When Gravity Returns: Trade Desk’s 2Q25 and the End of Act I

When Gravity Returns: Trade Desk’s 2Q25 and the End of Act I From unrivaled navigator of the open web to challenger in a walled-garden world, The Trade Desk now faces structural constraints that no pr

TLDR

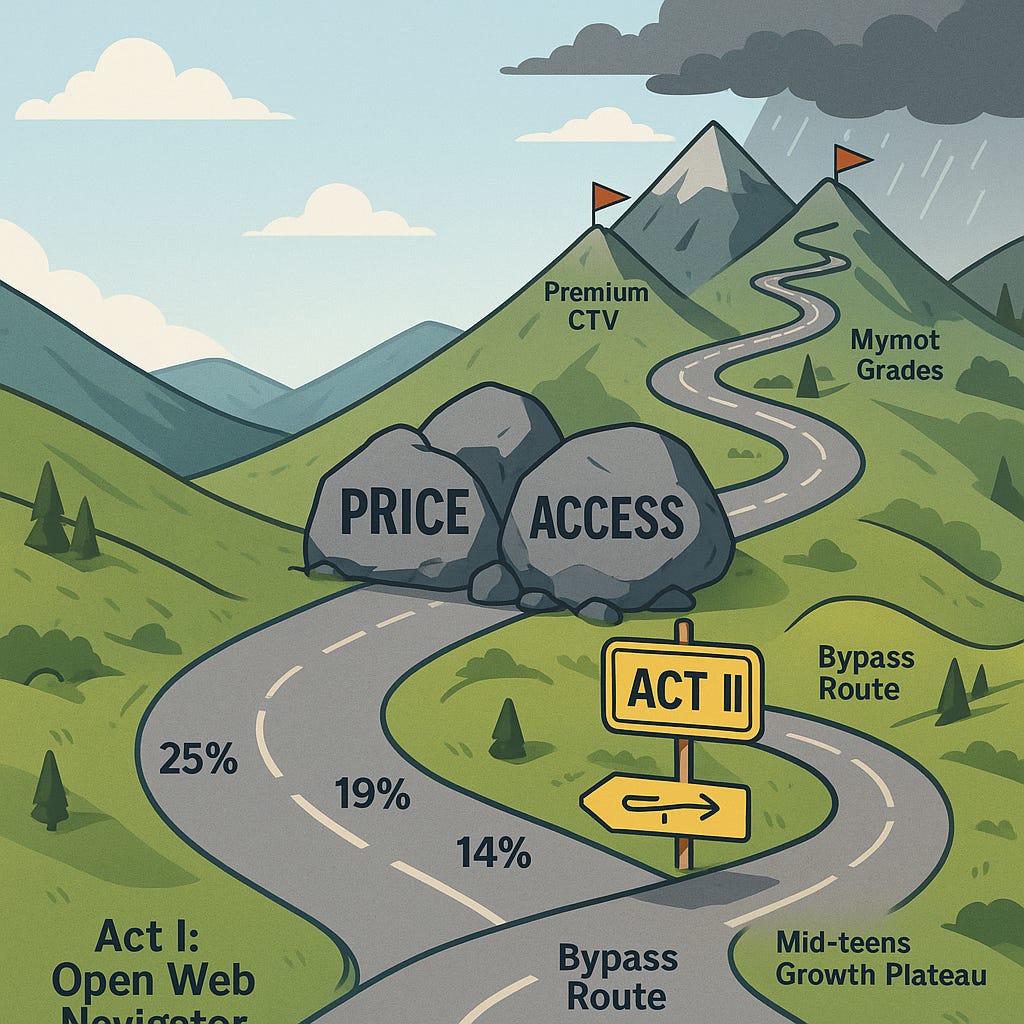

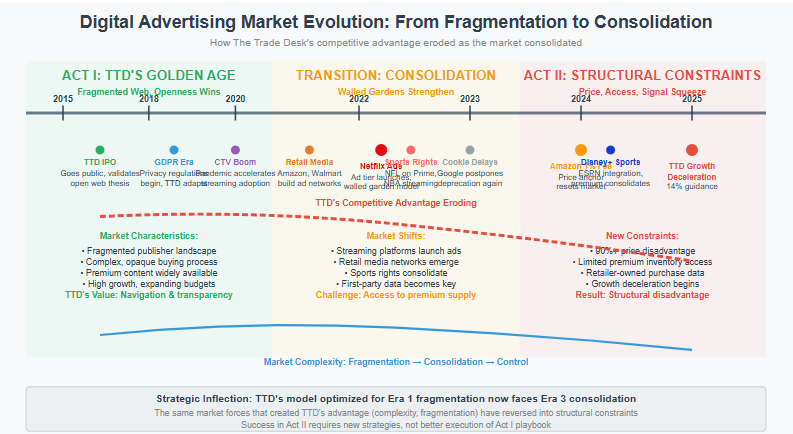

Growth engine meets market physics – Q2 2025 results show decelerating revenue growth (+25% → +19% → +14% guidance) despite strong product execution, as structural forces eclipse execution gains.

