United Health: The Regulatory Reckoning

How UnitedHealth's Optimization Machine Hit the Wall

Regulatory Arbitrage Was the Core Engine:

UnitedHealth's three-decade rise was fueled less by revolutionary care delivery and more by the systematic exploitation of Medicare's risk adjustment coding.

Through vertical integration under Optum, the company built a powerful

infrastructure for reimbursement maximization—an industrial-scale

regulatory optimization machine that outpaced peers in navigating

complex billing systems.

Systemic Shift: Optimization Era Ends:

A confluence of events in 2024–2025—including a DOJ criminal investigation, the CMS’s V28 model overhaul, and a sector-wide earnings shock triggered by Centene

—exposed UnitedHealth’s profit model to be highly dependent on

regulatory complexity. The simplification and tightening of rules turned

the company’s once-formidable scale into a liability, leading to a sharp

valuation decline.

Three Futures, One Reckoning:

UnitedHealth faces three strategic paths: (1) Clampdown Continuation—becoming a low-growth, utility-like healthcare provider; (2) Operational Renaissance—shifting from

billing optimization to genuine care innovation; or (3) Political

Reversal—temporary regulatory relief driven by electoral dynamics.

Each scenario implies a dramatically different valuation and strategic

posture, underscoring the fragility of business models built on regulatory

arbitrage.

I. Prologue: A Promise Made in Minneapolis

(1993)

On a crisp October morning in 1993, Richard Burke stepped to the podium at

the Minneapolis Chamber of Commerce, adjusting his tie as local business

leaders settled into their seats over coffee and Danish pastries. The

UnitedHealth CEO was about to unveil something unprecedented: the first truly nationwide HMO product, spanning all fifty states.

"Ladies and gentlemen," Burke began, his voice carrying the

confidence of a man who believed he was solving one of America's

most intractable problems, "we're not here to manage costs. We're

here to manage care."

The audience applauded politely, but Burke's words carried weight beyond

mere corporate speak. Just months earlier, Warren Buffett had declared

medical costs "the tapeworm of American economic competitiveness" at

Berkshire Hathaway's annual meeting. Here was Burke, promising that

UnitedHealth would be the cure—using private sector efficiency, integrated

networks, and aligned incentives to deliver better outcomes at lower costs.

Thirty-two years later, that promise lies in ruins. UnitedHealth's stock has

collapsed from $594 to $307, the company has withdrawn earnings guidance,

and a Department of Justice investigation looms over its Medicare billing

practices.

The question that haunts Burke's optimistic 1993 vision: Did

UnitedHealth become the solution to America's healthcare cost crisis, or did it

evolve into the most sophisticated parasite the system has ever seen?

II. The Great Optimization (1993-2023)

The three decades following Burke's Minneapolis moment represented one of

the most remarkable value creation stories in American business history.

UnitedHealth grew from a regional HMO to a healthcare colossus with $370

billion in revenues, delivering compound annual earnings growth of 15% while

accumulating a market capitalization that briefly touched $500 billion.

Wall Street celebrated UnitedHealth as the rare company that had "solved"

healthcare—using technology, vertical integration, and data analytics to

extract efficiency from America's $4 trillion medical sector. The Optum

acquisition spree seemed to validate this narrative: primary care physicians,

pharmacy benefit management, data analytics, and payment processing all

brought under one roof, creating what analysts breathlessly described as a

"healthcare operating system."

The company's premium valuation—often trading at 18-20x earnings while

hospital chains languished at 12x—reflected investor confidence that

UnitedHealth had built sustainable competitive advantages. Scale economics,

network effects, and technological sophistication appeared to create an insurmountable moat around the business.

