UnitedHealth Q2 2025 Earnings: The Optimization Machine Hits a Wall

When Scale Becomes Liability and Complexity Becomes Vulnerability

TLDR

Optimization Engine Broke: UnitedHealth’s profit model—built on gaming Medicare complexity—collapsed under new rules, audits, and DOJ scrutiny.

Scale Became a Liability: What was once a moat (AI, vertical integration, size) now amplifies margin risk, complexity, and political exposure.

Platform Illusion Shattered: The vaunted "healthcare platform" was really a billing machine—now obsolete in a world demanding transparency, not tricks.

From Bloomberg:

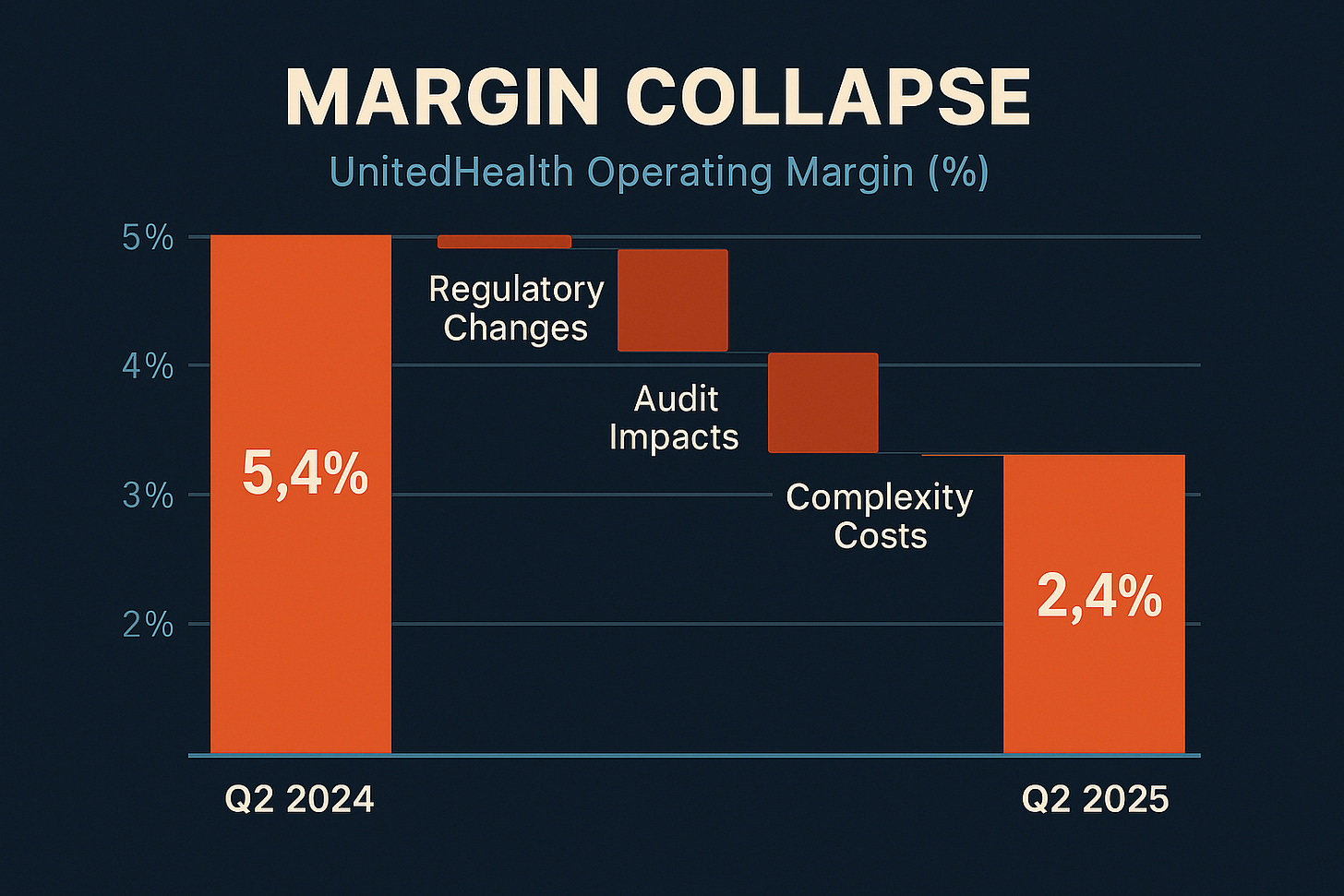

UnitedHealth Group reported Q2 2025 adjusted earnings of $4.08 per share, missing estimates of $4.59, while slashing full-year guidance from an original range of $29.50-30.00 to "at least $16.00" per share. The company's medical care ratio deteriorated to 89.4%, up 430 basis points year-over-year.

