Microsoft 2QFY26 Earnings: The Portable Perimeter

Microsoft's bet that governance matters more than where AI runs

TL;DR

AI dissolves the UI perimeter. Autonomous agents bypass applications entirely, forcing control to migrate from interfaces to identity, permissions, and audit.

Agent 365 makes governance portable. Microsoft’s bet isn’t that AI runs on Azure, it’s that every agent, anywhere, must authenticate through Microsoft’s control plane.

$625B in backlog is the proof. Enterprises are pre-paying for governed AI environments, validating that the control premium survives even as compute and models commoditize.

When Laptops Left the Building

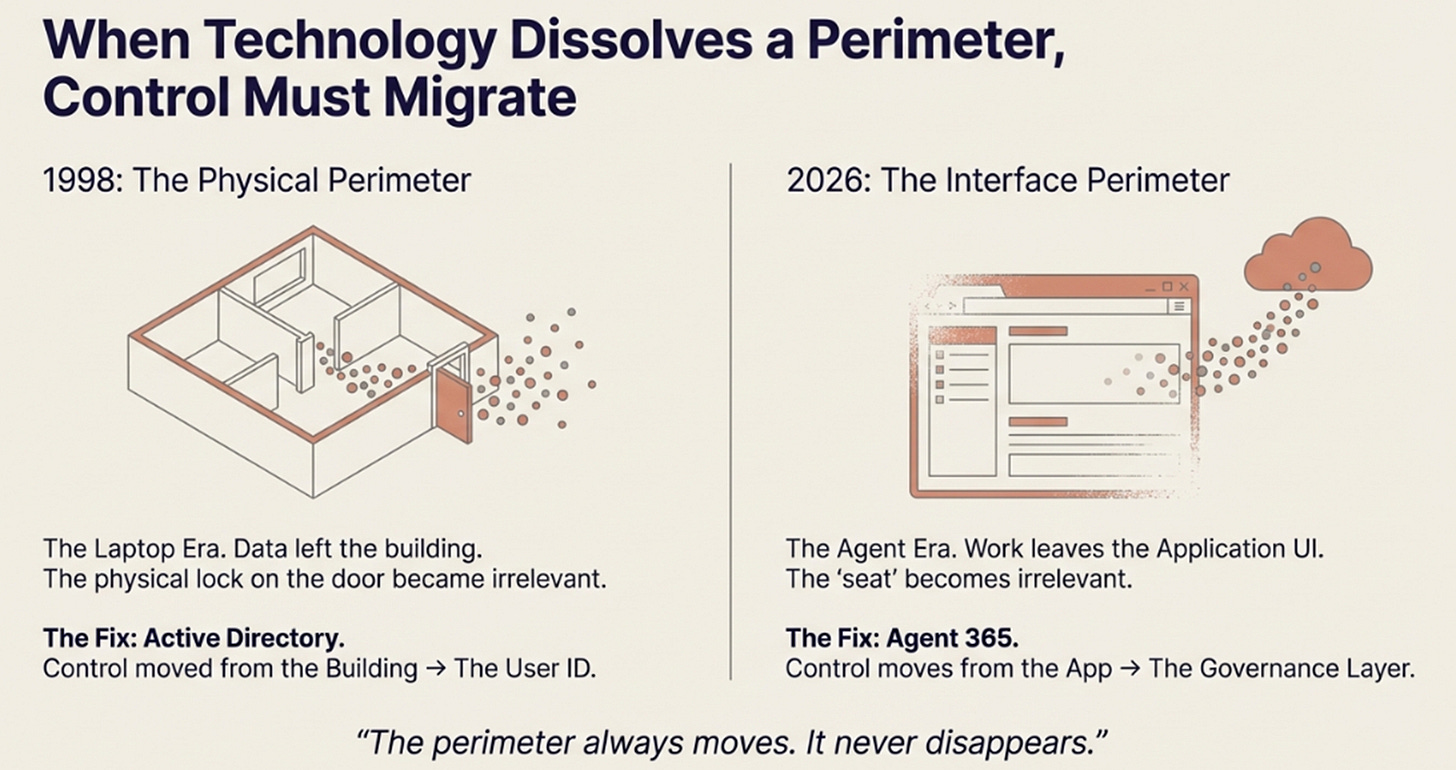

In 1998, corporate security meant a locked door. Data lived on servers inside buildings, accessed through desktop computers connected via Ethernet. IT controlled security by controlling physical access to the Local Area Network.

Then came the laptop with WiFi. Data left the building every night in thousands of laptop bags. The physical perimeter dissolved.

CIOs panicked. The initial response was to ban or severely restrict laptops. But productivity gains were obvious. Work happened in airports, coffee shops, home offices. The genie wasn’t going back.