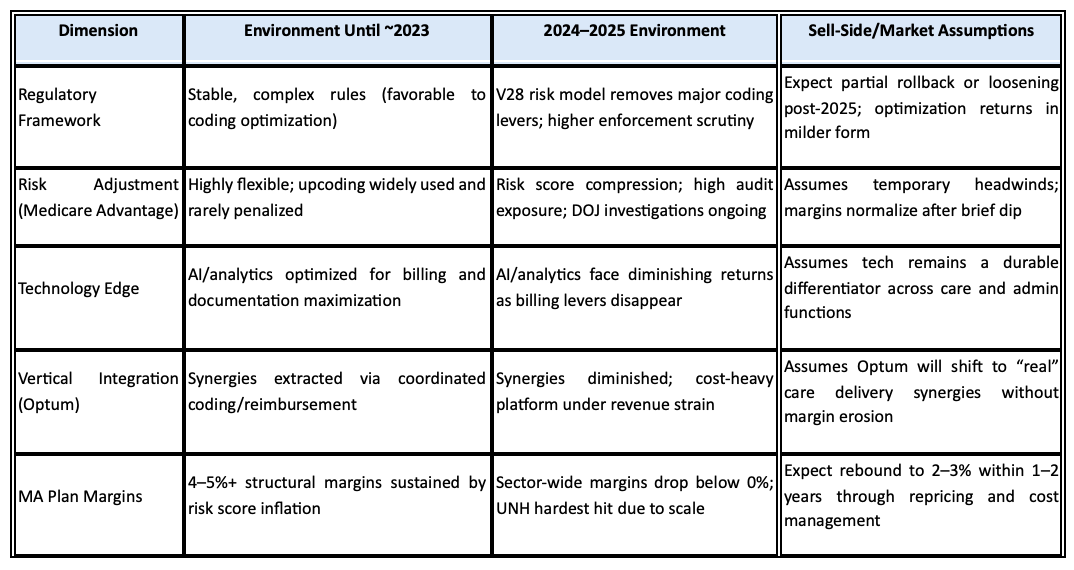

But this narrative, while compelling, obscured the true engine of

UnitedHealth's remarkable performance. The real driver wasn't revolutionary

care delivery or breakthrough cost management. It was something far more

prosaic and, ultimately, far more vulnerable: the systematic optimization of

healthcare's regulatory complexity.

III. The Hidden Engine: Mastering the Machine

To understand how UnitedHealth actually made money, one must delve into

the arcane world of risk adjustment—the mechanism by which the government

pays Medicare Advantage plans more money for sicker patients. Introduced to

prevent cherry-picking of healthy seniors, risk adjustment operates through

diagnostic coding: the more medical conditions a plan documents for its

members, the higher the government payments.

What UnitedHealth discovered, and perfected over two decades, was that

comprehensive documentation could generate revenue increases far beyond

what traditional medical management alone could achieve. Every additional

diagnosis code, properly documented and submitted, translated directly into

higher capitation payments from the Centers for Medicare & Medicaid

Services.

This wasn't fraud—it was optimization. UnitedHealth invested billions in

physician education, coding software, and data analytics to ensure that every

patient interaction captured the maximum allowable diagnostic complexity.

The company's army of nurse practitioners conducting home visits wasn't

primarily focused on improving health outcomes; they were documenting

conditions that supported higher risk scores.

The Optum integration strategy amplified this optimization capability

exponentially. OptumHealth provided primary care physicians who could be

trained in comprehensive diagnostic documentation. OptumRx generated

pharmacy data that revealed undocumented conditions. OptumInsight sold

coding optimization services to other healthcare organizations while

perfecting the techniques for UnitedHealth's own use.

This regulatory arbitrage—converting billing sophistication into consistent

margin expansion—became UnitedHealth's true competitive advantage. While

competitors struggled with medical cost management, UNH focused on

reimbursement maximization within the complex rules governing government

healthcare programs.

The scale effects were profound. Larger organizations could afford more sophisticated coding infrastructure, better training programs, and deeper analytics capabilities. UnitedHealth's size became a regulatory optimization platform, systematically extracting value from Medicare's complexity faster than smaller competitors could match.

IV. Cracks in the Code (2024)

The first hairline fractures appeared in early 2024, though few recognized their

significance at the time. A cyberattack on Change Healthcare, UnitedHealth's payments processing subsidiary, paralyzed medical billing across the United States for weeks. The incident revealed how dependent the entire healthcare system had become on UnitedHealth's infrastructure—and how vulnerable

that infrastructure was to disruption.