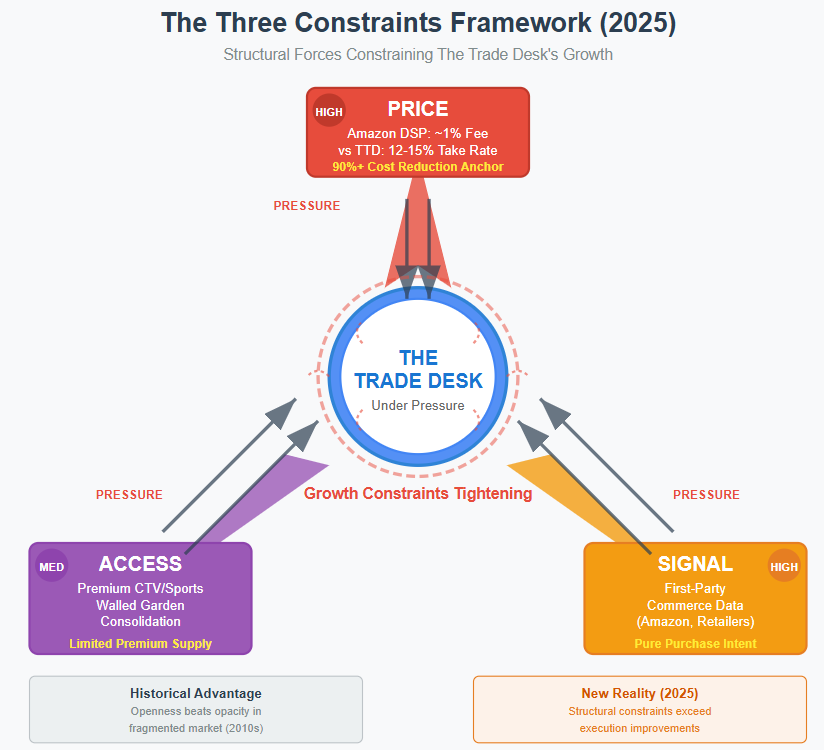

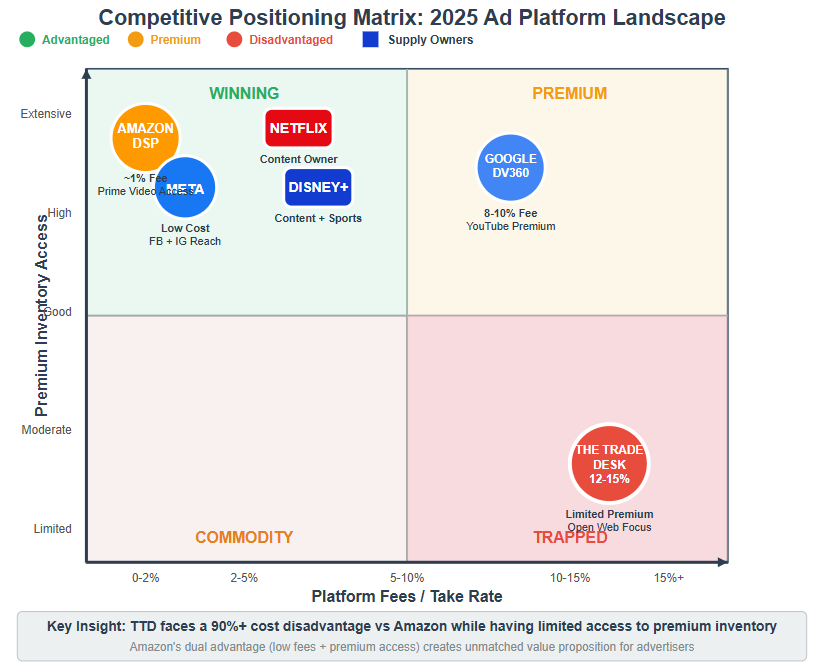

Three structural constraints – Amazon’s ~1% DSP fee (Price), consolidation of premium CTV/sports in walled gardens (Access), and retailer-owned purchase data (Signal) are redefining competitive advantage.

Act II demands reinvention – Without bold moves in pricing, premium supply access, and international partnerships, The Trade Desk’s growth will likely settle in the mid-teens, resetting its valuation ceiling.

In the late 1990s, the corporate world ran on complexity, and nowhere was this more apparent than in business travel. The landscape was a chaotic web of arcane airline fare codes, negotiated hotel block rates, and multiple, incompatible Global Distribution Systems (GDS). To navigate it was to require a guide.

That guide was the corporate travel agent. Companies like Carlson Wagonlit Travel were indispensable human middleware. Their value wasn't just booking tickets; it was expertise, aggregation, and simplifying chaos. They commanded significant fees because they managed a fragmentation that large clients could not manage themselves.

Then came Expedia, Priceline, and, most importantly, the airlines’ own direct booking websites. The disruption was not a better travel agent; it was the slow, inexorable elimination of the need for one. The new winning proposition was simplicity.

For over a decade, The Trade Desk has been the brilliant corporate travel agent for the digital advertising industry, masterfully navigating the fragmented open internet for the world's largest brands. Its Q2 2025 earnings report, however, was not just another data point; it was the first undeniable sign that its clients are discovering the powerful allure of “direct booking,” and that the very nature of the journey has changed. The original bet on openness worked, building a fantastic company. Q2 2025 asks whether that bet still maps to where budgets now flow.