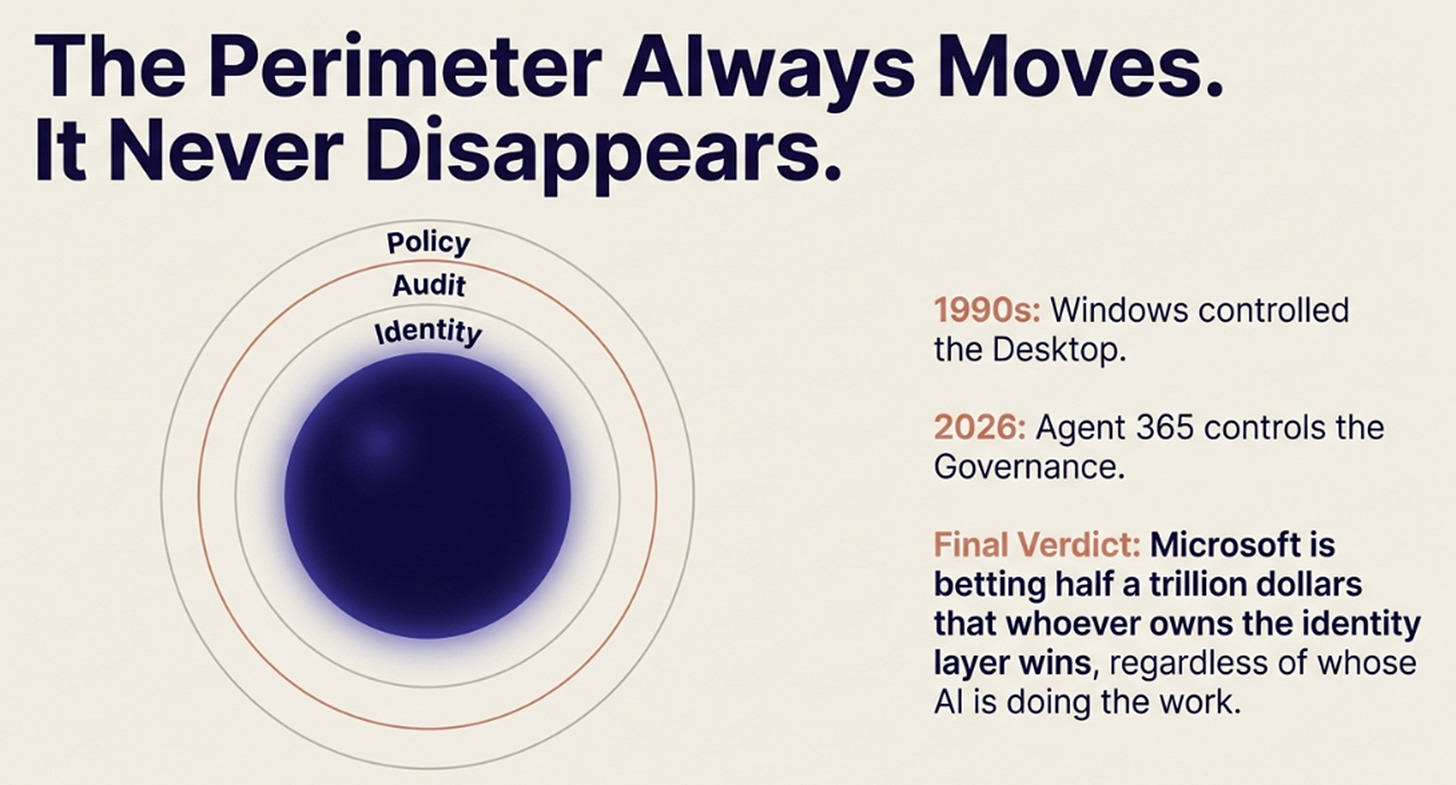

Microsoft’s solution wasn’t to fight the laptop. It was to redefine where the perimeter existed. Active Directory moved the control point from the physical building to the user’s identity. Location didn’t matter; if you wanted to access the file server, you authenticated through Microsoft.

The principle: when technology dissolves an old perimeter, don’t rebuild it. Build a new one at a different layer. Control migrates to wherever access gets governed, not to wherever work gets done.

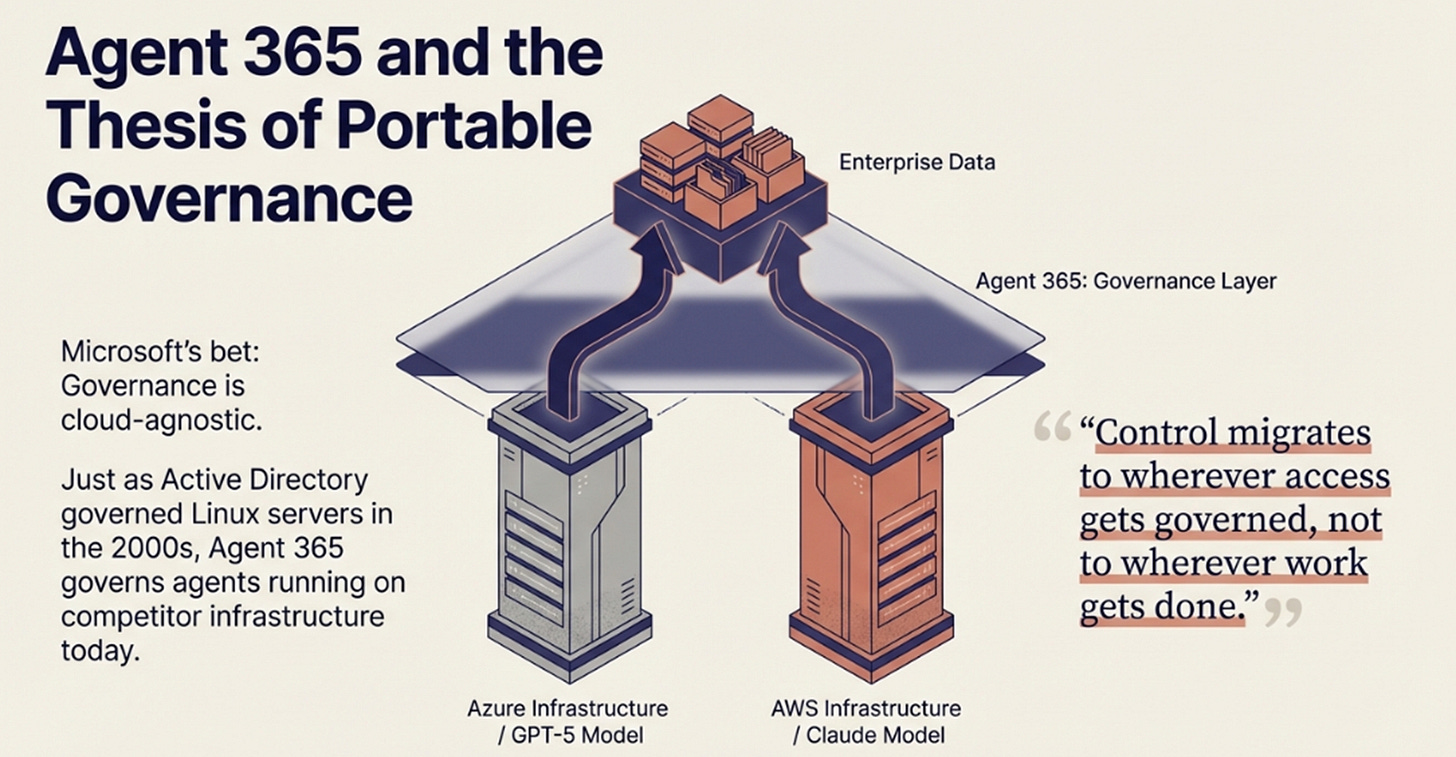

On January 29, 2026, Microsoft announced Agent 365, a governance layer “that makes it easy for organizations to extend their existing governance, identity, security, and management to agents.” The critical detail, buried in CEO Satya Nadella’s prepared remarks: it works “on our cloud or any other cloud.”