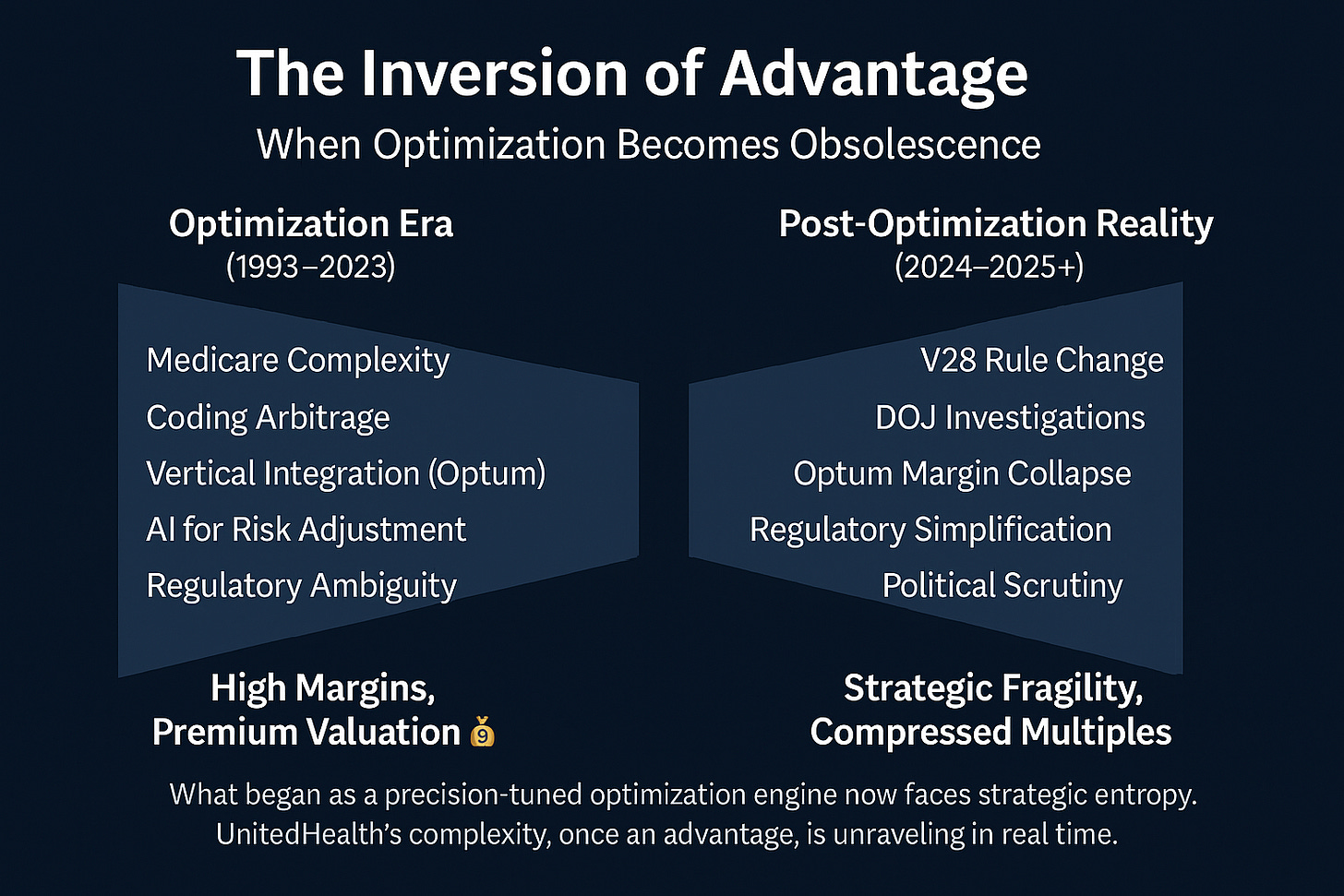

What we're witnessing isn't a typical earnings miss or cyclical downturn—it's the real-time breakdown of one of the most sophisticated regulatory arbitrage machines ever constructed. UnitedHealth spent three decades building competitive advantages based on navigating Medicare's complexity, and those advantages are being systematically eliminated by the very regulatory environment that created them.

The Hidden Metrics Tell the Real Story

UnitedHealth's Q2 presentation reveals a company frantically trying to manage the narrative around what amounts to a fundamental business model crisis. The metrics they're emphasizing versus hiding tell the story:

What They're Highlighting:

Revenue growth (13% year-over-year)

Technology investments and "AI-first orientation"

"Value-based care" patient counts

Market leadership position

What They're Minimizing:

Medical care ratio deterioration: 430 basis points is catastrophic, not cyclical

OptumHealth margin collapse: From 7.1% to 2.5% operating margin

Cash flow compression: Down to 1.1x net income vs. historical 1.5x+

Share repurchase reduction: Dramatic cuts to capital returns

The introduction of new metrics around "patient cohorts" and "V28 impact quantification" signals management recognizing they need new ways to explain why their historical advantages no longer work.

The Optimization Engine Exposed

The most revealing disclosure came from OptumHealth's patient cohort analysis, which inadvertently exposed the true nature of UnitedHealth's "value-based care" model:

Years 1-2 patients: Negative margins (40% of current membership)

Years 3-4 patients: ~2% margins

Years 5+ patients: 8%+ margins

This isn't evidence of care management learning curves—it's evidence of a risk adjustment optimization cycle that took multiple years to maximize billing efficiency per patient. True care management would show more consistent margins as providers learn to manage populations, not systematic improvement that correlates perfectly with risk score optimization timelines.

CEO Patrick Conway's language is telling: "underestimation of new members risk status as they came into our care" combined with acknowledgment of "suboptimal execution of the V28 risk model transition." Translation: their billing optimization algorithms broke when CMS changed the rules.