Where We Were: A Fast Recap

My analysis of The Trade Desk has evolved with the facts. After the company’s first earnings miss in eight years, I wrote in February’s Stumble or Sea Change? that the core issue seemed to be an internal, fixable execution stumble around its new Kokai platform, though I flagged real structural questions.

By May, after a strong Q1 rebound, Strikes Back argued that execution was healing. With regulatory tailwinds from the DOJ’s case against Google and clear KPI gains from Kokai, the open internet thesis looked healthier than it had in months. I argued the company had a plausible glide path back to outperformance—if product progress was met with access to premium supply.

What 2Q25 Said (Facts First, No Spin)

Then came the second quarter results, and the glide path steepened dramatically.

Revenue Growth: $694 million, +19% year-over-year.

3Q Guidance: At least $717 million, implying +14% YoY growth—a significant step-down.

The Trend: The growth trajectory is now unambiguously decelerating: +25% (Q1) → +19% (Q2) → +14% (Q3 Guide).

Profitability & Retention: Still strong, with an adjusted EBITDA margin in the high-30s and customer retention over 95%.

Product: Kokai adoption is now at ~75% of spend, with strong client results.

Market Reaction: Multiple analyst downgrades and a stock collapse of over 38%, driven by the decelerating guidance and a narrative of intensifying competition.

The story of the last nine months is clear: the engine improved, but the road got steeper. The question is why.

The 2025 Constraint: Price • Access • Signal

The Trade Desk’s business was built on a simple, powerful premise: openness beats opacity. In a fragmented world, an objective platform that could see everything would outperform a walled garden that could only see its own yard. This logic held for years. It is now being superseded by a new set of market forces—a trio of constraints that define the 2025 advertising landscape.