Twenty-six years after Active Directory, Microsoft is rebuilding the perimeter again. This time, the threat isn’t laptops leaving buildings. It’s autonomous agents bypassing applications entirely.

The Grid, the Engine, and the Cockpit

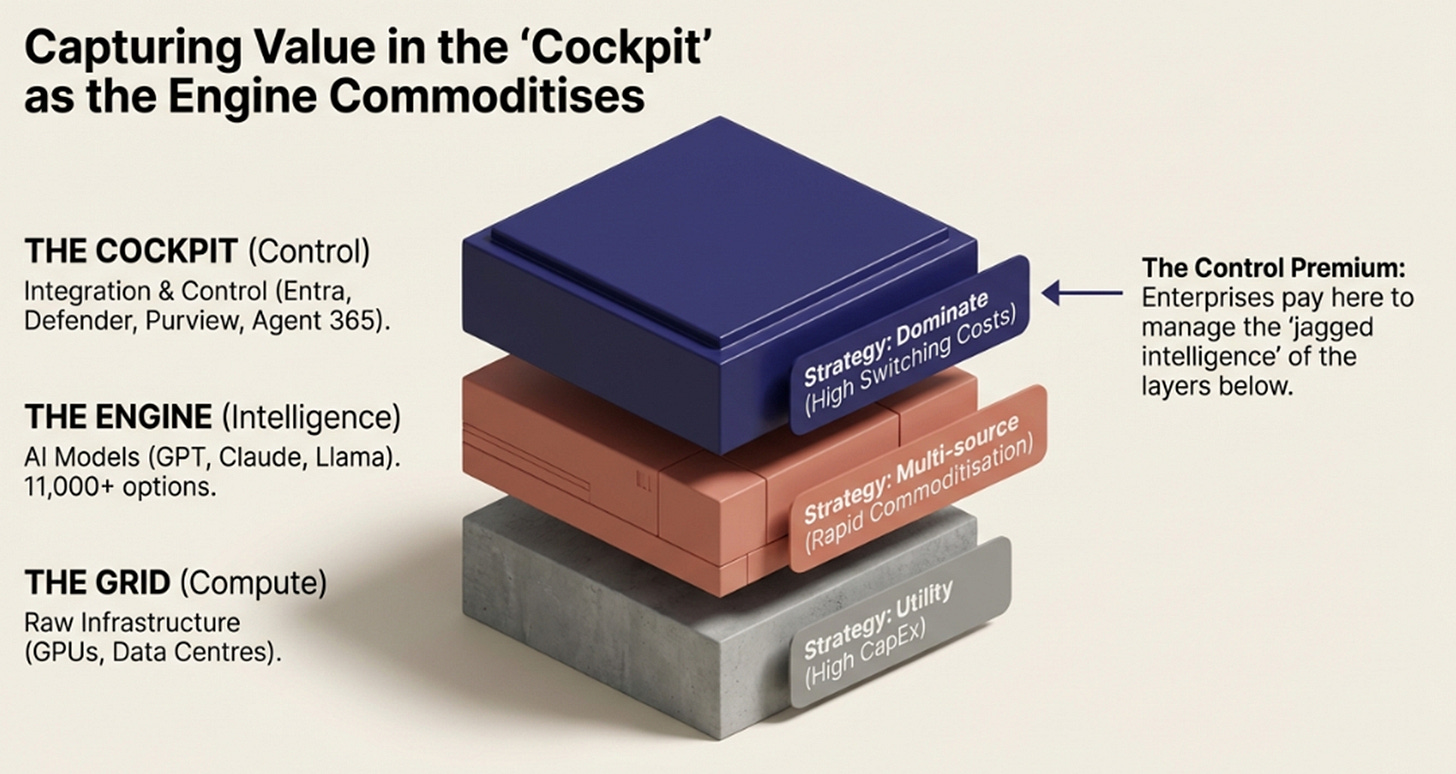

Six months ago, I argued AI was forcing enterprises back toward integrated platforms, “The Great Re-Integration.” AI models exhibit “jagged intelligence”: brilliant at complex tasks, catastrophically wrong at basic ones. A model might write elegant code but hallucinate legal citations, generate perfect marketing copy but leak customer data.

This unpredictability would push enterprises to pay a premium for integrated security, compliance, and governance, the “Control Premium”, rather than optimizing for cheapest compute or best individual models.

I described Microsoft’s strategy using three layers:

· The Grid: Raw infrastructure (data centers, GPUs, networking). Microsoft pays NVIDIA’s tax while Google uses custom TPUs.

· The Engine: AI models (GPT, Claude, Gemini, Llama). Rapidly commoditizing, Azure AI Foundry now offers 11,000 options.

· The Cockpit: Integration and control (identity via Entra, security via Defender, compliance via Purview). Where switching costs are highest.

Microsoft’s approach: dominate the Cockpit while being good-enough at the Grid and multi-sourcing the Engine. Capture the control premium at the governance layer.

