When the Map Moved: AppLovin's Position After ATT

How AppLovin turned privacy disruption into positioning advantage—rewiring mobile advertising around its own data switchboard.

TLDR

AppLovin didn’t try to fix the old map after Apple’s ATT broke mobile tracking—it moved to where new data is generated: ad auctions.

By owning the mediation layer (MAX), AppLovin rebuilt a proprietary data stream powering AXON’s optimization engine—fueling better ad performance and margins.

Its self-serve platform aims to scale this advantage globally, turning more advertisers into more data—and more data into compounding returns.

In 1870s Chicago, grain elevators controlled more than storage—they controlled the flow of market intelligence. As railroad networks converged on the city, these towering wooden structures became natural accumulation points for commodity information. Elevator operators knew which regions produced surplus wheat, which destinations faced shortages, and most crucially, they observed every transaction price as grain moved from farm to freight car.

When telegraph lines compressed time across this expanding network, those positioned at these data convergence points gained extraordinary pricing power. They didn't need to predict market movements better than their competitors; they simply sat where market movements were being made in real-time. The lesson was fundamental: where you position yourself in the information flow shapes what you can optimize. Technology matters, but positioning decides who compounds advantages over time.

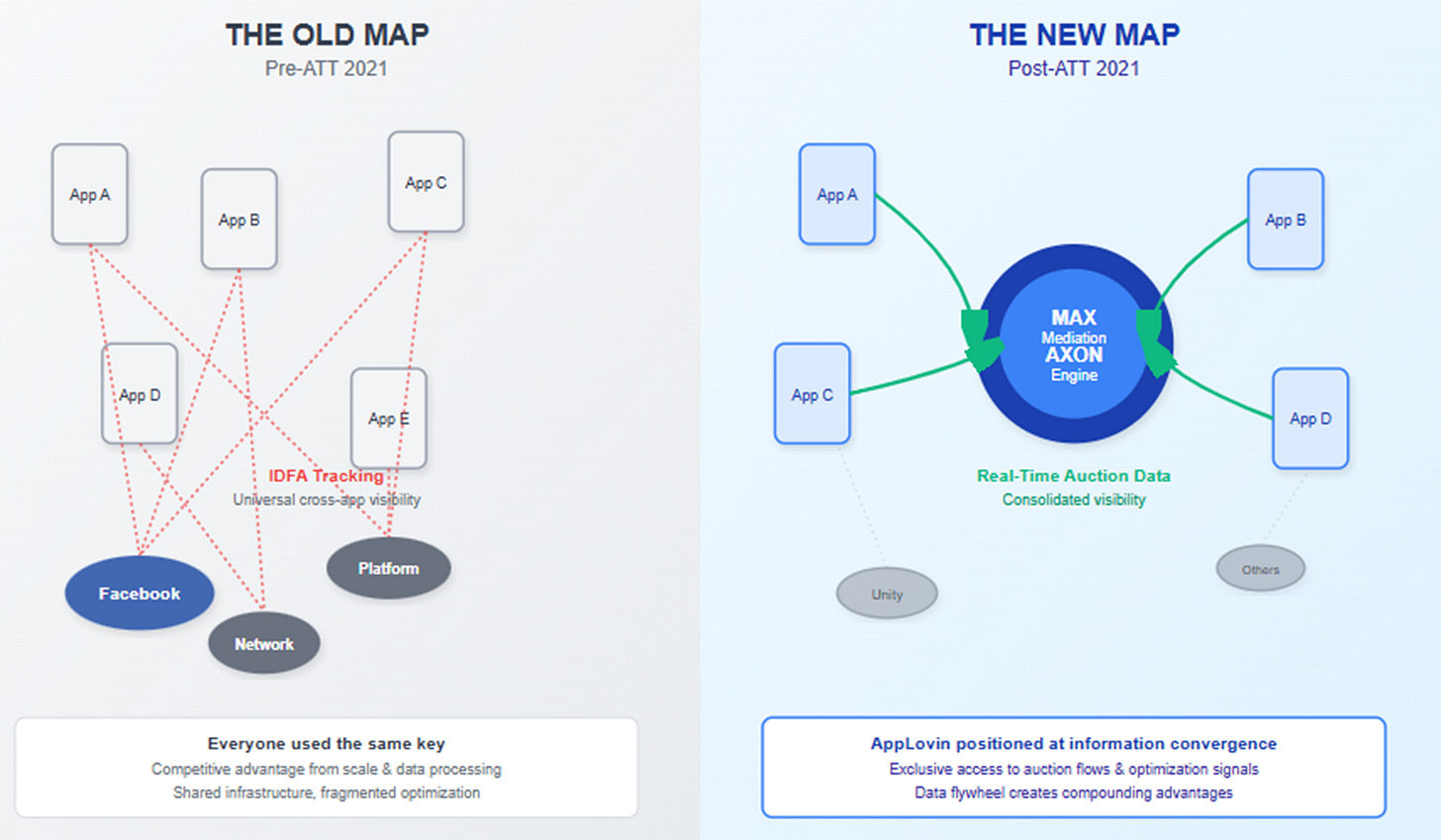

In mobile advertising, something remarkably similar happened after 2021. The industry had relied on Apple's Identifier for Advertisers as a universal key for tracking user behavior across apps. When Apple removed that key through App Tracking Transparency, the entire market's map of users went dark. Most companies scrambled to redraw a blurred version of the old map. A few quietly moved to where the new map was being made.

The Old Map — Deterministic Attribution Before 2021

The mobile advertising ecosystem of 2020 operated on elegantly simple principles. Apple's IDFA served as a universal key that unlocked cross-app user tracking, enabling platforms to stitch together complete user journeys from initial ad impression to eventual conversion, often days or weeks later.