Price (The Force of Gravity): The most potent force in any market is price. For years, The Trade Desk’s 12-15% take rate was justified by its unique value. That justification is now being challenged by a new benchmark: Amazon’s effective ~1% platform fee for its DSP. This is not merely a lower price; it is a new negotiating anchor for every CFO and CMO. The conversation is no longer just about ROI; it is about cost structure. When one provider offers a 90%+ reduction in platform fees, it creates a gravitational pull on the entire market.

Access (The Sovereignty of Supply): The most valuable, attention-grabbing content—live sports, flagship streaming shows, cultural moments—is increasingly consolidated within closed ecosystems. The NFL on Prime Video, the NBA on multiple platforms, top-tier shows on Netflix and Disney+; this is the advertising real estate with the highest value. The Trade Desk is the undisputed king of the open internet, but its ability to programmatically buy inventory in these premium “gated communities” is limited. Technology is irrelevant if you don't have access to what clients want to buy most.

Signal (The Purity of Data): The advertising world is in a secular shift from probabilistic targeting (cookies, demographic proxies) to deterministic proof of outcomes. The Trade Desk’s UID2 is a brilliant engineering solution for identity on the open web. However, Amazon’s first-party data on what millions of consumers actually purchase is not a reconstructed signal; it is the signal. In a world demanding proof of sales, data from the cash register is the ultimate ground truth.

Product Reality vs. Business Reality

This brings us to the Kokai Paradox. The platform is, by all accounts, a technical success. Clients who use it see better performance and increase their spend faster. It is a necessary upgrade.

However, it is not sufficient.

The Q2 deceleration proves that product optimization cannot overcome structural market constraints. A brilliant engine cannot win the race if its competitors have exclusive access to a shorter, faster track (Access) and are allowed to start with a massive head start (Price). The limits to The Trade Desk’s growth are no longer about its capabilities; they are about the physics of the market it operates in.

Reframing the Thesis

My viewpoint has evolved accordingly.

Prior View (February): The risk seemed to be internal execution.

Evolved View (May): Execution was healing, and the strategic environment looked surprisingly friendly.

Current View (August): The constraint is undeniably structural, driven by Price, Access, and Signal. The Trade Desk is a high-quality business, but its high-growth duration is shortening. Without a fundamental strategic shift, its growth will settle in the mid-teens, which implies a durable—but structurally lower—valuation multiple.

Strategic Options That Would Change the Story

The path back to a re-accelerating growth story and a premium multiple is narrow, but it exists. It requires management to move beyond its current playbook and embrace new strategies.

A Pricing Model Rethink: The monolithic 12-15% take rate is a liability. The strategic move is to unbundle it: offer a much lower headline platform fee to neutralize the Amazon anchor, then meter and charge for high-value services like identity resolution, data enrichment, advanced measurement, and AI-driven optimization. This defends gross profit per dollar of spend while closing the optics gap.

Premium Access Breakthroughs: Pragmatism must win over purity. The Trade Desk needs to secure meaningful, programmatic access to premium walled-garden inventory. A landmark deal with a Prime Video, a Disney+, or a Netflix—even with uncomfortable terms—would be a game-changer, proving they can get clients access to the supply they covet most.

An International Leapfrog: The current "export the US model" approach is not working. A true breakthrough requires country-level Joint Ventures with major broadcasters or telecom operators, creating local, data-rich ecosystems that TTD can power.

The Scorecard: What to Track for Act II

The burden of proof is now on management. Here is a scorecard to track whether they are successfully navigating this transition.