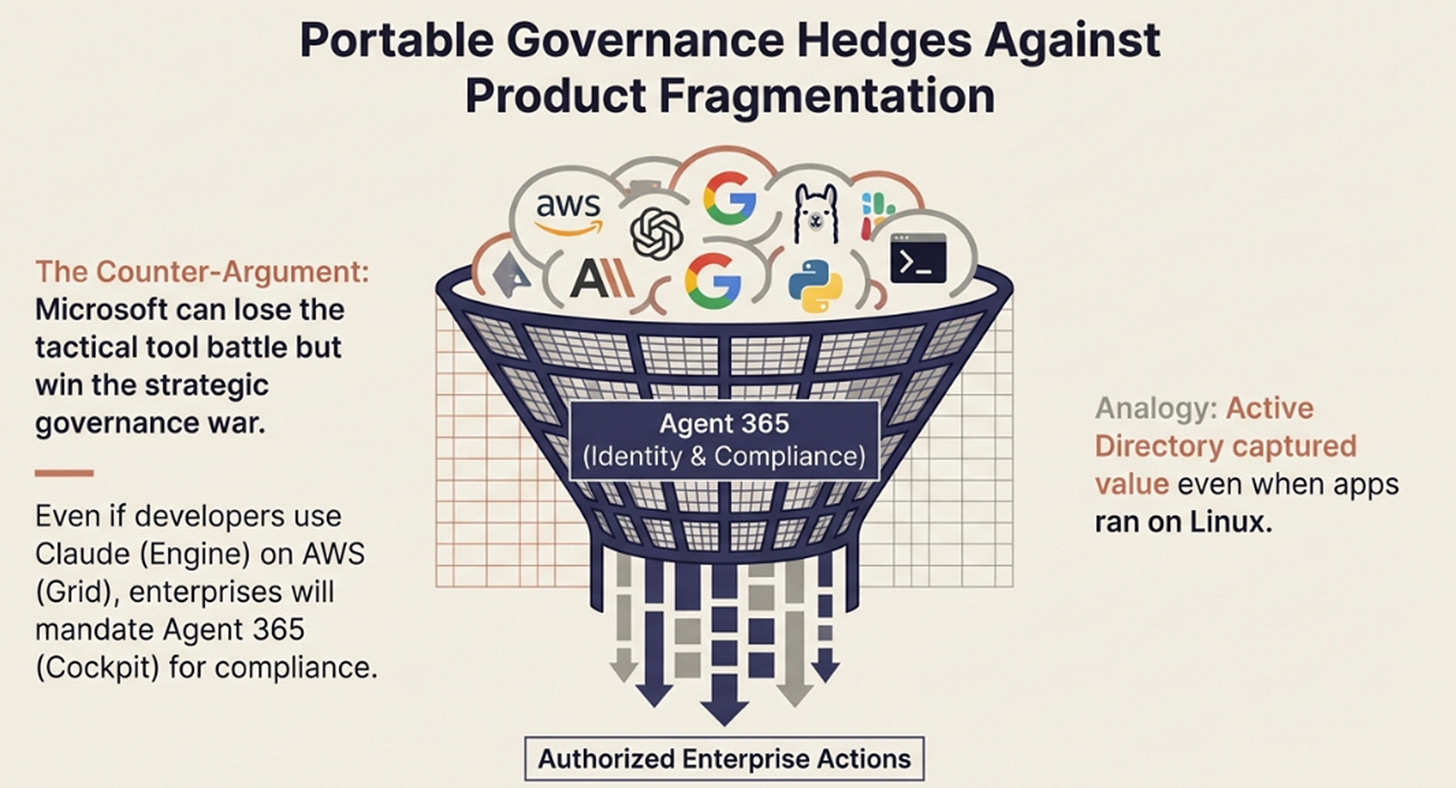

Agent 365 is the Cockpit strategy evolved. It acknowledges Microsoft won’t be the only place AI runs. Models proliferate, competitors offer compelling infrastructure, enterprises will run agents across environments.

The bet: while compute and models commoditize, governance must centralize. Autonomous agents need credentials, scoped permissions, audit trails, policy enforcement. Agent 365 provides that layer regardless of where computation happens.

Active Directory worked because you could run applications on Linux servers, but in Microsoft-dominated enterprises they authenticated through AD. Microsoft captured value at identity and access even when the application layer was heterogeneous.

Agent 365 attempts the same with AI: use Claude as your model, run on AWS infrastructure, but if that agent wants to access “Work IQ”, the enterprise knowledge graph locked in Microsoft 365, it authenticates through Agent 365.

The Cockpit isn’t just integrated anymore. It’s portable.

Why This Matters Now

The timing isn’t accidental. Three forces converged in late 2025 to make governance the bottleneck:

