Uber’s Q2 2025: The Coordination Layer Advantage

From rides to a unified mobility OS — how Uber’s platform shift is rewriting the economics of urban transportation.

TLDR

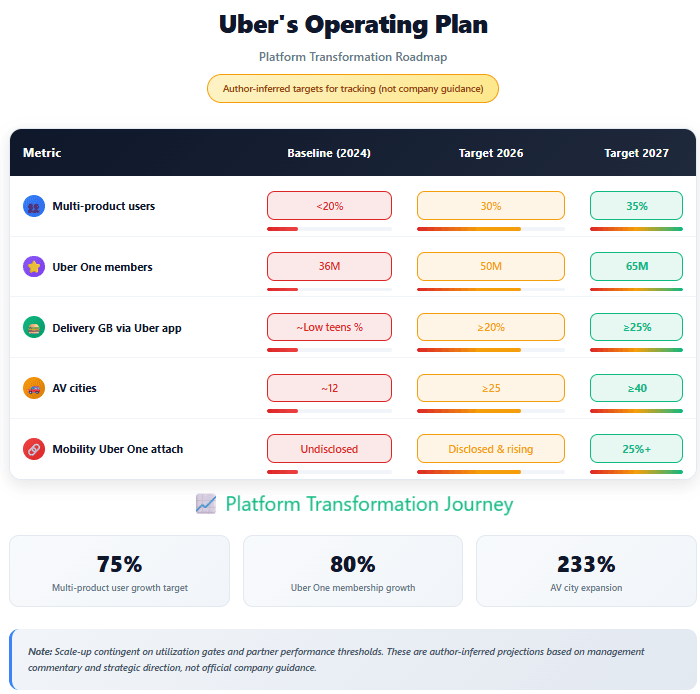

Platform Flywheel in Motion: Q2 saw revenue up 18% and EBITDA up 35%, as unified Mobility + Delivery integration, Uber One adoption, and cross-platform retention unlocked margin leverage typical of true platform economics.

Coordination Layer as Moat: Uber’s demand orchestration—programming when, where, and how people move—maximizes asset utilization (human or autonomous), making it indispensable infrastructure for AV profitability and urban mobility efficiency.

Optionality Beyond Rides: Advertising, subscriptions, and AV partnerships scale off the same coordination layer, creating multiple high-margin growth vectors while maintaining an asset-light, Microsoft-style ecosystem strategy.

Uber's Q2 2025 results tell a story that extends far beyond transportation: they reveal the moment when a transaction-based business transforms into genuine platform economics. The numbers—$12.7B revenue (+18%), $2.1B Adjusted EBITDA (+35%), $8.5B trailing twelve-month free cash flow—are impressive, but they mask a more fundamental shift in how value is created and captured in digital marketplaces.

The Microsoft Precedent

Consider Microsoft's transformation from the 1990s to today. Originally, Microsoft sold software products—Windows licenses, Office suites, server software. Revenue came from transactions: customers bought products, used them, and Microsoft captured value once at the point of sale.

The fundamental constraint wasn't Microsoft's ability to build great software—it was the transaction-based business model itself. Each sale was isolated, customer relationships were episodic, and value creation was limited to the software Microsoft directly built.

The transformation came not from better products, but from platform orchestration: Microsoft didn't just make software; it enabled entire ecosystems of value creation. More importantly, it shifted from transaction capture to ecosystem coordination—each additional participant made the platform more valuable for everyone.

Uber's Q2 2025 earnings reveal a remarkably similar transformation, but instead of orchestrating software ecosystems, Uber is orchestrating demand ecosystems.

Platform Economics Emerge

The clearest signal appears in the margin expansion data. While revenue grew 18% YoY, Adjusted EBITDA grew 35%—classic platform leverage where incremental volume flows through existing infrastructure at dramatically higher margins.

More telling are the cross-platform signals that CEO Dara Khosrowshahi highlighted: "Those who kind of use both sides, both mobility and delivery, their retention rates are higher. They're 35% higher than single business consumers. They generate three times the gross bookings and profits than single business consumers as well."