This deterministic attribution system created a shared foundation for optimization. Facebook mastered the model most completely, consuming vast streams of conversion events from thousands of apps to build detailed user profiles that extended far beyond Facebook's own properties. When users clicked Facebook ads for mobile games, Facebook tracked installation, spending behavior, and retention patterns, creating feedback loops that made targeting increasingly precise.

For other players in the ecosystem, competitive advantage came from scale and signal quality, but the fundamental rules remained consistent. Ad networks, measurement companies, and optimization engines all operated from the same basic infrastructure: cross-app user behavior tied to persistent identifiers. The constraint was shared—everyone used the same key—so differentiation emerged through data processing sophistication and advertiser relationships.

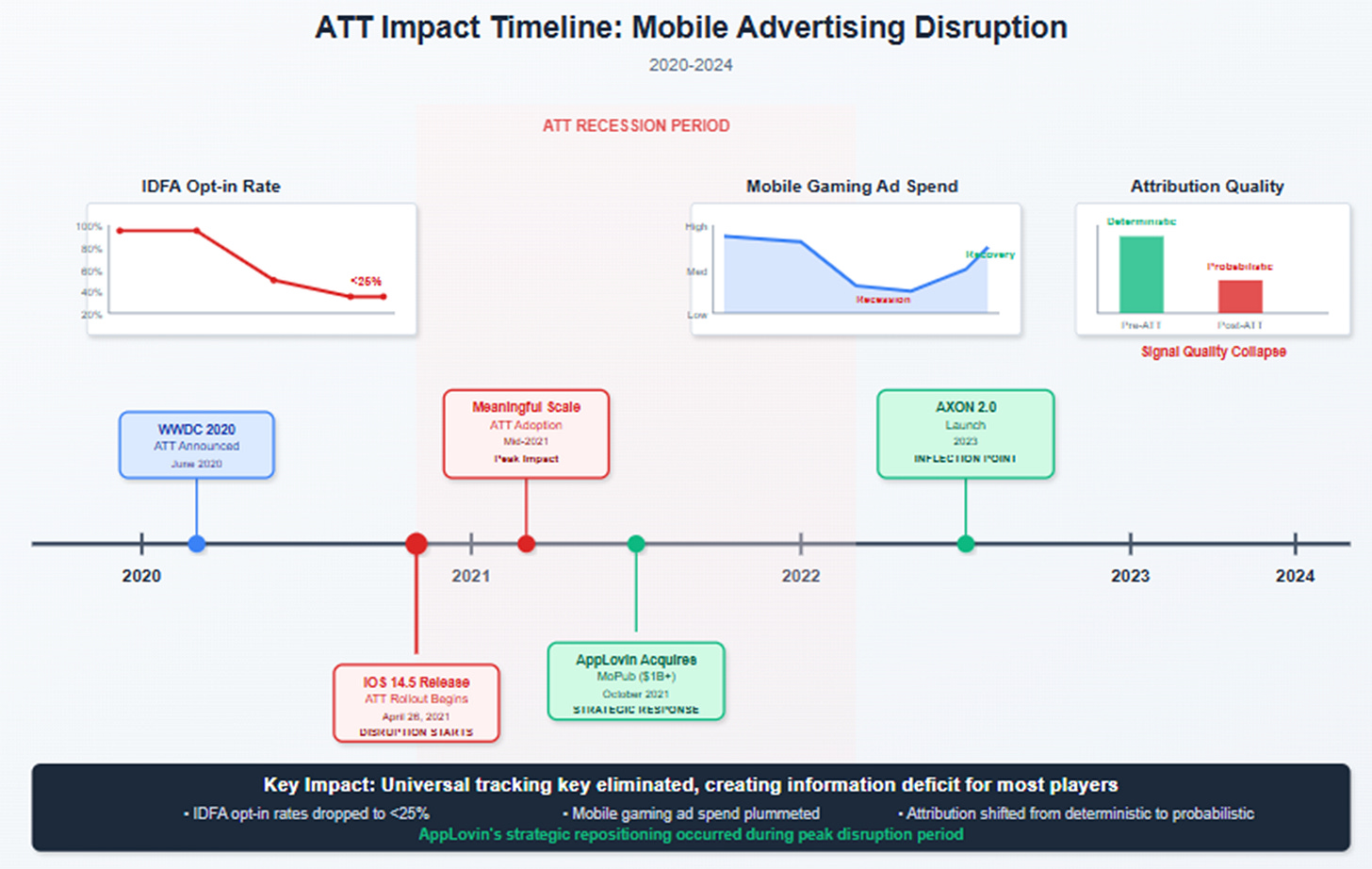

The Break — ATT and the Information Deficit

Apple's App Tracking Transparency framework, which reached meaningful scale in mid-2021, didn't merely reduce signal quality—it fundamentally restructured information flow throughout mobile advertising. The universal key disappeared for the vast majority of users, with fewer than 25% opting into cross-app tracking when prompted.

What replaced deterministic, user-level attribution was a system explicitly designed for privacy: campaign-level reporting with significant delays and severe granularity restrictions. For most platforms, this created an immediate information deficit. The detailed behavioral maps that had powered algorithmic optimization simply vanished.

Mobile gaming felt this disruption most severely. The "ATT recession" saw advertising spending plummet as performance marketing campaigns—previously optimized through granular user-level data—suddenly produced unpredictable results. Companies that had built entire growth engines around cross-app attribution found themselves operating without their primary navigation tools.

The industry's response divided along two distinct paths. Most companies pursued probabilistic reconstruction: fingerprinting techniques, statistical modeling, and fragile heuristics designed to approximate what had previously been known with certainty. This approach treated ATT as purely an information problem—if the old map was destroyed, build a new one with whatever signals remained accessible.

The alternative was structural repositioning: instead of attempting to rebuild a comprehensive map with degraded signals, move to a location where user outcomes remained directly observable.