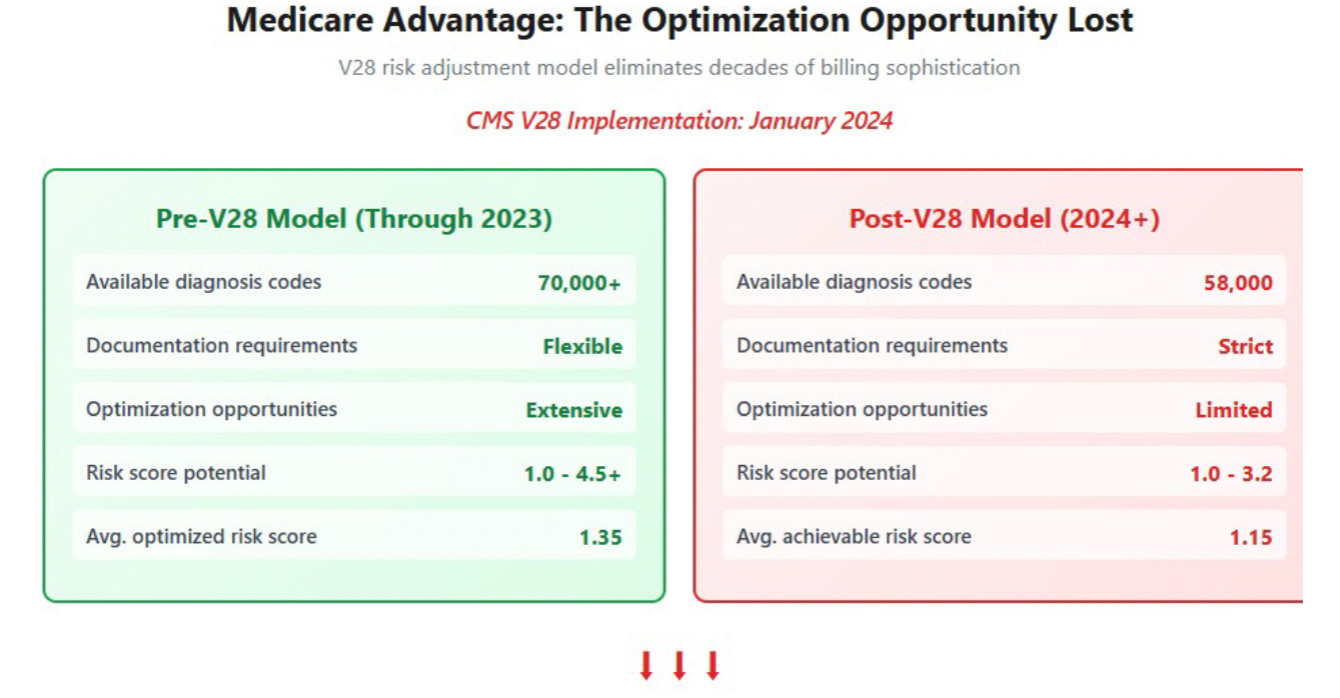

More ominously, the Centers for Medicare & Medicaid Services implemented

the V28 risk adjustment model, quietly eliminating thousands of diagnoses

codes that had been used for optimization purposes. Healthcare policy experts

noted that this change substantially reduced the scope for coding strategies

that had been developed over two decades, but Wall Street largely dismissed it

as a minor administrative adjustment.

Then came the rumors. In March 2025, whispers began circulating about

Department of Justice subpoenas related to UnitedHealth's Medicare

Advantage billing practices. Unlike previous investigations that had resulted in

civil settlements, sources suggested this inquiry was exploring criminal liability

—a fundamental escalation in enforcement philosophy.

UnitedHealth's management dismissed these concerns on quarterly earnings

calls, emphasizing their commitment to compliance and characterizing any scrutiny as routine regulatory oversight. But the company's margins told a different story. Medicare Advantage profitability, which had sustained double-digit returns for years, began showing signs of compression as the optimization playbook faced systematic constraints.