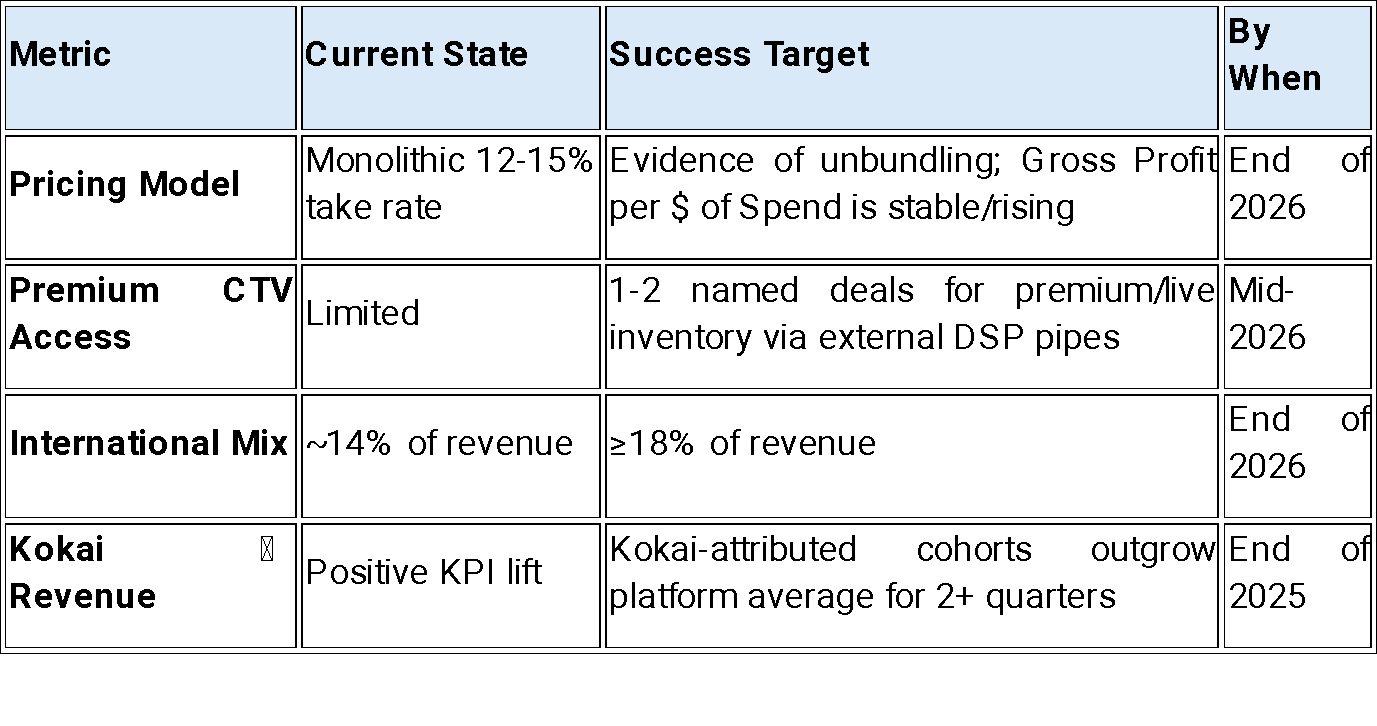

The Reinvention Scorecard

Conclusion: The End of an Era

Returning to the travel agent: Carlson Wagonlit never went out of business. It survived by reinventing itself as a specialized B2B service—a profitable, high-quality, but ultimately smaller and less central player in a travel world that had been redefined by simplicity and direct access.

This is the crossroads for The Trade Desk. It has masterfully completed Act I, building a phenomenal company for the advertising landscape of the 2010s. That landscape is now changing. The core question is no longer about executing a proven playbook, but about whether leadership has the strategic courage and operational humility to write a new one for a world with entirely new rules.

Act II has begun.

Disclaimer

The information presented in this communication reflects the views of the author and does not necessarily represent the views of any other individual or organization. It is provided for informational purposes only and should not be construed as investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or financial products.

While the information is believed to be obtained from reliable sources, its accuracy, completeness, or timeliness cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness or reliability of the information presented. Any opinions or estimates are subject to change without notice.

Past performance is not a reliable indicator of future performance. All investments carry risk, including the potential loss of principal. This communication does not consider the specific investment objectives, financial situation, or particular needs of any individual.

The author and any associated parties disclaim any liability for any direct or consequential loss arising from the use of this material and undertake no obligation to update or revise it.

doesn't The Trade Desk have programmatic partnership deals in place with Netflix and Disney already?

Which is the original?

https://nikhs.substack.com/p/when-gravity-returns-trade-desks?utm_source=%2Fsearch%2Fthe%2520trade%2520desk&utm_medium=reader2