2 years to ramp. Even perfect execution puts competitive threat 4, 5 years out. But it’s worth monitoring.

Geopolitics. A Taiwan Strait crisis , the variable TSMC can’t control through operational excellence. Arizona provides insurance, but the vulnerability window extends through 2028 before American capacity reaches meaningful scale.

Probability, weighted: AI collapse ~10%, competition ~10%, geopolitics ~15%. The base case remains intact.

The Valuation Disconnect

TSMC trades at roughly 22x forward earnings. This is a semiconductor multiple , the framework applied to cyclical businesses subject to inventory swings and competitive dynamics.

The Q4 results challenge whether that framework still applies.

A company that just printed 62.3% gross margins while supposedly facing headwinds, guided higher despite historical seasonality, verified multi, year demand through personal CEO diligence, and faces no credible competition at leading edge , this isn’t a cyclical semiconductor company.

It’s infrastructure. The toll booth on the AI highway.

The market will eventually update its framework. The question is when, not if.

The Pattern Continues

Post, Q4, the scenario probabilities shift: bull case 65% (was 60%), base case 30% (was 35%), bear case 5% (unchanged).

The margin compression narrative has been tested and failed. The demand has been verified at the source. The competitive moat shows no signs of narrowing.

The market prices TSMC like a semiconductor company. The earnings prove it’s something else entirely , the monopoly provider of the fundamental resource of the AI economy.

The sandbagging monopolist delivered again. Eventually, the market will stop being surprised.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.