The market, anchored to decades of consistent outperformance, initially interpreted these developments as temporary headwinds. UnitedHealth's stock remained near all-time highs through the first half of 2024, supported by analyst confidence that the company's scale and sophistication would overcome any regulatory challenges.

This complacency would prove catastrophically misplaced.

V. Centene's July 2nd Shock: The Validation

On July 2nd, 2025, Centene Corporation's investor relations team released a

terse press statement that would reverberate across the entire managed care

sector. The company was withdrawing its 2025 earnings guidance and warned

that adjusted earnings per share would fall.

The catalyst wasn't operational missteps or competitive pressure. Recent HHS

program integrity reviews had systematically removed low-utilization, low-cost

ACA enrollees—the exact members who had been subsidizing Centene's risk

pools and enabling profitable growth. In a single policy stroke, years of

optimization-based profit accumulation had been eliminated.

The market reaction was swift and merciless. Centene plunged 40% in pre-

market trading, recording what would become its worst trading day since

2006. But the contagion spread immediately: Molina (-22%), Oscar (-19%), and

UnitedHealth itself (-6%) as investors suddenly grasped that regulatory

tightening affected all government healthcare programs simultaneously.

For UnitedHealth, Centene's crisis provided a devastating validation of the

thesis that optimization-based profits were vulnerable to systematic policy

changes.

If ACA plans could lose 40% of earnings overnight from eligibility reviews, what did that suggest about Medicare Advantage margins facing V28 implementation and potential DOJ enforcement?

VI. When Rules Rewrite Business Models

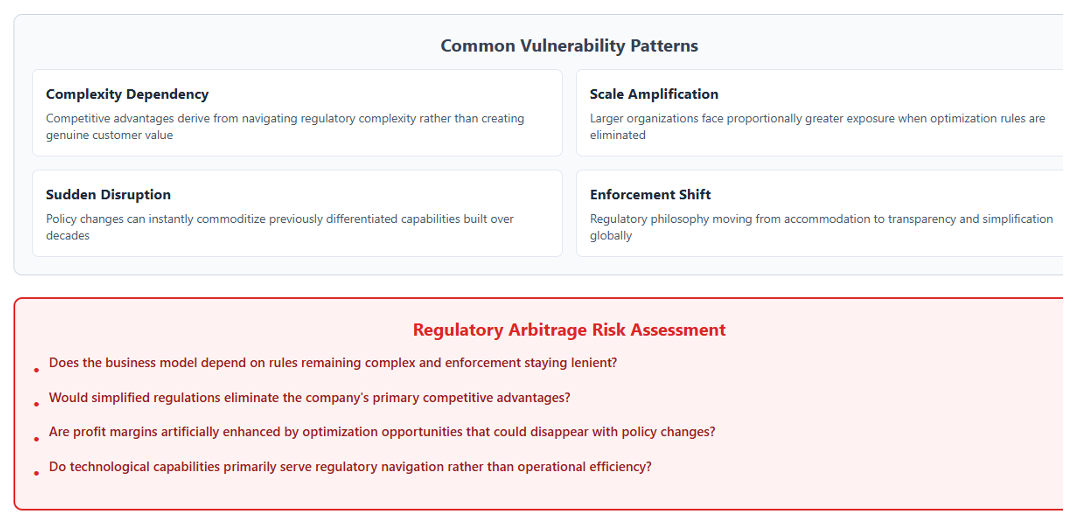

Centene's collapse illuminated a fundamental vulnerability that extends far beyond healthcare: businesses built on regulatory optimization are perpetually vulnerable to rule changes that can eliminate decades of value creation virtually overnight.

This dynamic isn't unique to medical billing.

Consider Europe's General Data Protection Regulation, which destroyed

billions of dollars in adtech value by constraining data collection

practices that had seemed permanently defensible.Or the Basel III banking regulations that forced the dismantling of

proprietary trading operations that had generated consistent profits for

decades

The pattern is consistent: when competitive advantages derive from

navigating regulatory complexity rather than creating genuine customer

value, policy shifts can instantly commoditize previously differentiated

capabilities. UnitedHealth's coding optimization, Centene's ACA risk pool

management, and adtech's surveillance capabilities all shared this

fundamental fragility—they were arbitrage opportunities masquerading as

sustainable business models.