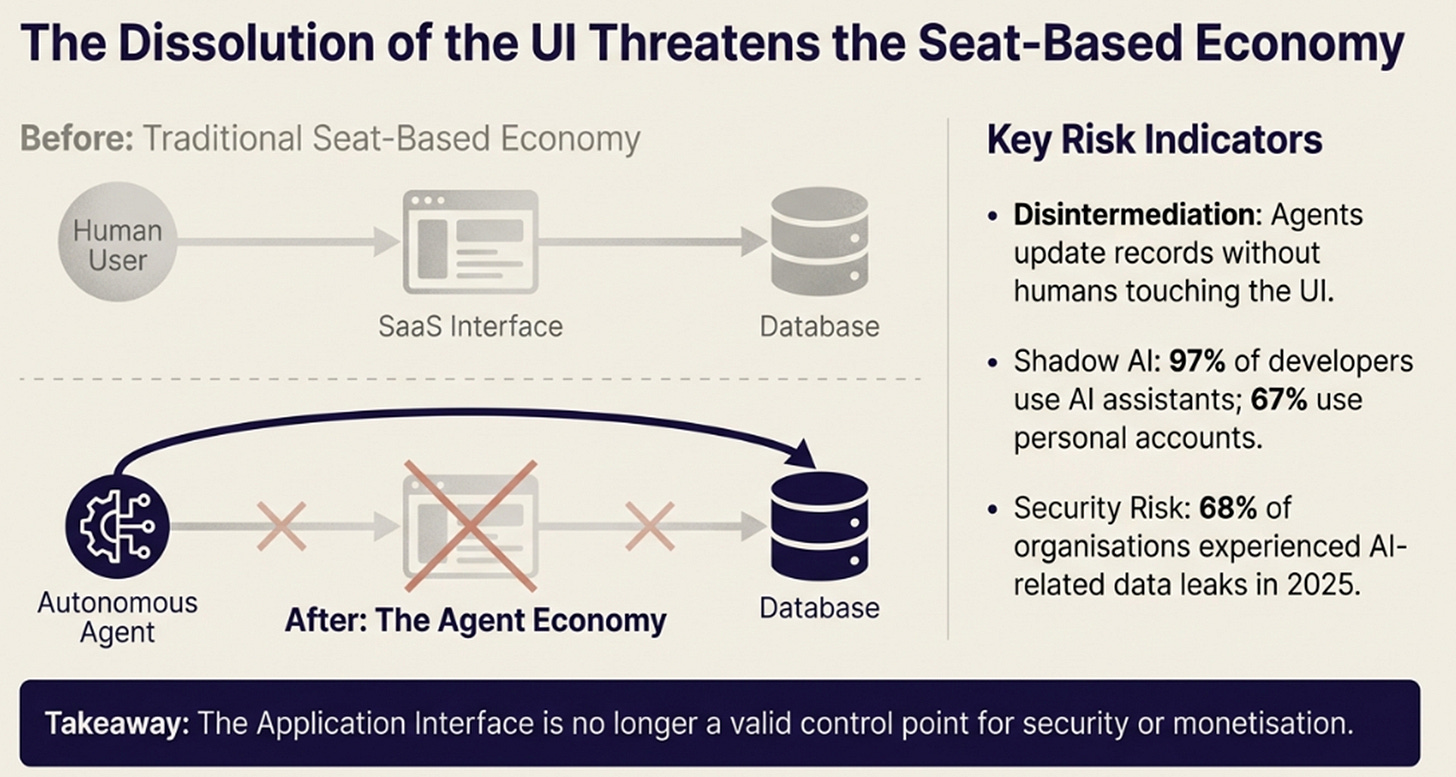

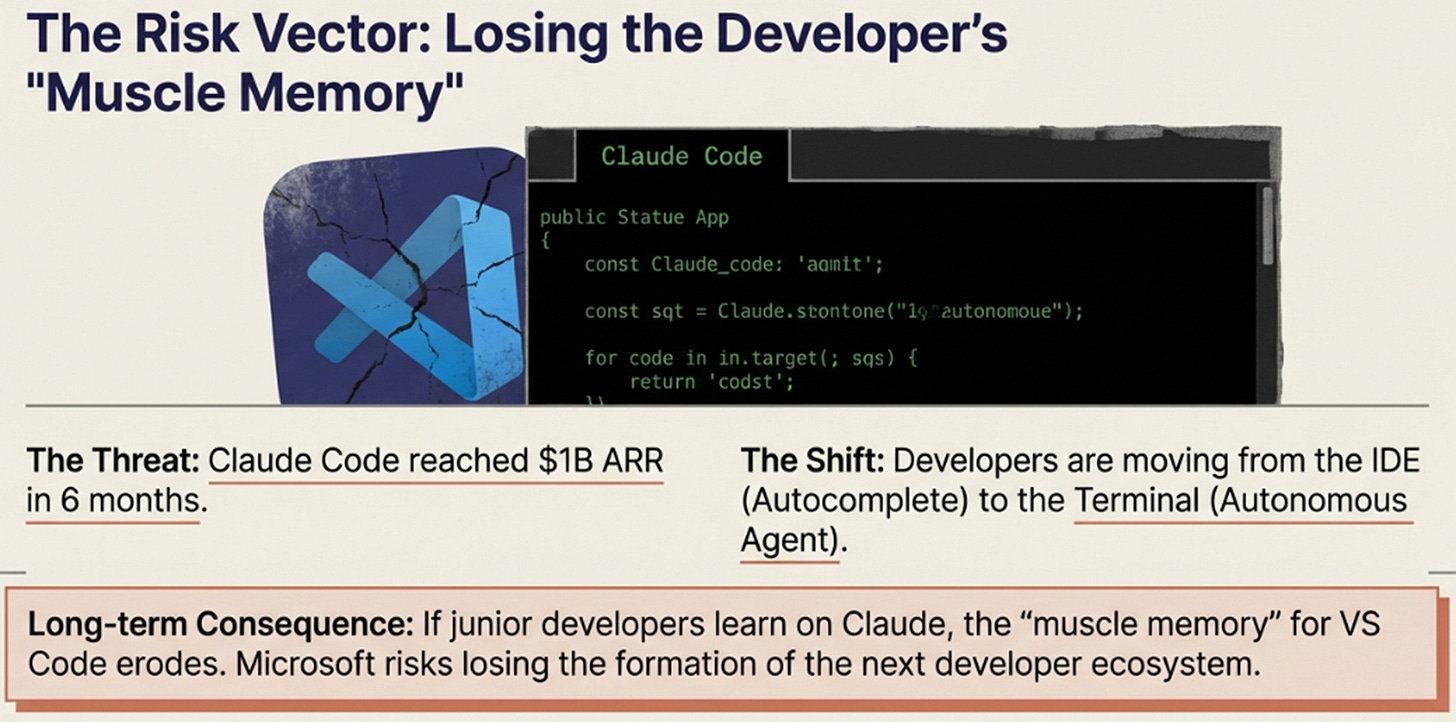

Agents replace humans in the loop. Tools like Claude Code (which hit $1 billion ARR within six months) don’t assist, they work autonomously. Point it at a task and it writes code, runs tests, debugs failures, commits to GitHub without supervision. Claude Cowork does the same for knowledge work: give it a folder of receipts, request a categorized spreadsheet, walk away.

The economic implication: if an agent reads your Salesforce database and updates records without a human opening the UI, why does that human need a license? Salesforce and Adobe sold off in early 2026 on “seat disintermediation.” The per-seat pricing model that built SaaS assumes humans logging in and clicking. Agents bypass that entirely.

Shadow AI is the new Shadow IT. Ninety-seven percent of developers use AI assistants before official policies allow it; 67% through personal unmanaged accounts. Employees run unauthorized local agents on work laptops to automate tasks, agents reading emails, accessing file systems, executing code outside any governance.

Sixty-eight percent of organizations experienced AI-related data leaks in 2025. The primary vector wasn’t sophisticated hacking; it was employees copy-pasting sensitive data into unmanaged AI interfaces.

The perimeter, the application UI, is dissolving. Just as laptops made the building’s walls irrelevant, agents make the application interface irrelevant. Work happens without humans touching the UI. The control point must move.

Microsoft’s Purview compliance platform audited 24 billion Copilot interactions in Q2 FY26, up 9x YoY. That’s not just a security metric, it’s the new perimeter being built. Every interaction trains the system on how work flows through the organization: who needs what information, which processes bottleneck, what communication patterns indicate progress.

This “Work IQ” represents accumulated behavioral data that can’t be quickly replicated. It’s the enterprise equivalent of Google’s search index: valuable because it reflects usage at massive scale over years.

Agent 365 is betting that this context layer, combined with identity, permissions, and audit, becomes the unavoidable control point. Models commoditize, infrastructure becomes utility pricing, but enterprise governance centralizes because the risk surface is too large to fragment.