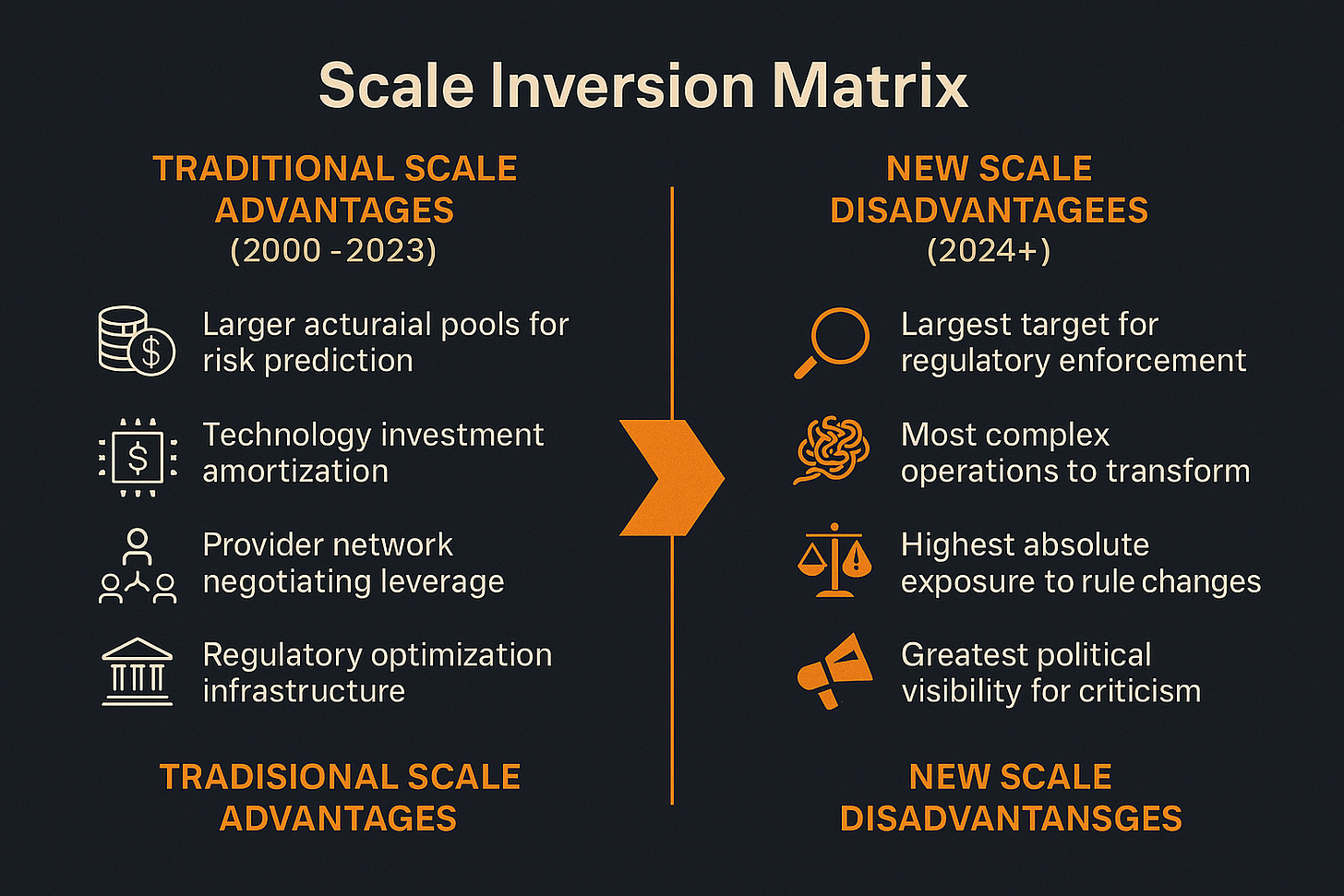

Scale as Strategic Liability

Stephen Hemsley's return as CEO represents acknowledgment that UnitedHealth's scale advantages have inverted into strategic liabilities. The company that mastered regulatory complexity at national scale now faces regulatory scrutiny at national scale.

Consider the strategic implications:

Traditional Scale Advantages (2000-2023):

Larger actuarial pools for risk prediction

Technology investment amortization

Provider network negotiating leverage

Regulatory optimization infrastructure

New Scale Disadvantages (2024+):

Largest target for regulatory enforcement

Most complex operations to transform

Highest absolute exposure to rule changes

Greatest political visibility for criticism

Management's admission that they're exiting 600,000+ Medicare Advantage members (primarily PPO products) while smaller regional plans are gaining market share validates this inversion. UnitedHealth's sophistication in gaming complex regulations becomes a burden when regulations simplify and enforcement intensifies.