What makes UnitedHealth's situation particularly precarious is the scale at

which this optimization occurred. The company didn't just benefit from

regulatory arbitrage; it industrialized it. Every process, every acquisition,

every technology investment was optimized for extracting maximum value

from Medicare's complexity. When that complexity gets constrained, the entire

integrated platform faces margin compression simultaneously.

The V28 risk adjustment model represents exactly this type of systematic

constraint. By eliminating diagnosis codes and tightening documentation

requirements, CMS has essentially downgraded the regulatory optimization

algorithms that powered two decades of outperformance. UnitedHealth's

sophisticated billing infrastructure, once a competitive advantage, risks

becoming a costly burden in an environment that rewards transparency over

complexity.

VII. Scale as Double-Edged Sword

For thirty years, UnitedHealth's massive scale appeared to provide

unassailable competitive advantages. Larger risk pools enabled better

actuarial predictions. Higher member volumes supported more sophisticated

technology investments. National reach created negotiating leverage with

providers and pharmaceutical companies.

But in the emerging regulatory environment, scale has become a liability

rather than an asset. Consider the contrast between UnitedHealth's national

exposure and regional nonprofit plans like Independence Blue Cross or

Premera Blue Cross. When CMS conducts risk adjustment audits, larger

organizations face proportionally more scrutiny, larger sample sizes, and

higher absolute dollar exposure to clawback.

The political dynamics compound this disadvantage. Regional plans serve

specific communities and maintain relationships with local congressional

delegations. UnitedHealth, as a national for-profit corporation, becomes a

more attractive target for political criticism about healthcare costs and access.

The company's $500 billion market capitalization and executive compensation

packages provide convenient symbols for politicians seeking to demonstrate

action on healthcare affordability.

Moreover, the operational complexity that scale enabled now works against

efficient adaptation. Regional plans can quickly adjust their coding practices,

provider relationships, and benefit designs to comply with new regulations.

UnitedHealth must coordinate changes across thousands of providers, dozens

of markets, and multiple business lines—all while maintaining the integrated

platform that Wall Street values.

This scaling paradox—where size amplifies both opportunity and risk—helps

explain why UnitedHealth's stock has underperformed smaller, regionally

focused plans throughout 2024 and 2025. Investors are beginning to recognize

that in a more transparent, heavily regulated environment, simplicity and focus may triumph over complexity and scale.

VIII. The Three Roads Ahead

UnitedHealth's future trajectory appears to hinge on three distinct scenarios,

each requiring fundamentally different strategic responses and delivering

vastly different investor outcomes.

Clampdown Continuation: This path assumes regulatory tightening

continues across all government healthcare programs, with enforcement

shifting permanently from civil to criminal frameworks. Medicare

Advantage margins stabilize around 2-3% rather than historical 4-6%,

while OptumHealth struggles to generate sustainable profits without

reimbursement optimization advantages. UnitedHealth evolves into a

low-growth utility with stable but unexciting cash flows, trading at 12-

13x earnings like other regulated infrastructure businesses. Stock price

settles in the $300-350 range, reflecting mature industry dynamics and

regulatory constraints.Operational Renaissance: Here, UnitedHealth successfully pivots its

technological capabilities from billing optimization to genuine care

delivery efficiency. The company's data analytics infrastructure enables

meaningful medical cost reductions through better chronic disease

management, preventive care coordination, and provider efficiency

programs. OptumHealth demonstrates authentic value creation

independent of reimbursement optimization, while the integrated

platform delivers the care management synergies that were always

promised but never fully realized. This transformation supports a return

to premium valuations around $400-450, albeit with more modest

growth expectations than the optimization era.Political Reversal: Election-year dynamics and healthcare access

concerns could moderate regulatory enforcement, particularly if

Medicare Advantage enrollment declines significantly. CMS might extend

RADV audit timelines, soften V28 implementation, or provide transition

relief to maintain plan participation. The DOJ investigation concludes

with financial settlements rather than criminal charges, while political

pressure prioritizes healthcare access over billing scrutiny. This scenario

enables partial recovery toward historical business models, supporting

stock prices in the $375-425 range, though with ongoing regulatory

uncertainty.