AppLovin's Structural Bet — Move to the Data Stream

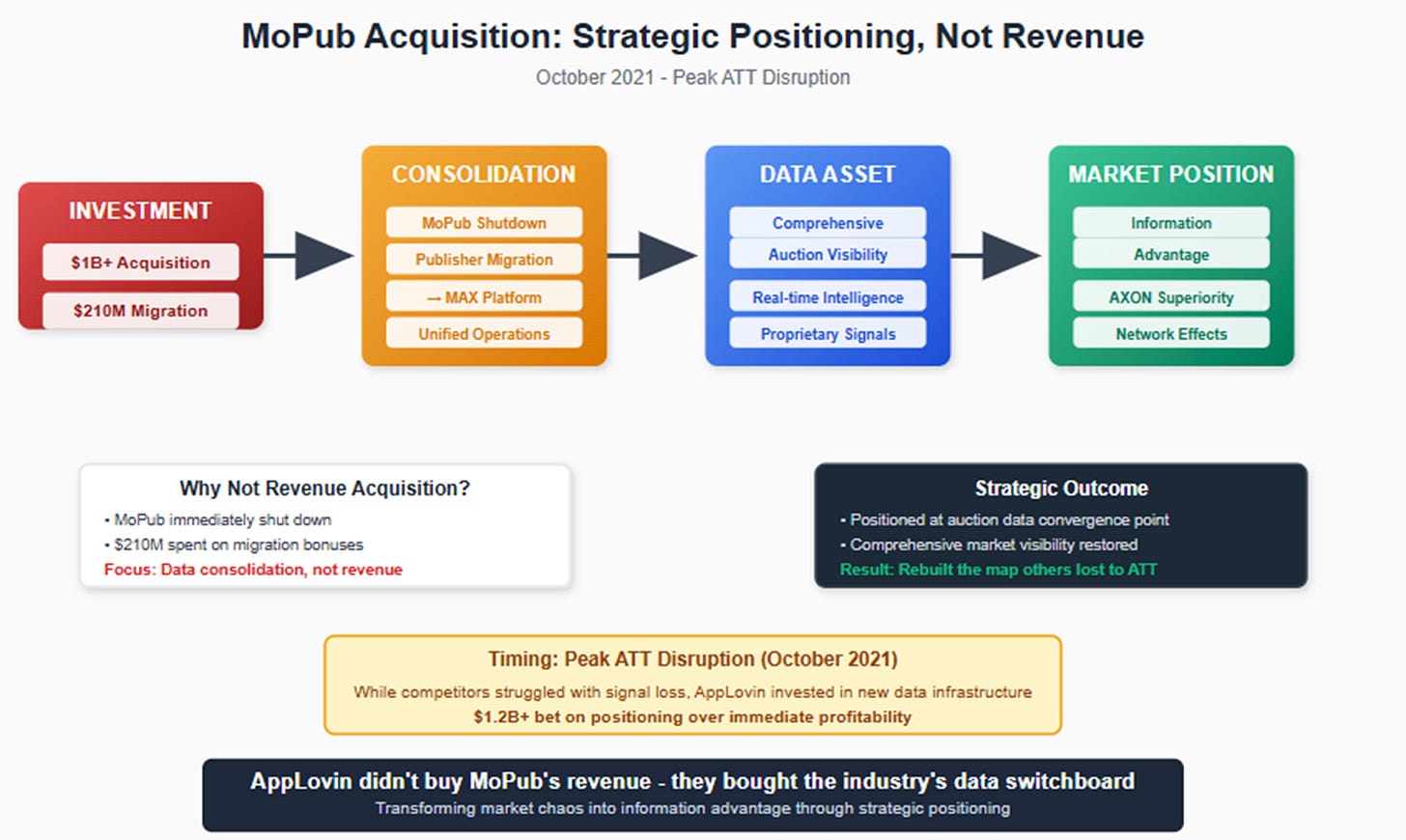

In October 2021, as the mobile advertising industry struggled with ATT's aftermath, AppLovin acquired MoPub from Twitter for over $1 billion. The timing appeared coincidental—routine consolidation in a distressed market. The execution revealed different strategic intentions entirely.

Rather than integrate MoPub's existing operations, AppLovin immediately announced the platform's shutdown. They invested an additional $210 million in publisher bonuses to migrate MoPub's entire client base to AppLovin's MAX mediation platform within months. This wasn't acquisition for immediate revenue growth; it was acquisition for strategic positioning.

Mediation platforms like MAX function as the central nervous system of mobile app monetization. They operate real-time auctions determining which advertisements appear in which applications at what price points. Every bid submission, every auction outcome, every pricing decision flows through these systems at massive scale.

By consolidating the market's largest supply-side platform onto their own infrastructure, AppLovin positioned themselves at the mobile advertising industry's primary switchboard. This created something valuable that ATT had destroyed elsewhere: comprehensive visibility into supply and demand equilibrium across thousands of applications.