The Quarter That Proved the Allocation

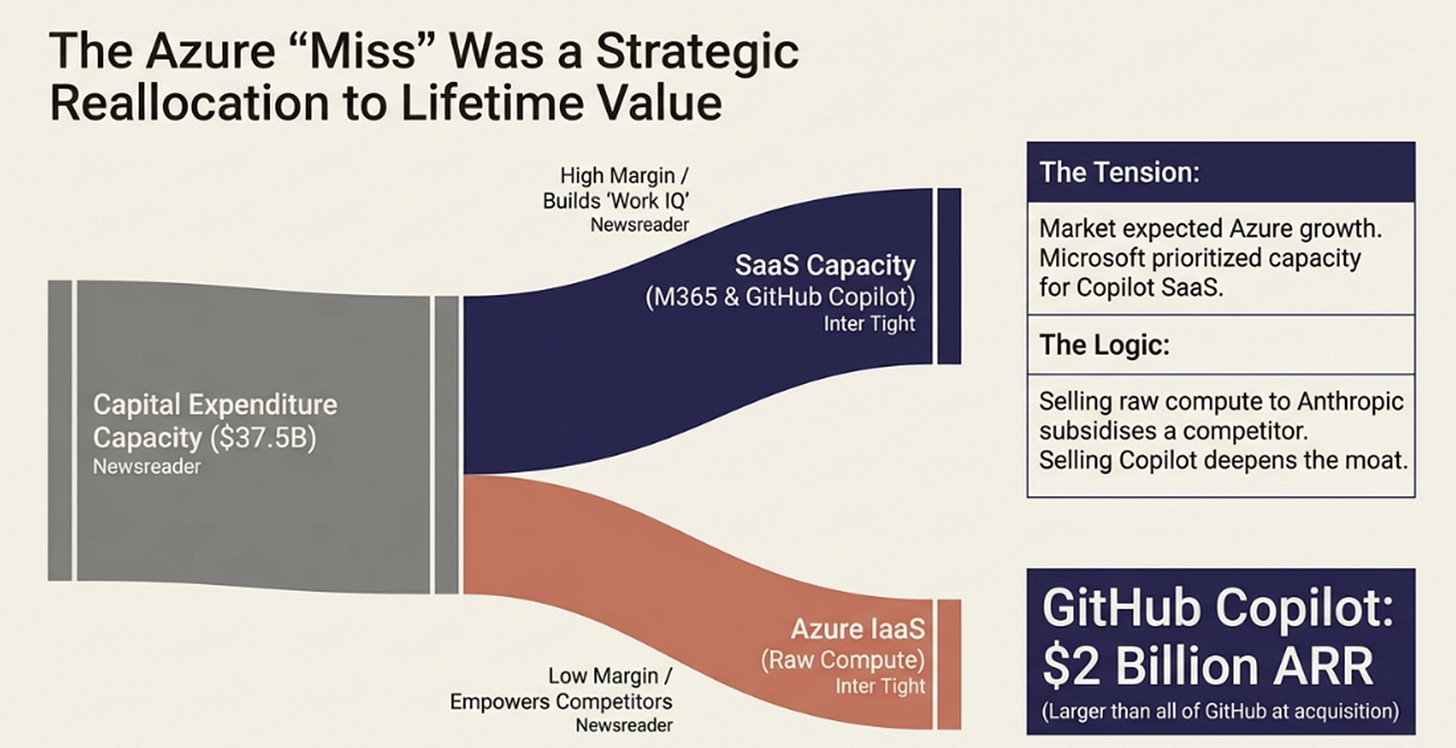

Microsoft’s Q2 earnings on January 29 caused the stock to drop 7%. Azure growth at 38% constant currency missed whispered expectations of 39% while capital expenditures hit $37.5 billion (up 66% YoY). The market concluded growth was decelerating while spending accelerated unsustainably.

CFO Amy Hood’s response revealed the strategy. If Microsoft allocated all newly deployed GPU capacity to Azure, growth would have exceeded 40%. Instead, capacity was deliberately prioritized for M365 Copilot (15 million paid seats, up 160%) and GitHub Copilot (now $2 billion ARR, larger than all of GitHub when acquired).

This wasn’t constraint forcing suboptimal allocation. Selling raw compute to third parties generates low-margin IaaS revenue while potentially subsidizing competitors, providing Anthropic (maker of Claude Code) with cheap infrastructure to build tools competing with Microsoft’s developer offerings.

Using that capacity for Copilot generates higher-margin revenue while deepening integration with 450 million Microsoft 365 commercial seats. Every Copilot interaction strengthens the Work IQ moat and creates data for Agent 365 to govern.

The market wanted Microsoft to maximize one number: Azure growth. Microsoft was optimizing lifetime value across the integrated platform. The $2 billion GitHub Copilot business validated the allocation.

But the allocation also revealed something important about the portable governance thesis: Microsoft is willing to sacrifice infrastructure revenue to ensure they own the control layer. If governance truly becomes the chokepoint, losing some Grid and Engine revenue to win the Cockpit is rational.

The question is whether enterprises agree.