Each path requires different capabilities and suggests different investment

positioning. The clampdown scenario rewards defensive strategies and

dividend focus. The renaissance path demands patience for multi-year

transformation execution. The reversal case benefits from tactical trading around political and regulatory developments.

IX. Investor Blind Spots: Why Smart Money Missed the Signal

Despite mounting evidence of structural challenges, institutional investors

have been remarkably slow to adjust their UnitedHealth positioning.

Consensus price targets remain anchored near $450—implying confidence that current difficulties represent temporary headwinds rather than permanent

impairment.

Several cognitive biases help explain this persistence in the face of

contradictory evidence. Anchoring effects keep analysts projecting recovery

scenarios based on historical performance metrics that assumed continued

regulatory optimization opportunities. Financial models extrapolating from two

decades of 15% EPS growth struggle to incorporate the possibility that those

growth rates were artificially enhanced by rule arbitrage rather than

operational excellence.

Complexity bias compounds the problem. UnitedHealth's sophisticated

operations, multi-segment integration, and technological capabilities create

an impression of sustainable competitive advantages that are difficult for

competitors to replicate. This sophistication appears durable and defensible,

but much of it was optimized for regulatory navigation rather than care

delivery. When regulations evolve, complexity becomes a burden rather than a

benefit.

Management credibility effects also influence assessment. Stephen Hemsley's

return as CEO has been widely interpreted as stabilizing leadership during a

challenging transition. Hemsley successfully navigated UnitedHealth through

previous regulatory changes and economic cycles, creating confidence that

current challenges are similar to difficulties overcome in the past. However,

systematic regulatory philosophy shifts may require different capabilities than

cyclical operational adjustments.

The investment community's response reflects a broader difficulty in

distinguishing between temporary volatility and permanent disruption.

UnitedHealth's historical track record of overcoming challenges creates strong

priors that current difficulties are surmountable through superior execution.

Acknowledging that competitive advantages were regulatory rather than

operational requires fundamental revision of long-held investment theses.

X. Lessons Beyond Healthcare: The Regulatory Arbitrage Trap

UnitedHealth's predicament offers crucial insights for investors evaluating any

business where profit pools depend on navigating regulatory complexity rather

than creating genuine customer value. The pattern extends across multiple

sectors experiencing similar dynamics.

Financial technology companies that profit from regulatory arbitrage around

banking, payments, or lending regulations face comparable vulnerabilities.

Carbon credit markets, where value derives from interpreting complex rather

than creating genuine customer value. The pattern extends across multiple

sectors experiencing similar dynamics.

Financial technology companies that profit from regulatory arbitrage around

banking, payments, or lending regulations face comparable vulnerabilities.

Carbon credit markets, where value derives from interpreting complex

environmental regulations rather than reducing actual emissions, exhibit similar fragility. Artificial intelligence companies positioning "explainability" and "algorithmic auditing" capabilities as sustainable moats may discover that regulatory clarification commoditizes their differentiation.

The fundamental distinction lies between businesses that create value within

regulatory frameworks versus those that primarily capture value from

regulatory complexity. Companies in the first category tend to maintain

competitive positioning even when rules evolve, because their core value

proposition remains intact. Organizations in the second category face

existential challenges when regulations simplify, clarify, or tighten

enforcement.

UnitedHealth's experience suggests several diagnostic questions for evaluating regulatory arbitrage risk:

Does the business model depend on rules remaining complex and enforcement staying lenient? Would simplified regulations eliminate the company's primary competitive advantages? Are profit margins artificially enhanced by optimization opportunities that could disappear with policy changes? Do technological capabilities primarily serve regulatory navigation rather than operational efficiency?

Businesses answering "yes" to these questions may face similar disruption

when regulatory environments evolve. The optimization era that benefited

UnitedHealth appears to be ending across multiple sectors simultaneously, as

governments worldwide focus on transparency, simplification, and

enforcement rather than complexity and accommodation.