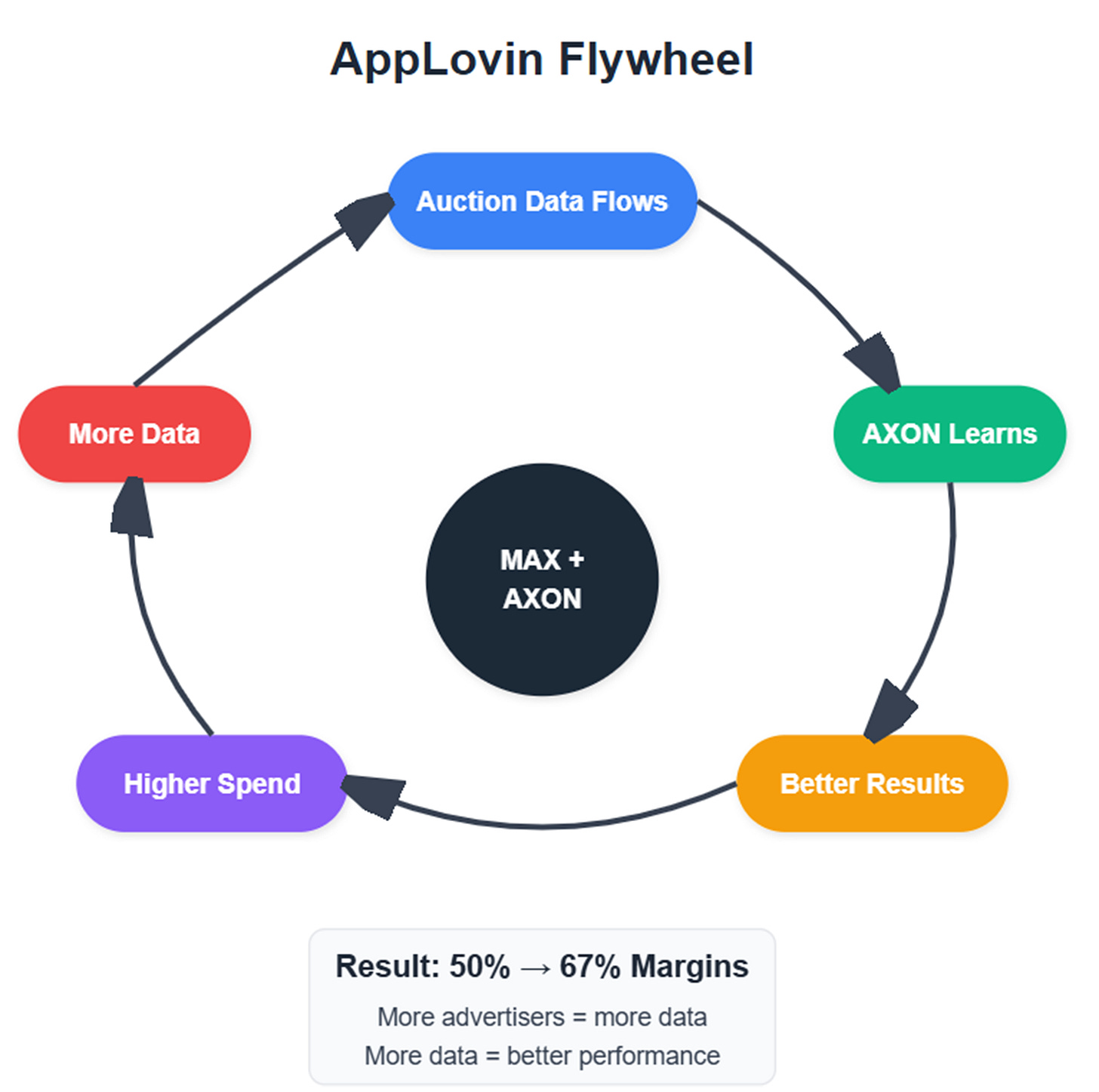

The mechanism that emerges from this positioning operates through a straightforward but powerful flywheel:

MAX mediation generates continuous auction telemetry → AXON processes this data for optimization features → improved bid/win/price decisions deliver better advertiser ROAS → better returns automatically expand advertiser budgets → more spending generates additional auction data

The $210 million migration expense, criticized by some analysts as operational waste, should be reframed as strategic infrastructure investment. AppLovin was paying to reconstruct the data foundation that ATT had eliminated, but rebuilding it in a location they controlled completely.

The Inflection — From Integration Year to Model Lift

AppLovin's 2022 financial performance reflected the operational complexity of this repositioning strategy. Consolidated margins remained pressured by integration costs, publisher migration bonuses, and broader market uncertainty around post-ATT performance marketing effectiveness. The company's stock declined over 75% from peak valuations as investors questioned whether the transformation would succeed.