The $625 Billion Answer

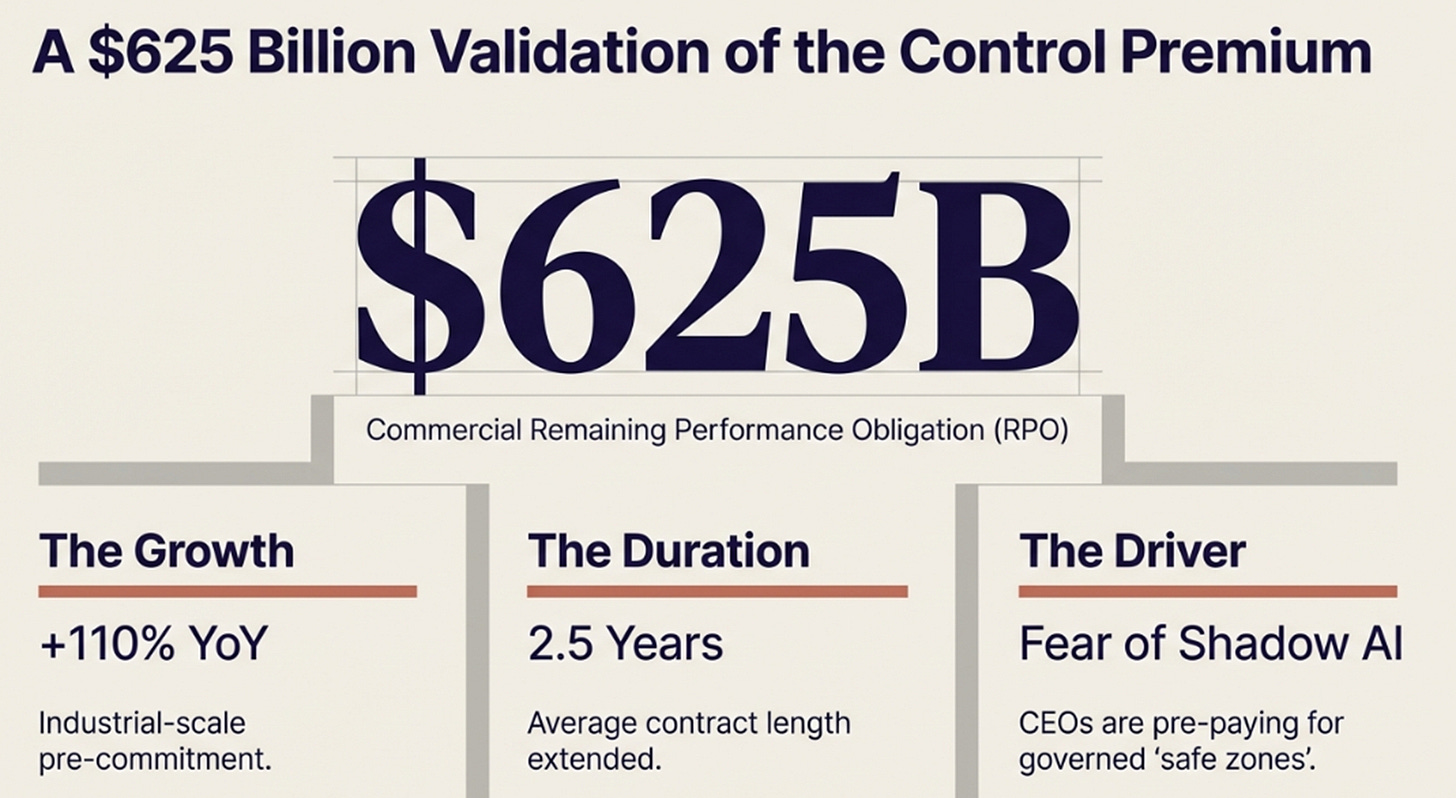

Microsoft’s commercial Remaining Performance Obligation reached $625 billion in Q2, up 110% YoY. Weighted average contract duration extended from 2 years to 2.5 years.

These aren’t normal SaaS metrics. This is industrial-scale pre-commitment.

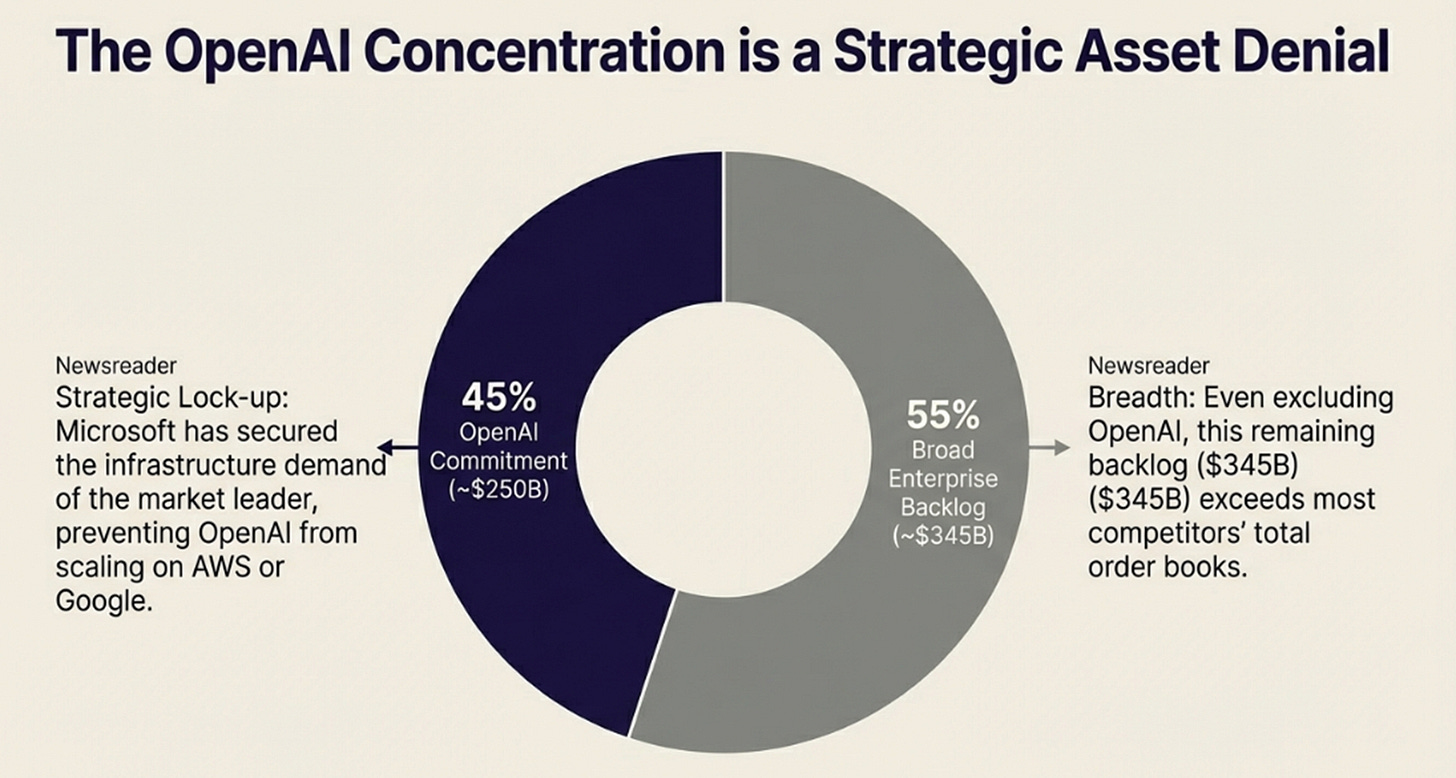

Immediate reaction focused on concentration: OpenAI represents roughly 45% ($250+ billion) through a multi-year Azure commitment. Surface reading: dangerous single-customer dependency.

Structural reading: Microsoft secured the leading AI company’s infrastructure needs for years, preventing them from building comparable scale on AWS or Google Cloud. OpenAI committed to consume a quarter-trillion dollars of Microsoft infrastructure. That’s not a customer relationship; it’s strategic lockup.