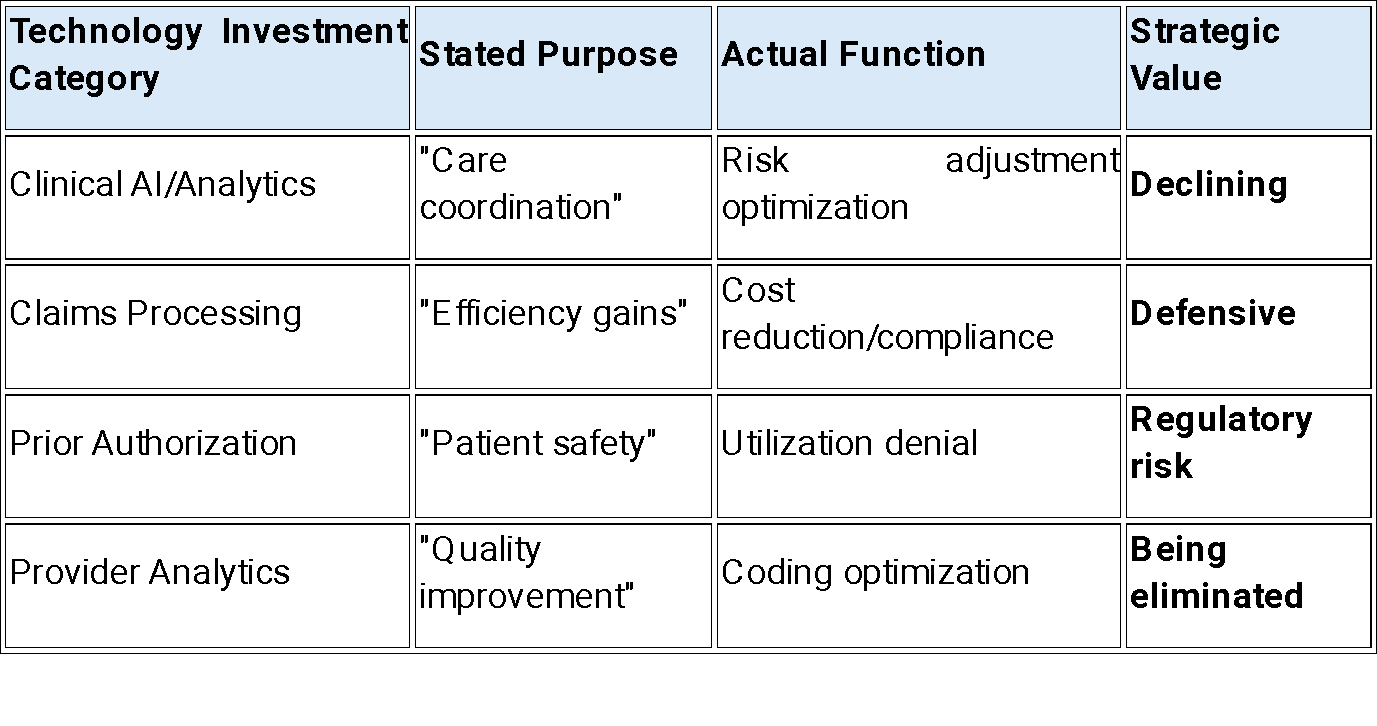

The Technology Narrative Unravels

The company's positioning around AI and technology investments reveals itself as primarily defensive when examined closely. Every specific example management provides focuses on cost reduction and compliance rather than growth:

"Payment integrity tools to protect customers from unnecessary costs"

"AI efforts across health plan operations" for "cost savings"

"Modern tools" for "identifying waste and abuse in outlier coding and billing practices"

This is billing optimization infrastructure being repurposed for cost management and regulatory defense, not genuine healthcare innovation. The telling absence: no specific examples of AI improving clinical outcomes or patient engagement independent of reimbursement optimization.

Executive Commentary: Reading Between the Lines

Three quotes reveal the strategic reality management is grappling with:

Stephen Hemsley: "More than anything, it is a tone of change and reform born out of recommitment to our mission."

This isn't typical corporate speak about operational improvements—it's acknowledgment that the fundamental business approach must change. "Reform" suggests the previous model was problematic, not just suboptimal.

Tim Noel: "We significantly underestimated the accelerating medical trend and did not modify benefits or plan offerings sufficiently to offset the pressures we are now experiencing."