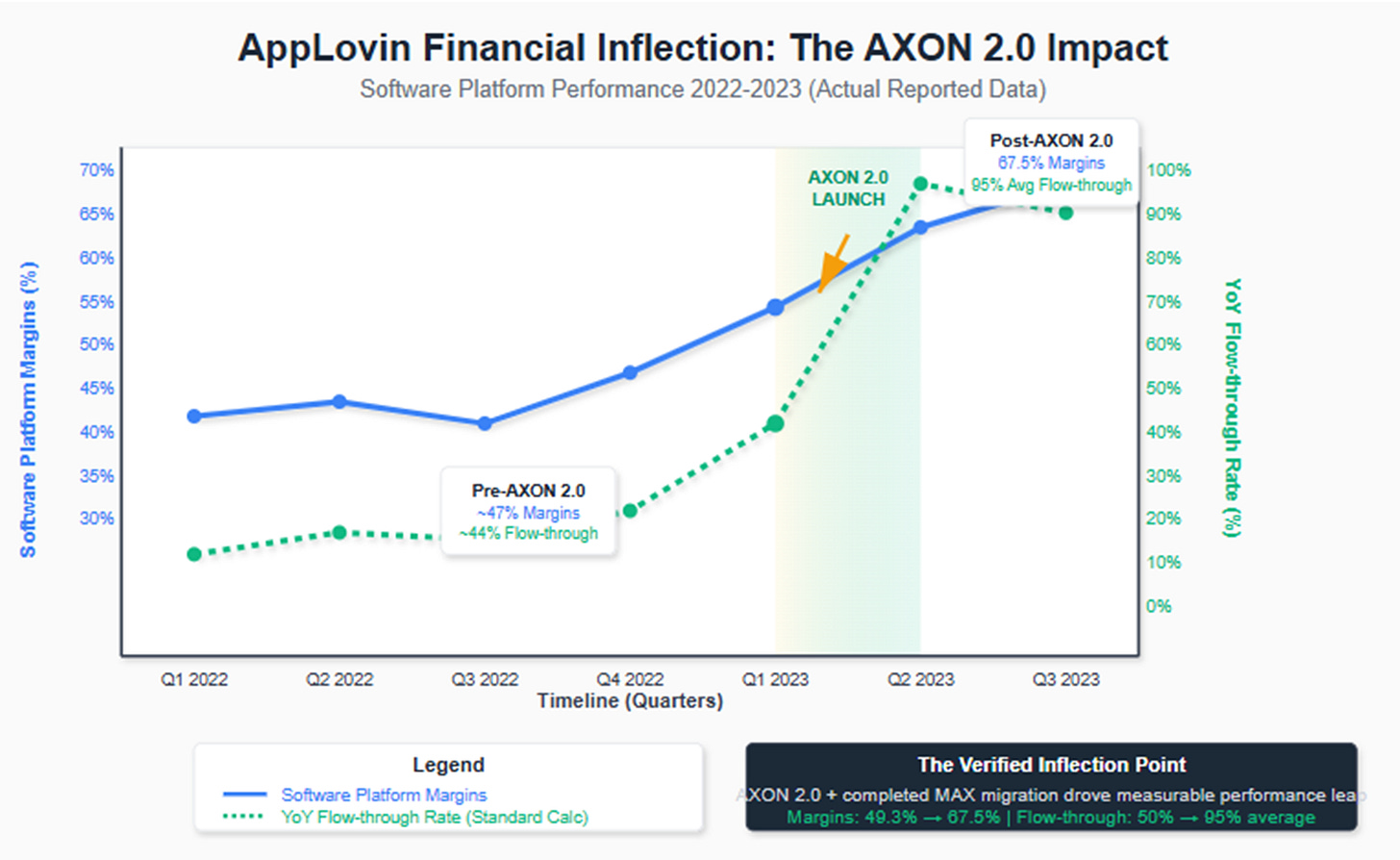

2023 marked a clear inflection point. AppLovin launched AXON 2.0, describing it as a fundamental upgrade to their optimization capabilities. The timing coincided with completed MAX migration and scaled auction data visibility, producing immediate results: software platform margins expanded from approximately 50% to 67% within quarters, with revenue flow-through rates exceeding 100% during certain periods.

The "AXON 2.0 breakthrough" narrative that management promoted emphasized algorithmic improvements, but the underlying mechanism suggests both technological advancement and dramatically enhanced data quality played crucial roles. The consolidated, comprehensive auction intelligence flowing through MAX enabled optimization sophistication that would have been impossible with the fragmented, partial signals available to competitors.

This period also witnessed AppLovin divest its mobile gaming portfolio—the collection of applications originally acquired to generate first-party user data for AXON training. This strategic decision signaled an important conclusion: owning consumer applications was no longer necessary to access high-quality behavioral data, because MAX provided superior visibility into user behavior across the entire mediated ecosystem.

The Turn — Opening the Platform

AppLovin's current expansion phase represents the logical next step in this positioning strategy. The self-service platform launching internationally on October 1, 2025, with global public access planned for the first half of 2026, transcends simple revenue growth objectives—it's designed to densify the learning environment that makes AXON's optimization effective.