The numbers reinforce this: 36M Uber One members drive over 40% of combined bookings, and 12% of delivery bookings now originate in the main Uber app rather than Uber Eats.

As Khosrowshahi explained, this creates a fundamental competitive advantage: "Structurally for a subset of consumers, we can just pay more than anyone else can, and that's a structural advantage that's going to continue to get better over a period of time."

This isn't growth; it's structural change. Two previously separate businesses are becoming a unified demand operating system.

The Utilization Insight

"The average Waymo is busier than 99% of our drivers in terms of completed trips per day," Khosrowshahi revealed during the earnings call.

This single statistic contains the key to understanding both Uber's transformation and the autonomous vehicle industry's core challenge.

Autonomous vehicles represent massive capital investment—$250,000-$500,000 per unit. At these price points, utilization becomes existential. A fleet optimized for peak demand sits idle during off-peak hours, creating what Khosrowshahi called "cash incinerators."

The 99th percentile utilization that Waymo achieves on Uber's platform proves a crucial point: demand orchestration creates value that AV companies cannot replicate independently. While autonomous vehicle companies spent billions perfecting self-driving technology, Uber built something equally valuable—a system that eliminates idle time.

This reveals the classic platform dynamic: hardware becomes commoditized while the coordination layer captures increasing value.

As Khosrowshahi put it: "We are a supply led company. The more drivers there are in the ecosystem that we can amalgamate with our platform, the better our service becomes, and that applies with robotic and autonomous drivers as well."

Membership as Demand Programming

Uber One has evolved beyond traditional loyalty into something unprecedented: programmable demand management for physical transportation networks.

Consider the mechanics:

Surge savings offers members discounted rides during off-peak hours

"Member Days" provides targeted incentives for specific behaviors

Cross-platform promotions encourage delivery orders during traditional mobility hours

For autonomous vehicles, this demand shaping is transformational. Peak smoothing directly translates to utilization rates that determine AV profitability. With 36M members representing over 40% of platform bookings, Uber possesses genuine ability to program when, where, and how people move through cities.

This isn't marketing—it's infrastructure. Uber One becomes the software layer that makes autonomous transportation networks economically viable.

The COO as Platform Integration

Andrew McDonald's appointment as COO, with both Mobility and Delivery reporting to him, represents more than organizational restructuring—it's a forcing function for platform execution.

Khosrowshahi explained the structural problem this solves: "Andrew McDonald, Mac, we call him, heading both mobility and delivery kind of solve the structural problem. Because to some extent, you know, the teams who are optimizing for the mobility app, they just wanna optimize for mobility... Now both of those organizations are under one person, which structurally allows us to be more aggressive on the platform."

Previously, separate P&L teams optimized for different metrics, creating natural conflicts between platform integration and individual business unit performance. McDonald's unified accountability structure aligns incentives with cross-platform outcomes rather than siloed growth.

The implications extend to executive compensation. Expect metrics weighted toward multi-product usage, Uber One attachment rates, and cross-platform conversion—not just segment-level P&Ls. Platform effects require platform organization, and compensation drives behavior faster than strategy documents.

Autonomous Distribution Strategy

Rather than building proprietary autonomous vehicles, Uber is becoming the essential distribution layer for whatever solutions emerge—a strategy directly analogous to Microsoft's approach with hardware manufacturers.

Microsoft doesn't manufacture PCs, but Windows becomes the essential platform layer for whatever hardware solutions emerge. The company partners with hundreds of OEMs globally, with expansion driven by market demand rather than manufacturing constraints.

Similarly, Uber partners with 20 AV companies across 12 cities, with expansion planned to at least 25 cities by 2026. The expansion strategy follows careful ecosystem development:

Light partnership investments prove unit economics—like Microsoft's developer incentives

Scale occurs only when AV trips per day reach human top-decile performance—analogous to Microsoft's hardware certification requirements

Multiple partners per metro preserve negotiating leverage—similar to Microsoft's OEM competition dynamics

Third-party financing unlocks once economics are demonstrated—like the PC financing ecosystem

This transforms Uber's relationship with AV companies from customer to essential infrastructure partner. The monetization model resembles Microsoft's platform strategy: asset-light, high-margin services that capture value from ecosystem growth rather than hardware ownership.