The subtext: their actuarial models broke because they were optimized for regulatory gaming rather than genuine medical cost prediction. When optimization opportunities disappeared, they had no underlying cost management capabilities.

Patrick Conway: "We are early in our value-based care journey. We know we have real and self-inflicted executional challenges and we bear the responsibility to get this right."

"Self-inflicted" acknowledges strategic mistakes, while "early in our journey" after a decade of integration suggests the whole platform was built on false premises.

Competitive Positioning: The Great Inversion

UnitedHealth's crisis illuminates a broader industry transformation where traditional competitive advantages are becoming strategic vulnerabilities:

Winners in the New Environment:

Regional/nonprofit plans: Simpler operations, lower regulatory scrutiny

Kaiser Permanente model: Genuine integrated delivery without optimization dependency

Direct primary care: Transparent pricing, minimal intermediation

Losers in the New Environment:

National for-profit plans: Regulatory targets with complex operations

Vertical integration strategies: Built on billing synergies rather than care synergies

"Value-based care" platforms: Optimization schemes disguised as care management

The competitive landscape is fundamentally reshuffling around transparency and simplicity rather than complexity and scale.

Financial Engineering vs. Operational Recovery

Management's guidance for 2026 recovery appears mathematically implausible given the margin compression across all segments. The path from "at least $16" in 2025 to growth in 2026 requires either:

Miraculous operational turnaround (unlikely given structural challenges)

Aggressive cost cutting (undermines care delivery transformation)

Financial engineering (asset sales, accounting changes, one-time gains)

The cash flow compression to 1.1x net income suggests option #3 is most likely, meaning the "recovery" will be artificial rather than operational.

Strategic Implications: Platform Destruction in Real Time

What makes UnitedHealth's situation historically significant is that we're witnessing the real-time breakdown of what appeared to be a sustainable platform business model. The integrated delivery platform that Wall Street celebrated was actually a regulatory arbitrage coordination system disguised as healthcare innovation.

The platform economics worked as long as regulatory complexity created optimization opportunities that scale could exploit. When regulations simplify and enforcement intensifies, the platform becomes a coordination burden rather than a competitive advantage.

This has implications beyond healthcare: any business model built on navigating regulatory complexity rather than creating genuine customer value faces similar vulnerabilities when regulatory philosophies shift.

Forward-Looking Assessment: Three Scenarios, One Reckoning

UnitedHealth's trajectory depends on three distinct futures:

Scenario 1: Regulatory Clampdown Continues (60% probability)

Criminal charges possible, civil penalties certain

Margins settle at 2-3% utility-like levels permanently

Stock trades at $200-250 range on 12-13x earnings

Transformation takes 5-7 years, results in different company

Scenario 2: Operational Renaissance (25% probability)

Successfully pivots technology to genuine care delivery

Demonstrates sustainable integration advantages without optimization

Stock recovers to $350-400 range on execution proof

Requires multiple years of consistent operational evidence

Scenario 3: Political Reversal (15% probability)

Election dynamics moderate enforcement intensity

Partial return to optimization opportunities through transition relief

Stock bounces to $325-375 range on regulatory accommodation

Provides temporary reprieve but doesn't solve structural issues

The key insight: even the "bull case" scenarios result in permanently lower margins and growth rates than the optimization era delivered.

Broader Industry Impact: The End of an Era

UnitedHealth's crisis signals the end of the regulatory arbitrage era across healthcare. The company that most successfully industrialized Medicare complexity optimization has triggered the systematic elimination of optimization opportunities industry-wide.

This creates profound implications for healthcare technology, vertical integration strategies, and the entire managed care intermediation model. Companies built on billing sophistication rather than care delivery face similar challenges as government healthcare programs prioritize transparency over complexity.

The irony is profound: UnitedHealth's success at gaming healthcare regulations may have accelerated the regulatory response that's now destroying the entire optimization ecosystem they mastered.

We're witnessing creative destruction in real time—and UnitedHealth is on the wrong side of the disruption they helped create.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.