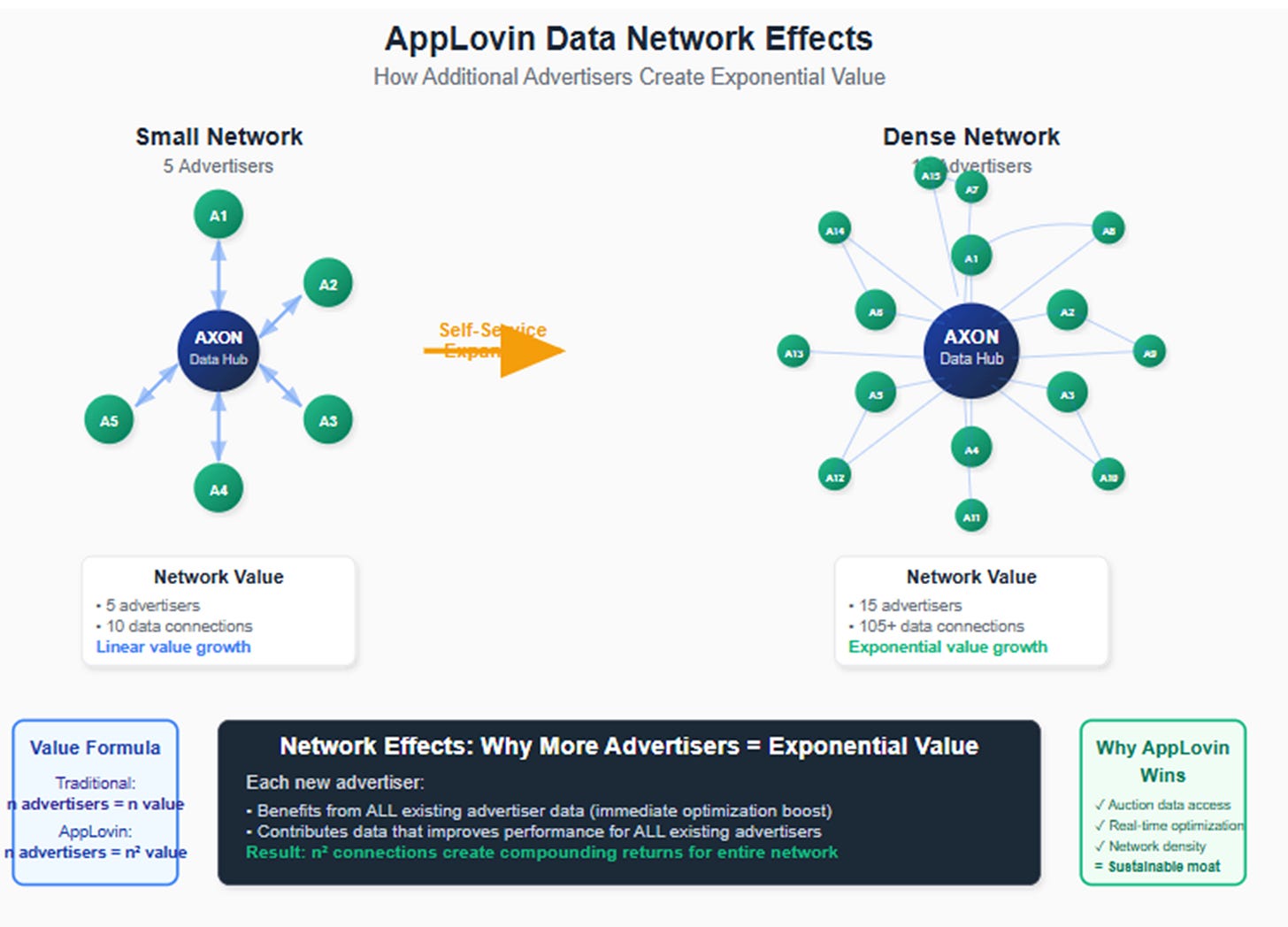

Traditional enterprise software companies approach self-service cautiously, concerned that lower-touch offerings might cannibalize higher-margin managed services. AppLovin confronts the opposite dynamic: additional advertisers using the platform generate superior data, which improves performance for all participants, which attracts increased spending across the entire ecosystem.

Early e-commerce pilot results suggest this theory functions in practice. Companies testing AppLovin's platform for web-based advertising report strong return on ad spend and high incrementality compared to existing channels. The crucial question is whether these results reflect genuine competitive advantages or merely novelty effects from advertisements appearing in unexpected contexts.

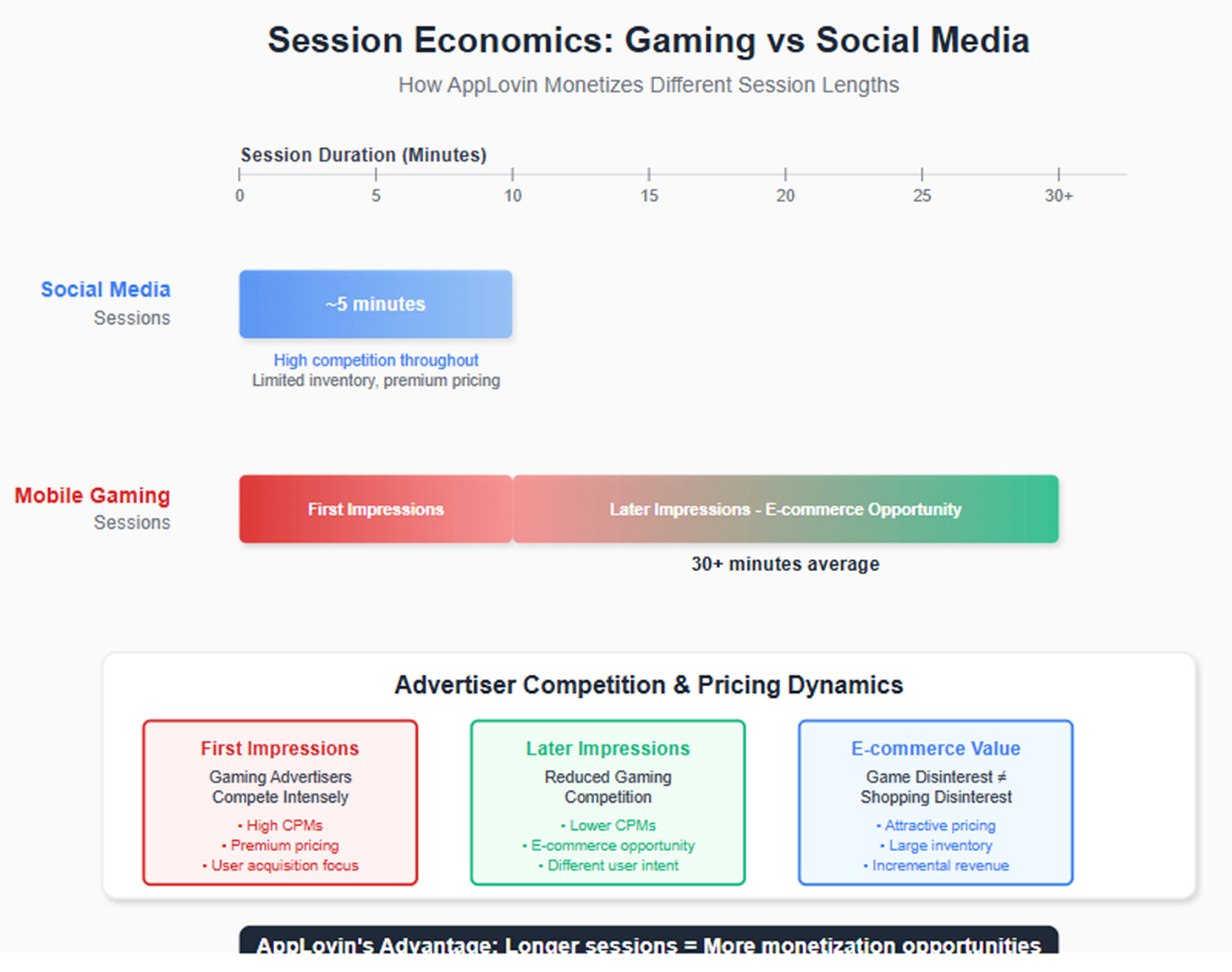

This expansion also leverages session economics that become important beyond gaming. Mobile gaming sessions average over 30 minutes—significantly longer than social media interactions. First impressions in these sessions command premium pricing as gaming advertisers compete intensively for user acquisition opportunities. Subsequent impressions face reduced competition, since users unresponsive to initial gaming advertisements remain unlikely to respond to additional gaming content.