XI. What to Watch Next: The Catalyst Calendar

Several specific developments over the next eighteen months will provide definitive evidence about which scenario is most likely to unfold for UnitedHealth and the broader managed care sector.

September 2025: DOJ charging decisions will signal whether enforcement proceeds along criminal rather than civil paths, fundamentally altering risk assessment for the entire industry.

December 2025: V28 full-year audit results will quantify precisely how

much coding optimization opportunity has been eliminated, providing

concrete measurement of "regulatory alpha" lost.March 2026: 2026 Medicare Advantage bid results will reveal

UnitedHealth's strategic positioning between membership retention andmargin recovery, indicating whether the company can maintain market

share while restoring profitability.June 2026: OptumHealth segment performance will demonstrate

whether provider integration generates sustainable value without

reimbursement optimization advantages, testing the durability of the

vertical integration strategy.Ongoing: CMS rate-setting cycles, RADV clawback invoices, and

congressional oversight hearings will provide continuous signals about

regulatory philosophy and enforcement intensity.

These catalysts will enable real-time assessment of scenario probability rather

than relying on management guidance or analyst projections. The regulatory

environment is evolving faster than corporate adaptation, making external

validation crucial for investment positioning.

XII. Epilogue: Buffett's Tapeworm Revisited

Thirty-two years after Richard Burke's optimistic Minneapolis presentation,

Warren Buffett's healthcare challenge has developed in ways the Oracle of

Omaha likely never anticipated. UnitedHealth did indeed grow to massive

scale and profitability, seemingly validating Burke's promise that private

sector efficiency could solve America's medical cost crisis.

But as we sit in the wreckage of the optimization era—with UnitedHealth's

market cap cut in half, Centene's earnings evaporated, and the entire

managed care sector under regulatory assault—Burke's confident declaration

rings hollow. "We're here to manage care," he had proclaimed, "not

costs."

The uncomfortable truth emerging from the regulatory reckoning is that

UnitedHealth may have done neither. Instead of managing care, the company

optimized billing. Instead of reducing costs, it captured value from complexity.

The sophisticated platform that Wall Street celebrated as healthcare

innovation was, in essence, a regulatory arbitrage machine dressed up as care

coordination.

This doesn't make UnitedHealth villainous—the company operated within legal

frameworks and delivered services that millions of Americans depend upon.

But it does suggest that Burke's 1993 promise was built on a fundamental

misconception about what creates sustainable value in healthcare delivery

The question that haunts UnitedHealth's current crisis extends beyond any

single company to the broader challenge of American healthcare reform:

Can genuine innovation emerge from regulatory constraint, or does the complexity of government healthcare programs inevitably reward optimization over improvement?

Warren Buffett's tapeworm metaphor may have been more prescient than

anyone realized. UnitedHealth didn't eliminate the parasite—it evolved into

the most sophisticated strain the system had ever seen. Whether the

constraint of the optimization era finally creates incentives for authentic

healthcare innovation remains the defining question for American medical

delivery systems.

The Minneapolis Chamber of Commerce luncheon where this story began

represented a moment of tremendous optimism about market-based

healthcare solutions. Today, as regulatory pressure mounts and optimization

strategies face systematic elimination, we're discovering whether that

optimism was justified or whether it simply enabled a more complex form of

the same problem Burke promised to solve.

The answer will determine not just UnitedHealth's future, but the trajectory of

American healthcare delivery for decades to come.

General Legal Disclaimer

This research analysis is based on publicly available documents, company

filings, and third-party media reports through July 3, 2025. Forward-looking

statements and scenario analyses are illustrative projections based on current

information and should not be considered predictions of actual outcomes.

Actual results may differ materially from scenarios described due to regulatory

changes, competitive dynamics, company execution, and other factors

beyond the scope of this analysis. This content is for informational and educational purposes only. Readers should conduct their own due diligence and consult qualified financial professionals before making investment decisions.

All earnings projections, valuation scenarios, and financial calculations are

estimates based on available data and may not reflect actual company performance. Regulatory outcomes, policy changes, and enforcement actions remain uncertain and could significantly impact the scenarios described.