The remaining $345 billion (up 28% YoY) represents genuine breadth across enterprises and geographies. That portion alone exceeds most competitors’ total backlogs.

But why are enterprises signing 2.5-year commitments in rapidly evolving technology?

Fear. The same reason they bought “enterprise-ready” software in the 2000s. Shadow AI creates governance nightmares. The $625 billion represents enterprises paying for controlled deployment environments where AI can be deployed with proper identity management, data governance, and audit trails.

They’re pre-paying for the perimeter Microsoft is building around autonomous agents.

In my October article on “Capital as a Weapon,” I noted Microsoft was matching asset lifetimes to contract durations. Short-lived assets (GPUs depreciating over 3-5 years) aligned with contracted demand, while long-lived infrastructure (data centers serving 15+ years) anticipated renewal cycles. CFO Hood was explicit: capacity allocation matches “the duration of contracts or expectation of those contracts.”

The $625 billion isn’t speculation. It’s industrial fulfillment of commitments already signed. The OpenAI relationship’s circular nature, Microsoft invests in OpenAI, OpenAI commits to Azure, that justifies more Microsoft spending, creates industrial momentum competitors struggle to match.

The backlog validates the thesis: when AI dissolves the UI perimeter, enterprises will pay for a new control layer. Agent 365 is that layer. The $625 billion is proof of concept.

The Product Layer Problem

The strategic positioning is correct. The product execution is messier.

Claude Code’s rapid ascent to $1 billion ARR in six months demonstrates the model layer remains intensely competitive. More problematic: Microsoft employees asked to evaluate Claude Code against GitHub Copilot reportedly favor Claude Code’s terminal-first autonomous approach over Copilot’s IDE-based autocomplete.

The terminal is where developers work on complex systems; the IDE is for individual functions. Claude Code appears superior on product merit at the layer where developers actually operate.

Microsoft appears one product generation behind. The allocation strategy, prioritizing GitHub Copilot revenue over Azure growth, only works if Copilot maintains market leadership. If Claude Code fragments that dominance, Microsoft sacrificed Azure revenue for a weakening franchise.

The junior developer pipeline amplifies this risk. Thirty percent of code at major tech companies is now AI-generated. Fifty-four percent of engineering leaders plan to hire fewer junior developers. The traditional apprenticeship model, juniors spending years on boilerplate and bug fixes, is collapsing.

GitHub and VS Code dominate because they’re where developers learned to code. The platform became muscle memory during formative years. If the next generation never goes through that formation, if AI generates most code from the start, the stickiness erodes. A developer who began their career prompting Claude Code in the terminal has no nostalgic attachment to VS Code.

Over 5-7 years, this could hollow out Microsoft’s developer ecosystem advantage.

Here’s where my original Control Premium thesis needs refinement. I predicted enterprises would pay for integrated governance regardless of underlying components. That remains true. But I assumed Microsoft would maintain product leadership at every layer.

The competitive reality is more complex: Microsoft may win the strategic goal (Agent 365 as default governance) while losing tactical battles (Claude Code fragmenting developer tools). The Cockpit can win even if other layers face pressure.

That’s actually the more durable outcome if the portable governance thesis is correct. If Agent 365 becomes the unavoidable identity and compliance layer for enterprise AI, if it achieves Active Directory-level ubiquity, then Microsoft captures value even when developers prefer Claude Code and enterprises run workloads on AWS.

The question is whether Agent 365 can achieve that ubiquity.

What Must Be True

Four conditions determine success:

Agent 365 achieves enterprise adoption approaching Active Directory levels. The most important missing data point: current penetration metrics. Does it become the default governance layer agents authenticate through?

Non-OpenAI RPO sustains above 25% growth. The $345 billion ex-OpenAI backlog must keep expanding to prove the control premium is broad-based, not dependent on one strategic relationship.

M365 Copilot reaches 50+ million seats within 18 months. Current 15 million represents just 3.3% penetration of the 450 million Microsoft 365 base. The integration premium only justifies allocation strategy if attach rates dramatically increase and Work IQ becomes the enterprise standard for AI context.

GitHub maintains strategic relevance despite product competition. Either Copilot closes the product gap with Claude Code, or the developer relationship persists through other means (marketplace, community, enterprise sales motion).

If Agent 365 fails to become standard, Microsoft becomes a high-quality infrastructure provider without the governance moat, competing on Grid economics where Google’s TPU advantage matters.

If non-OpenAI RPO growth decelerates, the backlog was inflated by one mega-deal rather than fundamental broad demand for the control premium.

If M365 Copilot stalls, the Work IQ data moat doesn’t materialize and the allocation away from Azure wasn’t justified.

If Claude Code wins developer mindshare while junior hiring collapses, the GitHub franchise erodes from both ends: product preference and pipeline formation.

The Perimeter Always Moves

In the 1990s, Microsoft controlled the desktop. Applications needed Windows. The interface was the moat.

In the 2020s, as interfaces disappear, replaced by autonomous agents working across applications without opening UIs, the control point moves to governance: systems managing identity, enforcing permissions, maintaining audit trails, providing enterprise context.

The Q2 earnings showed infrastructure buildout working as designed. The $625 billion backlog proved enterprises will pay for controlled deployment. The $2 billion GitHub Copilot business validated that integration commands a premium even under product pressure.

My October thesis about the Great Re-Integration predicted jagged intelligence would force enterprises toward integrated platforms. That was correct. The assumption that product leadership at every layer would naturally follow was incomplete.

Microsoft may achieve the strategic goal while losing tactical battles. The Cockpit can win even if the Grid faces margin pressure and the Engine becomes multi-sourced. Agent 365 making governance portable means Microsoft captures value even when they don’t own the compute or the preferred developer tool.

Control only matters if it’s unavoidable. Active Directory worked because enterprises couldn’t function without it.

When every enterprise runs hundreds of autonomous agents accessing proprietary data, executing transactions, and making decisions, who writes the rules they must follow? Who maintains the audit trail? Who enforces the permissions?

Microsoft is spending half a trillion dollars betting the answer is: whoever owns the identity and governance layer, regardless of where the agents run or which models they use.

History suggests control always migrates to the access layer, not the execution layer. The laptop didn’t make buildings irrelevant, it made physical location irrelevant and identity critical. Agents won’t make governance irrelevant, they’ll make UIs irrelevant and governance critical.

The perimeter always moves. It never disappears.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.