E-commerce advertisers operate under different assumptions. User disinterest in puzzle games provides minimal information about potential interest in clothing or electronics. This creates opportunities to monetize later-impression inventory at rates attractive to e-commerce advertisers without directly competing with gaming's first-impression pricing dynamics.

Competitors & Platforms

The competitive landscape reflects the broader industry's struggle adapting to post-ATT realities. Unity's merger with ironSource, announced in 2022, represented a parallel attempt to gain auction visibility through supply-side consolidation. However, integration complexity has proven substantial, with the companies operating separate data science teams as recently as January 2024.

This integration difficulty created a timing advantage for AppLovin's MAX consolidation approach. While Unity worked to unify distinct platforms, data architectures, and organizational cultures, AppLovin's cleaner acquisition enabled faster innovation cycles and earlier realization of data network effects.

Broader competitive threats emerge from platforms with superior structural positions. Meta could potentially launch webshop-optimized advertising products that circumvent Apple's restrictions entirely by directing users to web-based purchasing flows. Google's Android ownership provides access to advertising signals that remain unavailable to third parties.

Most significantly, Apple and Google themselves could theoretically replicate AppLovin's approach using their platform-level data access. Their restraint likely reflects antitrust considerations and strategic preferences for remaining neutral infrastructure providers rather than direct advertising market participants.

The regulatory environment remains unpredictable. Apple and Google function as ultimate regulators of mobile advertising through platform policy decisions. AppLovin's mediation-centric approach provides some protection against specific policy changes, but offers no defense against broader structural shifts that could reshape the mobile application ecosystem entirely.

What the Market Misreads

Investment community analysis of AppLovin frequently centers on two significant misframings that obscure actual strategic dynamics.

The first treats AXON primarily as an "artificial intelligence breakthrough"—superior algorithms delivering better results through technological innovation alone. This interpretation misses the positioning component entirely. AXON's competitive advantage stems from unique data access created through MAX's consolidated auction visibility, not merely superior mathematics. The algorithm represents the optimization engine, but MAX provides the proprietary fuel that makes the engine powerful.

The second misframing assumes self-service expansion will inevitably compress margins through increased customer support complexity and adverse selection effects. This analysis treats AppLovin like traditional software companies where scaling down-market requires accepting lower-quality customers and higher service costs.

AppLovin's model functions differently because of data flywheel dynamics. Additional advertisers don't simply represent incremental revenue; they generate improved data that enhances performance for existing advertisers. If executed successfully, self-service expansion could strengthen rather than weaken the core value proposition.

The market also underweights the possibility of another step-function improvement in AXON performance once international expansion and vertical diversification significantly increase the model's learning surface area. Historical precedent from AXON 2.0 suggests major increases in data quality can produce non-linear improvements in advertiser outcomes.