A closed-loop system might dominate a single use case, but a coordination platform wins when every market operates differently—the fundamental insight that made Microsoft's ecosystem strategy so powerful.

Advertising as Platform Leverage

Uber's advertising business has reached a $1.5B annual run rate, growing 60% YoY. While most revenue currently comes from Delivery merchants, Mobility advertising represents the larger long-term opportunity.

The platform advantage is evident: cross-platform inventory creates higher advertiser lifetime value than single-service competitors can offer. Mobility advertising enables concrete implementations:

Pre-trip offers based on destination patterns

In-trip partnerships during ride duration

Post-trip recommendations upon arrival

As autonomous vehicles eliminate driver interaction, programmable in-vehicle experiences could generate per-mile revenue exceeding traditional transportation margins. The same infrastructure that coordinates transportation becomes an advertising platform—classic platform economics where each additional revenue stream leverages existing assets.

Capital Allocation as Strategic Signal

The simultaneous $20B buyback authorization and continued AV investments demonstrates platform-level cash generation. Trailing twelve-month free cash flow of $8.5B (+44% YoY) provides both shareholder returns and growth optionality.

This capital strategy offers downside protection through buybacks while creating upside leverage through platform positioning. Share reduction mathematics combined with platform revenue growth could accelerate earnings per share significantly, even if business growth moderates.

More importantly, the capital allocation signals confidence in platform sustainability—the kind of cash generation that comes from coordination rather than transaction processing.

The Coordination Premium

By the 2010s, Microsoft had completed its transformation from software vendor to platform orchestrator. Developers could focus on application innovation while Microsoft's cloud infrastructure handled system-wide scalability invisibly. The result: exponential growth in cloud adoption and developer ecosystem value creation.

Uber's Q2 2025 earnings suggest a parallel transformation in urban mobility. Cross-platform user growth, Uber One membership expansion, and autonomous vehicle partnership orchestration aren't separate initiatives—they're components of an integrated platform system for urban transportation.

The financial metrics increasingly resemble Microsoft's platform economics rather than traditional service delivery. Each additional user and autonomous vehicle leverages existing coordination capabilities while generating data that improves system-wide efficiency—the classic platform flywheel that Microsoft perfected.

This explains why traditional transportation valuation frameworks may prove inadequate. Uber is transforming into platform infrastructure that captures value from ecosystem growth it enables but doesn't directly control, following the Microsoft playbook of ecosystem orchestration.

Whether the future includes electric vehicles, autonomous fleets, or transportation modes not yet invented, the demand orchestration platform Uber is building becomes more valuable, not less—just as Microsoft's platform became more valuable as the software ecosystem expanded. The platform is running; the question is how much ecosystem value it can coordinate.

Implications

The broader implication extends beyond Uber to any marketplace transitioning from transaction facilitation to demand orchestration. The companies that survive and thrive will be those that create genuine platform effects—where each additional participant makes the system more valuable for everyone.

The scale of opportunity remains vast.

As Khosrowshahi noted: "In our top 10 markets, for consumers who are 18 years and older, only about 20% of them come to us on a monthly basis. So there's a ton of audience that we can continue expanding into."

For Uber specifically, the platform transformation creates optionality that pure-play transportation companies lack. Whether that's advertising, subscription services, autonomous vehicle coordination, or business models not yet conceived, the underlying demand orchestration infrastructure becomes the foundation for multiple value creation strategies.

The Microsoft transformation it made entirely new types of businesses and products possible. Similarly, Uber's platform transformation won't just improve transportation; it will enable mobility solutions that aren't possible without coordination infrastructure.

The earnings numbers are impressive. The platform transformation they represent is potentially transformational.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.