Three-Year Price Scenarios

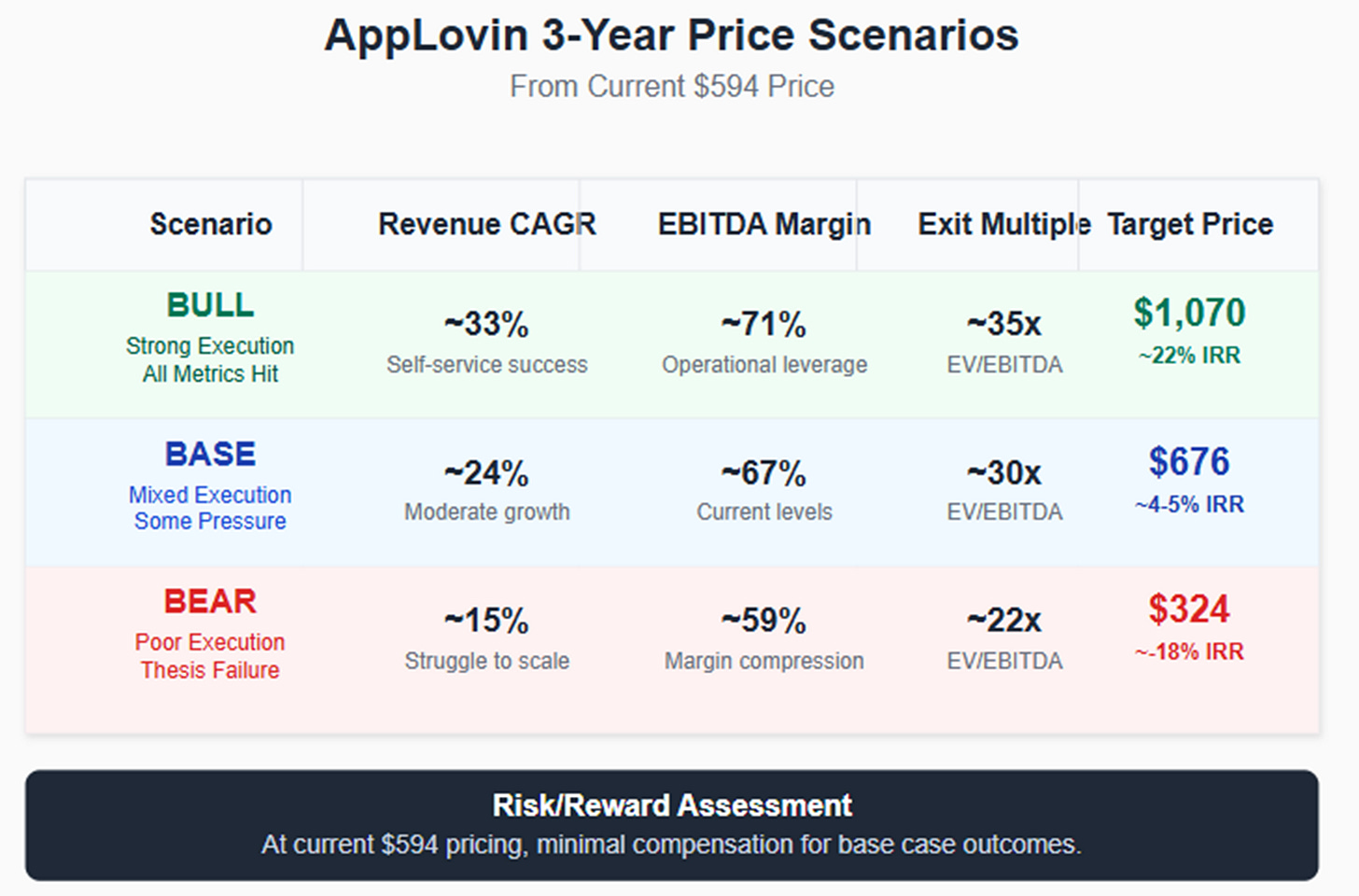

AppLovin's clear strategic timeline and measurable execution milestones enable concrete scenario analysis. Starting from today's $594 price with approximately $5.7 billion trailing revenue and 60% EBITDA margins, three distinct paths emerge:

The bull case assumes successful self-service execution with international expansion generating meaningful revenue contributions while maintaining infrastructure-like margins through automation. This scenario requires activation rates above 60%, rapid time-to-first-conversion, and evidence of data flywheel effects improving performance across the platform.

The base case reflects mixed execution where self-service scaling faces operational challenges and competitive pressure intensifies as Unity completes its integration process. Margins compress moderately as customer mix shifts toward smaller advertisers requiring more support.

The bear case envisions fundamental execution failure where self-service attracts primarily low-value customers, margin compression accelerates beyond management expectations, and competitive advantages prove less durable than positioning theory suggests.

At current pricing, investors receive minimal compensation for base case outcomes, requiring successful execution of unproven strategies for positive returns. This risk-reward profile suggests the market has already incorporated significant optimism about AppLovin's expansion prospects.

Scorecard — What to Track Each Quarter

AppLovin's strategic clarity creates specific, measurable indicators for thesis validation or falsification:

Self-Service Funnel Metrics: Invitation-to-activation conversion rates should exceed 55-60% for referral cohorts, with time-to-first-conversion measured in days rather than weeks. Healthy 30/60/90-day spend ramps must demonstrate genuine engagement beyond trial activity. Fraud and chargeback rates should remain below 1% to validate operational controls. International mix should grow consistently as global expansion proceeds.

Engine Health Indicators: Auction win-rates and CPM density trends indicate competitive positioning strength. Gross profit per dollar of compute spending measures efficiency during infrastructure scaling. Flow-through rates maintaining 75-85% during capacity expansion periods suggest operational costs remain controlled.

Mix and Supply Evolution: Non-gaming advertising revenue percentage growth without corresponding publisher retention degradation would validate session economics theory. New integrations with non-gaming applications and open web properties indicate supply diversification success. CTV performance moving from "strategic" to financially material suggests additional expansion opportunities.

Capital Allocation Patterns: Net cash accumulation, share buyback pace, and share count evolution reflect management's confidence in growth investment opportunities versus returning capital to shareholders.

Risks & Falsifiability

Several specific outcomes would falsify the positioning thesis and suggest fundamental strategy problems:

Execution risks include activation rates below 40% persisting across multiple quarters, indicating self-service product-market fit issues. Weak spend ramps suggest onboarding friction prevents meaningful advertiser engagement. Rising fraud rates or unexpected chargeback costs could indicate inadequate operational controls during scaling.

Flow-through compression without clear capacity investment explanations would suggest hidden operational cost increases undermining the infrastructure economics model.

Publisher resistance manifesting as retention deterioration when e-commerce advertising mix increases would invalidate session economics assumptions. Widespread opt-outs or declining revenue per user associated with non-gaming advertising would force strategic reconsideration.

Policy disruption from Apple or Google could eliminate positioning advantages regardless of execution success. Credible competitive responses, particularly webshop-optimized products from major platforms, could siphon advertiser budgets and reduce AppLovin's auction visibility advantages.

Most fundamentally, if AXON demonstrates no discernible performance improvements for 4-6 quarters despite major data surface expansion from self-service and international growth, it would suggest data flywheel effects may be weaker than the positioning argument predicts.

Closing the Arc

The Chicago grain elevator operators of the 1870s understood a principle that transcends specific industries and historical periods: when market rules change fundamentally, competitive advantage accrues to those positioned where information naturally accumulates. They succeeded not through superior price prediction capabilities, but by situating themselves where prices were actively being determined.

In mobile advertising, Apple's privacy changes didn't simply make existing market maps less precise—they moved the map-making process entirely. While most industry participants attempted to reconstruct navigation tools for the previous system, AppLovin repositioned itself where new maps were being drawn: the real-time auction flows determining advertising prices and performance across thousands of mobile applications.

The self-service expansion now underway represents the critical test of whether this positioning advantage can scale globally while preserving the infrastructure-like margins that make the strategy compelling. Opening the platform to millions of potential advertisers could densify the data environment sufficiently to generate another step-function improvement in AXON performance, or it could introduce operational complexity that erodes fundamental unit economics.

AppLovin's next chapter will determine whether they can maintain their position at the industry's information convergence point while democratizing access to that position worldwide. Success would establish the company as something resembling market infrastructure—a platform that improves as participation increases, with margins reflecting that structural role.

Failure would reduce AppLovin from exceptional to merely competent: a well-executed advertising technology company that capitalized skillfully on specific market disruption, but couldn't extend those advantages into broader, more durable competitive positioning.

The grain elevators eventually lost their information advantages as markets became more transparent and communication technology democratized access to pricing data. Whether AppLovin's position proves more enduring depends on execution decisions being implemented currently, with measurable results that should become apparent within the next several quarters.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.